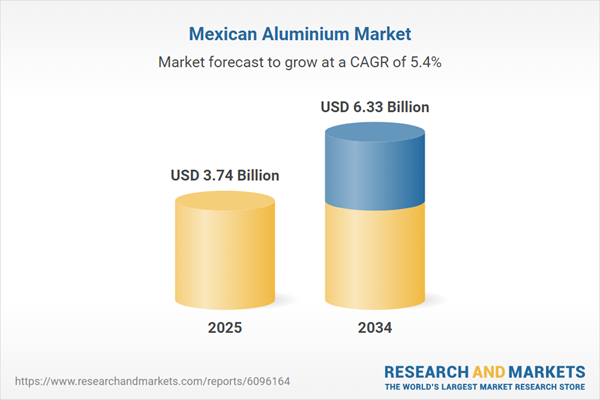

Mexico Aluminium Market Growth

The Mexico aluminium market is driven by the increasing consumption of packaged goods and rising export levels. Companies like Grupo Bimbo, a major player in the food industry, utilise aluminium packaging for products like snacks and baked goods to ensure freshness and extend shelf life. Furthermore, Mexico was the main exporter of aluminium products to the US market, accounting for USD 660 million of the US extruded aluminium imports in 2022.Environmental laws and sustainability criteria, such as waste management, energy efficiency goals, and emissions control, have an impact on the Mexico aluminum market value. For instance, in order to comply with environmental rules and sustainability criteria, businesses like Alcoa Corporation and Norsk Hydro ASA have made major investments in lowering their carbon footprint and increasing their energy efficiency.

Further, the growing use of sustainable packaging is further supporting the Mexico aluminium industry revenue. As part of their sustainability measures, companies like PepsiCo and Coca-Cola are switching to aluminum cans for their beverages, which is increasing demand for aluminum in the Mexican market.

Mexico Aluminium Market Share

By product type, the flat-rolled segment is expected to dominate the Mexico aluminium market share due to its wide range of applications in various industries such as automotive, construction, and packaging. For example, Novelis, a subsidiary of Hindalco Industries Ltd., is a leading producer of flat-rolled aluminium products and has a significant presence in the Mexican market.As per Mexico aluminium industry analysis, the transport segment is expected to dominate the market due to the increasing demand for lightweight materials in the automotive industry. For example, companies such as Ford Motor Company and General Motors have a significant presence in the Mexican market and are investing in the use of lightweight aluminium materials to reduce the weight of their vehicles and improve fuel efficiency.

Aluminium Industry Outlook

According to the International Aluminium Institute, there were notable regional variations in the global primary aluminum production from 2018 to 2023. From 64.16 million metric tonnes in 2018 to 70.58 million metric tonnes in 2023, the total production showed a steady upward trend, propelled by growing demand globally in sectors such as electronics, construction, and automotive.Africa's production declined little between 2018 and 2023, from 1.66 million metric tonnes to 1.59 million metric tonnes, indicating issues with infrastructure or the economy. A similar situation occurred in North America, where output levels decreased marginally from 3.77 million metric tonnes in 2018 to 3.89 million metric tonnes in 2023, although they stabilized in subsequent years and peaked in 2023.

South America saw production increase from 1.16 million metric tonnes in 2018 to 1.46 million metric tonnes in 2023, indicating a recovery phase after consistent declines. Asia (excluding China) maintained steady growth, with production rising from 4.41 million metric tonnes in 2018 to 4.67 million metric tonnes in 2023, highlighting the region's expanding industrial activities.

Production in Western and Central Europe fell, from 3.73 million metric tonnes in 2018 to 2.71 million metric tonnes in 2023. This loss may have been spurred on by moving production capacities or a decline in demand. Russia and Eastern Europe produced consistently, with very slight variations in their levels of output.

Oceania's production remained stable, with a slight decrease from 1.91 million metric tonnes in 2018 to 1.88 million metric tonnes in 2023, indicating consistent output despite minor variations. The Gulf Cooperation Council (GCC) region showed robust growth, with production rising from 5.33 million metric tonnes in 2018 to 6.21 million metric tonnes in 2023, driven by investments in industrial infrastructure.

Mexico Aluminium Market Regional Insight

The global aluminium market significantly impacts the aluminium market of Mexico. For instance, China, the leading global producer, demonstrated continuous and significant growth, with production levels increasing from 36.48 million metric tonnes in 2018 to 41.66 million metric tonnes in 2023, maintaining its dominant position in the global market.How is Mexico Positioned to Leverage its Strengths in the Aluminium Market?

- Abundant Natural Resources: Mexico has significant bauxite reserves, essential for aluminium production, which is supporting the aluminium demand growth.

