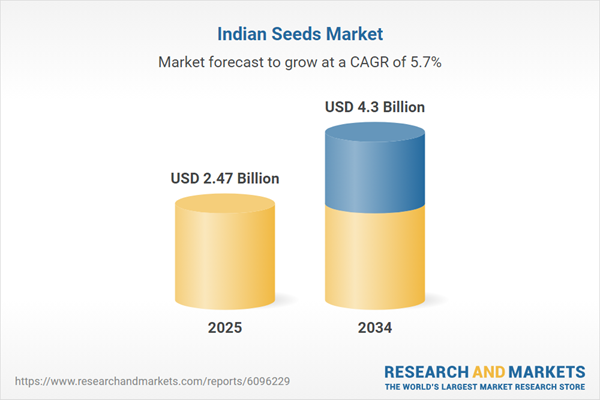

India Seeds Market Growth

A key driver of the market is the rising role of private companies in India’s seed sector. In 2020-21, the share of the private sector in seed production grew from 57.28% to 64.46%. The sector now plays a significant role in supplying quality seeds of vegetables and crops like rice, bajra, cotton, and sunflower. Many private entities are getting attracted towards seed companies and are investing in them, aiding the seeds demand growth in the country. As of 2024, Kalash Seeds Pvt Ltd., a leading seed organisation in India, dominates the vegetable seed market in the supply of chilli, pumpkin, beetroot, onion, broccoli, and muskmelon.Government policies and provisions are also positively influencing the India seeds market revenue. The efforts of the State Governments in producing seed varities of national importance are being supported by the National Seeds Corporation (NSC) and State Farms Corporation of India (SFCI). Furthermore, with the continuous efforts of the Indian Council of Agricultural Research (ICAR), there has also been a steady increase in the production of breeder seeds over the years. Other major drivers of the market include rising population levels, increased agricultural activity, and upcoming digital technologies to diminish the effects of pests, and climate, amongst other variables, on crops.

Key Trends and Recent Developments

Technologies such as nano fertilizers, growing demand for rice domestically and globally, and use of hybrid seeds are supporting the India seeds market value.August 2024

Indian PM launched 109 high-yielding, climate resilient, and biofortified variety seeds to raise the overall productivity levels of Indian seeds market and increase farmer’s income. The seeds were launched at three experimental agricultural plots in Delhi for varieties including cereals, millets, forage crops, oilseeds, pulses, sugarcane, cotton, and fiber crops.June 2024

Kaveri Seeds, India’s largest agri produce company recorded a net sale of Rs.808.08 crores in June 2024, which was a 5.32% year-on-year growth. Besides, the net profit during this period grew by 5.63%. The company is competing with the largest seed companies globally in terms of exports, seed production, and the development of the latest seed technologies.January 2023

The Indian Government approved setting up a national level multi-state Seed Cooperative Society to act as the apex organisation for production, procurement, processing, branding, labelling, packaging, storage, marketing, and distribution of quality seeds. It also promotes research and development in various seed technologies, besides the preservation of indigenous seeds varieties, which will likely impact the seeds demand forecast.February 2021

In 2021, the Department of Agriculture, Cooperation and Farmer’s Welfare implemented the “Sub-Mission on Seeds & Planting Materials” scheme to supply better quality seeds to farmers at subsidised rates, to aid in improving production and to increase productivity in the sector.Use of Nano Urea Fertilizers to Increase Seed Productivity

Nano urea, a development of nanotechnology, is helping Indian farmers increase the productivity of their seeds. The use of this fertilizer is also being encouraged by the Indian Government, as an alternative to traditional urea which is heavily imported, raising the input cost of farmers to extreme levels.Increasing Use of Hybrid Seeds

Hybrid seeds have brought a major transformation in the market by increasing the productivity of seeds, providing uniformity in yield, and introducing resistance against disease-causing pests. The government is encouraging their use by distributing free of cost hybrid seed kits, providing subsidies on hybrid seed purchases and so on. The introduction of gene editing technologies for hybrid seed production is also providing a major boost to seeds demand.Increasing Demand for Rice

Due to the country's diverse agroclimatic zones, which offer ideal growing conditions for rice, rice is becoming more and more popular in India. A lot of Indian farmers find rice to be an appealing alternative because of its steady demand and stable market.India Seeds Industry Segmentation

‘India Seeds Market Report and Forecast 2025-2034’ offers a detailed analysis of the market based on the following segments.Market Breakup by Type

- Conventional Seeds

- Genetically Modified Seeds

Market Breakup by Crop Type

- Row Crops

- Fiber Crops

- Forage Crops

- Grains and Cereals

- Oil Seeds

- Pulses

- Vegetables

- Brassicas

- Cucurbits

- Roots and Bulbs

- Solanaceae

- Unclassified Vegetables

Market Breakup by Treatment

- Treated Seeds

- Untreated Seeds

Market Breakup by Trait

- Herbicide Tolerance

- Insect Resistance

- Others

Market Breakup by Region

- North India

- East and Central India

- West India

- South India

India Seeds Market Share

Genetically modified seeds occupy a significant share in the market. In the next five years, maize, rice, and vegetables are likely to fuel the growth of the Indian hybrid seed sector. Research is also being conducted by ICAR along with various other organisations to develop genetically modified seeds for plants such as potatoes, pigeon pea lentils, chickpeas and bananas. The country is engaged in the process of developing genetically modified seeds for 13 different plants with improved yield and quality.Leading Companies in the India Seeds Market

The market players are increasingly receiving government support to improve the quality of seeds, which in turn helps improve sales.- BASF SE

- Bayer AG

- Corteva Inc.

- Nuziveedu Seeds Limited

- Syngenta AG

- Groupe Limagrain Holding

- East-West Seed Group

- Sakata Seed Corporation

- UPL Ltd. (Advanta)

- Rijk Zwaan Zaadteelt en Zaadhandel B.V

- Others

India Seeds Market Report Snapshots

India Seeds Market Size

India Seeds Market Growth

India Seeds Market Share

India Seeds Companies

Table of Contents

Companies Mentioned

- BASF SE

- Bayer AG

- Corteva Inc.

- Nuziveedu Seeds Limited

- Syngenta AG

- Groupe Limagrain Holding

- East-West Seed Group

- Sakata Seed Corporation

- UPL Ltd. (Advanta)

- Rijk Zwaan Zaadteelt en Zaadhandel B.V.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 128 |

| Published | May 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 2.47 Billion |

| Forecasted Market Value ( USD | $ 4.3 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |