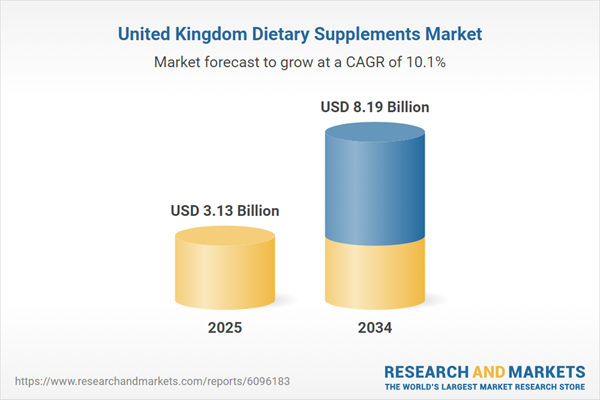

United Kingdom Dietary Supplements Market Overview

Dietary supplements in the UK play a vital role in supporting overall health, filling nutritional gaps, and addressing specific wellness needs such as immunity, energy, and aging. Increasing health awareness, lifestyle changes, and a growing ageing population are driving strong demand for dietary supplements. Consumers seek supplements to complement diets, manage chronic conditions, and boost well-being. The rise of personalized nutrition and advances in supplement formulations further fuel market growth. Additionally, the expansion of online retail channels improves accessibility, making dietary supplements an essential part of many UK consumers’ daily health routines.United Kingdom Dietary Supplements Market Growth Drivers

Vitamin D Deficiency Awareness Driving the Market Growth

Nearly 49.5% of the United Kingdom adults have below-optimal vitamin D levels, with young adults (18-29) showing the highest deficiency at 56%. Regional variations also exist, with the North East recording the lowest levels. This growing awareness of vitamin D deficiency is boosting demand for supplements across the United Kingdom, particularly in vulnerable groups, driving market expansion and encouraging product innovation focused on targeted nutritional support and improved consumer health outcomes.Retail Innovation and Consumer Health Focus Driving the United Kingdom Dietary Supplements Market Value

The rising consumer demand for personalized nutrition and healthier lifestyle choices is a significant key driver in the market. For instance, in July 2024, Waitrose launched Zoe, a “first-to-market” food supplement designed to help customers make more conscious health decisions. This strategic introduction in retail settings enhances supplement accessibility and encourages proactive wellness management in the market, bolstering market growth. By meeting evolving consumer preferences through innovative product offerings, such launches are expected to significantly boost the United Kingdom dietary supplements market growth during the forecast period.

United Kingdom Dietary Supplements Market Trends

Some of the notable trends include innovations in product formulations, surge in investments and product launches as well as growing aging population, among others.Technological Innovations Driving Market Growth

Funding and innovation are accelerating the development of dietary supplements targeting healthy aging, gastrointestinal health, and cognitive decline, meeting rising consumer demand. For instance, the Innovate UK Better Food for All competition awarded £17.4 million in January 2023 to 47 projects, including innovations by Mitocholine and Agroceutical Products. This investment supports new product launches, expanding the UK dietary supplements market by addressing key health concerns.Strong Investment Fueling Product Development and the United Kingdom Dietary Supplements Market Expansion

Significant capital injections enable personalized supplement innovation and scaling operations to meet growing consumer needs. For instance, in July 2024, London-based Bioniq completed a Series B funding round of EUR 13.74 million, raising its valuation to EUR 68.73 million. The funding will support market expansion, product development, and integration with global laboratory networks, boosting the UK dietary supplements market’s growth potential.

Growth in Post-Pandemic Product Launches to Influence the United Kingdom Dietary Supplements Market Size Positively

The rise in immunity and recovery-focused supplements reflects shifting consumer preferences and health priorities. For instance, AstroZhi launched VitaZhi in April 2024, a supplement range addressing COVID-19 recovery and vaccination aftereffects. This strategic product positioning strengthens the company’s leadership in the UK health sector and contributes to sustained growth in the dietary supplements market.

Aging Population to Boost the United Kingdom Dietary Supplements Market Demand

The growing elderly population is increasing demand for supplements that support healthy aging and overall well-being. For instance, 19% of the UK population was aged 65 or above in 2022, projected to reach 27% by 2072. Coupled with strict Good Manufacturing Practices (GMPs) by the UK Food and Drug Administration, consumer confidence and market expansion are further enhanced, driving the UK dietary supplements market growth over the long term.Preference for Vegan Lifestyle Driving Dietary Supplements Demand Growth

The vegan lifestyle of many UK residents is a major factor driving the sales in the market. Growing concerns over lack of nutrition from their restrictive diets is anticipated as the leading cause for the effect. This has been confirmed with the rising sales of vegan products in UK’s leading food chain Holland and Barrett since 2023.Probiotics and Women Supplementary Products are Leading the Market Share

Probiotics and women supplementary products are leading the dietary supplements market share in United Kingdom amid growing concerns over gut health and potential nutritional deficiency during menopause. Leading dietary manufacturers such as Proctor and Gamble are supporting women during these challenging times with their new supplementary launches and awareness initiatives.Pet Supplements Boosting New Demand in UK Dietary Supplements Industry