- Strategic Location: Proximity to the United States provides easy access to a large market and trade opportunities.

- Skilled Workforce: Availability of skilled labor in the mining and manufacturing sectors.

- Strong Manufacturing Base: Well-established manufacturing industry supports the downstream aluminium market, which positively impacts the Mexico aluminium market dynamics and trends.

- Government Support: Favorable government policies and incentives for the mining and metals industry.

Mexico Aluminium Market Industry Trends

- Major players like Alcoa, Grupo Vasconia, and Rio Tinto dominate the aluminium market of Mexico with extensive production capacities and advanced technologies.

- Large-scale operations enable significant production capacity to meet domestic and international aluminium demand efficiently.

- Investment in advanced technologies and automation enhances production efficiency and product quality.

- Technological innovation is critical for maintaining market competitiveness.

Mexico Aluminium Market Opportunities

- Increasing demand for aluminium in automotive, construction, and packaging industries.

- Expanding export opportunities to neighboring countries and global markets.

- Adoption of advanced technologies to improve production efficiency and reduce costs will likely influence the aluminium demand forecast.

- Opportunities to integrate renewable energy sources to reduce production costs and environmental impact.

- The Mexico aluminium market revenue is expected to increase due to continued government initiatives to support industrial growth and foreign investment.

Key Factors Impacting Cost and Price in Mexico's Aluminium Industry

- Price and availability of bauxite impact aluminium production costs.

- High electricity and fuel costs increase production expenses.

- Wages and benefits for skilled labor affect operational costs.

- Investment in advanced technologies can lead to long-term savings, thus propelling the growth of the Mexico aluminium market.

- Compliance with environmental regulations adds to production costs.

- Transportation costs for raw materials and finished products are significant.

- Large-scale production reduces per-unit costs through economies of scale.

- Maintenance and overhead costs contribute to overall expenses.

- High demand in sectors like automotive and construction drives prices up.

- Exchange rate fluctuations impact costs of imported materials and global competitiveness.

- Intense competition leads to aggressive pricing strategies.

- Sustainable practices can increase short-term costs but offer long-term savings.

- Changes in trade policies and tariffs impact costs and pricing.

Mexico Aluminium Market Growth Could be Hindered due to Limited Infrastructure and Other Challenges

- Limited infrastructure in certain regions can hinder efficient production and distribution.

- Aluminium production is energy-intensive, and high energy costs can affect profitability.

- Mining and production processes can have significant environmental impacts, leading to regulatory and public scrutiny.

- Reliance on imported technology and machinery for production processes frequently has a negative influence on growth of aluminium market.

- Transportation and logistical challenges can hamper supply chain efficiency.

- Fluctuations in global aluminium prices and market demand impact the industry.

- Changes in environmental and mining regulations increase operational costs and affect profitability, negatively impacting the aluminium industry In Mexico.

- Intense competition from global aluminium producers' pressures local companies.

- Economic downturns and instability in Mexico affect industrial growth and investment.

- Potential supply chain disruptions due to geopolitical issues, natural disasters, or other unforeseen events.

Mexico Aluminium Industry Segmentation

Mexico Aluminium Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Type:

- Primary

- Secondary

Market Breakup by Processing Method:

- Flat Rolled Products

- Castings

- Extrusions

- Forgings

- Pigments and Powder

- Rod and Bars

Market Breakup by End Use:

- Automotive

- Aerospace and Defence

- Building and Construction

- Electrical and Electronics

- Packaging

- Industrial

- Others

Market Breakup by Region:

- Baja California

- Northern Mexico

- The Bajío

- Central Mexico

- Pacific Coast

- Yucatan Peninsula

Competitive Landscape

Market players are focused on providing premium quality of silica sand across industries to stay ahead in the competition.- Aluminio Industrial Mexicano, S.A. de C.V.

- Arzyz, SA de CV

- ALRETECH

- Norsk Hydro ASA

- Fracsa Alloys

- Grupo Valsa

- Riisa

- Others

Mexico Aluminium Market Report Snapshots

Mexico Aluminium Market Size

Mexico Aluminium Market Growth

Mexico Aluminium Market Share

Mexico Aluminium Companies

Mexico Aluminium Market Regional Analysis

Table of Contents

Companies Mentioned

- Aluminio Industrial Mexicano, S.A. de C.V.

- Arzyz, SA de CV

- ALRETECH

- Norsk Hydro ASA

- Fracsa Alloys

- Grupo Valsa

- Riisa

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 168 |

| Published | May 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 3.74 Billion |

| Forecasted Market Value ( USD | $ 6.33 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Mexico |

| No. of Companies Mentioned | 7 |