North America Cocoa Market Growth

Cocoa liquor manufacturers in the United States are capitalising on the increasing demand for whiskey and Americans’ habitual chocolate consumption to manufacture bittersweet chocolate whiskeys with low sugar content. Moreover, the use of rare varieties of chocolate (such as Criollo) to make chocolate liquors without emulsifiers is gaining traction, which leaves a lasting taste on the tongue. This is expected to drive the consumption of cocoa liquors among consumers.The increasing demand for speciality and sugar-free chocolates is prompting major market players to establish large-scale chocolate manufacturing facilities, boosting the demand for cocoa. In April 2022, Barry Callebaut announced an investment of $104 billion into the development of a new chocolate manufacturing facility in Ontario, Canada, with an annual production capacity exceeding 50,000 tonnes.

By gaining micro-market insights into chocolate consumption and preferences on a regional level, cocoa manufacturers can significantly enhance chocolate sales by designing customised product offerings and introducing unique tastes and toppings into their desserts.

North America Cocoa Industry Segmentation

"North America Cocoa Market Report and Forecast 2025-2034" offers a detailed analysis of the market based on the following segments:Market Breakup by Type

- Cocoa Butter

- Cocoa Powder

- Cocoa Liquor

Market Breakup by Application

- Food and Beverages

- Confectionery

- Dairy

- Bakery

- Others

- Cosmetics and Pharmaceuticals

- Others

Market Breakup by Country

- United States of America

- Canada

North America Cocoa Market Share

Based on application, the market can be segmented into food and beverages, and cosmetics and pharmaceuticals, among others. The application of cocoa in the food and beverages sector is expected to rise in the forecast period, as cocoa enjoys great appeal among chocolate manufacturers and small restaurants. High consumer disposable incomes are expected to offsetchocolateprice increases by major manufacturers, thereby leading to the market growth.Leading Companies in the North America Cocoa Market

The report provides a detailed analysis of the following key players in the market, covering their competitive landscape and latest developments like mergers and acquisitions, investments, and capacity expansion.- Cargill Inc.

- Barry Callebaut AG

- Hershey Co.

- Nestle S.A.

- Mondelez International, Inc.

- BASF SE

- Buhler AG

- Ferrero International S.A.

- Olam International Ltd.

- Blommer Chocolate Co.

- Canada Cacao Company Inc.

- Others

More Insights on

Mexico Cocoa Market

Cocoa Market

Canada Cocoa Market

Japan Cocoa Market

Asia Pacific Cocoa Market

United Kingdom Cocoa Market

France Cocoa Market

Europe Cocoa Market

Singapore Cocoa Market

Middle East and Africa Cocoa Market

Table of Contents

Companies Mentioned

- Cargill Inc.

- Barry Callebaut AG

- Hershey Co.

- Nestle S.A.

- Mondelez International, Inc.

- BASF SE

- Buhler AG

- Ferrero International S.A.

- Olam International Ltd.

- Blommer Chocolate Co.

- Canada Cacao Company Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 112 |

| Published | May 2025 |

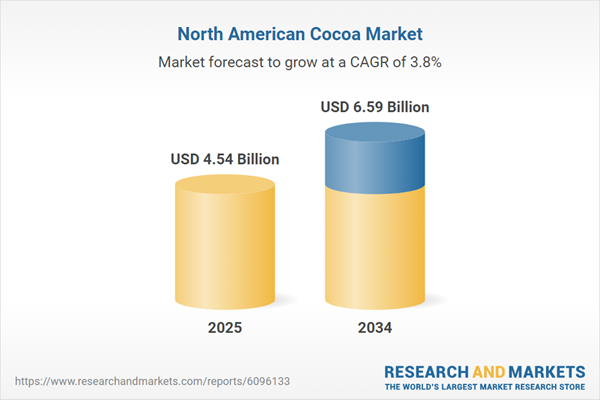

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 4.54 Billion |

| Forecasted Market Value ( USD | $ 6.59 Billion |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | North America |

| No. of Companies Mentioned | 11 |