The pet supplements have become a major part of UK’s overall dietary supplement industry with associated startups and established businesses contributing a significantly to its growth. This includes organisations such as Naturvet and All About Pet Health, leading distributors of pet health products in the UK.Online Retail Sale Increases United Kingdom Dietary Supplements Market Revenue

Online retailing is a major trend developing in the market, with both customers and manufacturers increasingly shifting to online retailing platforms. The anticipated reasons for this growing trend include a wider range of choices available to customers and the easier mode of purchase.United Kingdom Dietary Supplements Market Segmentation

“The United Kingdom Dietary Supplements Market Report and Forecast 2025-2034" offers a detailed analysis of the market based on the following segments:Market Breakup by Type

- Proteins and Amino Acids

- Vitamins and Minerals

- Botanicals

- Probiotics

- Others

Market Breakup by Form

- Tablets

- Powders

- Liquids

- Soft Gels

- Others

Market Breakup by Application

- Energy and Weight Management

- Diabetes

- Anti-cancer

- Anti-aging

- Immunity

- Cardiac Health

- Others

Market Breakup by Distribution Channel

- Supermarkets and Hypermarkets

- Pharmacies and Drug Stores

- Online

- Others

United Kingdom Dietary Supplements Market Share

Immunity to Hold a Significant Value for Segmentation by Application

The immunity segment is likely to hold the largest market share by application due to increasing consumer focus on health resilience, especially post-pandemic. Growing awareness of immune-boosting nutrients like vitamin C, D, and zinc drives demand. Additionally, frequent seasonal illnesses and government health campaigns further support this trend. While other segments like anti-aging and energy management are expanding, immunity supplements remain the primary choice for proactive health maintenance among UK consumers.Leading Players in the United Kingdom Dietary Supplements Market

The key features of the market report comprise funding and investment analysis, and strategic initiatives by the leading players. The major companies in the market are as follows:Nestle S.A.

Founded in 1867 and headquartered in Vevey, Switzerland, Nestlé is a global leader in nutrition and health products. In the UK dietary supplements market, Nestlé offers a broad portfolio including vitamins, minerals, and wellness supplements under brands like Garden of Life and Persona. The company focuses on science-backed, personalized nutrition solutions aimed at improving overall health, immune support, and healthy aging, catering to diverse consumer needs with a strong commitment to quality and innovation.

Alticor Global Holdings Inc. (Amway Corp.)

Established in 1959 and headquartered in Ada, Michigan, USA, Alticor Global Holdings is the parent company of Amway Corp., a major player in the UK dietary supplements market. Amway offers a wide range of nutritional products, including vitamins, minerals, and herbal supplements, through its Nutrilite brand. Known for high-quality, plant-based formulations, the company emphasizes sustainability, science-driven development, and direct-to-consumer sales channels, supporting wellness and healthy lifestyles across the UK.Procter & Gamble Co.

Procter & Gamble, founded in 1837 and headquartered in Cincinnati, Ohio, USA, operates a significant presence in the UK dietary supplements market. Its portfolio includes supplements focused on immune health, wellness, and energy support through trusted brands like Vicks and Nutritional Supplements. P&G leverages strong research capabilities and extensive distribution networks to offer innovative products that meet evolving consumer health needs, driving growth in the competitive UK supplements sector.

Abbott Laboratories

Abbott Laboratories, established in 1888 and based in Abbott Park, Illinois, USA, is a leading healthcare company with a robust presence in the UK dietary supplements market. Abbott provides a variety of nutritional products, including adult and pediatric supplements, medical nutrition, and wellness products under brands like Ensure and Glucerna. The company focuses on clinically proven formulations to support health conditions, recovery, and overall wellness, maintaining a strong commitment to science and quality in the UK market.Other key players in the market include Otsuka Holdings Co. Ltd, Reckitt Benckiser Group Plc, Nu Skin Enterprises, Inc., Bayer AG, Glanbia Plc, Herbalife Ltd, and International Flavors & Fragrances Inc., among others.

Key Questions Answered in the United Kingdom Dietary Supplements Market

- What was the United Kingdom dietary supplements market value in 2024?

- What is the United Kingdom dietary supplements market forecast outlook for 2025-2034?

- What are the major factors aiding the United Kingdom dietary supplements market demand?

- How has the market performed so far, and how is it anticipated to perform in the coming years?

- What are the market's major drivers, opportunities, and restraints?

- What are the major United Kingdom dietary supplements market trends?

- Which type will lead the market segment?

- Which form will lead the market segment?

- Which application will lead the market segment?

- Which distribution channel will lead the market segment?

- Who are the key players involved in the United Kingdom dietary supplements market?

- What is the patent landscape of the market?

- What are the current unmet needs and challenges in the market?

- How are partnerships, collaborations, mergers, and acquisitions among the key market players shaping the market dynamics?

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Nestle S.A.

- Alticor Global Holdings Inc. (Amway Corp.)

- Procter & Gamble Co.

- Abbott Laboratories

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | June 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 3.13 Billion |

| Forecasted Market Value ( USD | $ 8.19 Billion |

| Compound Annual Growth Rate | 10.1% |

| Regions Covered | United Kingdom |

| No. of Companies Mentioned | 4 |