Meat supplemented with additives and preservatives is defined as processed meat. These additives include acidifiers, minerals, salts, seasonings, flavouring agents, and more, which prevents degeneration and enhances product quality and taste. The types outlined in the North America processed meat market analysis include pork, beef, and poultry. Some examples of processed meat are salami, pepperoni, sausages, and jerky, among others.

The major factors impacting the growth of processed meat market in North America include higher purchasing power due to increased disposable income, busy schedules of consumers, advancement in production technology, and a high rate of production due to feed availability.

Key Trends and Development

North America processed meat market growth is driven by an increase in the number of processed meat retailers, growing demand for high-value animal protein and increasing demand for convenience food products.February 2024

The Canadian Meat Council, Consejo Mexicano de la Carne (Comecarne) and the Meat Institute in the United States signed a Memorandum of Understanding (MoU) to enhance co-ordination and governmental collaboration in the North American meat industry.February 2024

The governments of Ontario and Canada are infusing over CD 13 million to enhance the processed meat industry in Canada. The financial injection is channelled through the Sustainable Canadian Agricultural Partnership (Sustainable CAP) initiative.April 2023

The United States Department of Agriculture announced that it has invested over USD 43 million for meat and poultry processing research, innovation and expansion through the Agriculture and Food Research Initiative and the American Rescue Plan.May 2020

In a bid to focus more on its core offerings such as beef and chicken, Tyson Foods, the largest US meat processor, announced the sale of its non-meat businesses, including Sara Lee Frozen Bakery and Van's waffle and cereal business to Kohlberg & Co.Increase in disposable income

The North America processed meat market is witnessing growth due to the rising disposable income of consumers. The increase in the number of working professionals has resulted in busy schedules, which, in turn, is propelling the processed meat market growth.Increasing number of processed meat retailers

The expansion of the market is further fuelled by the proliferation of processed meat retailers. A rising number of specialised stores, supermarkets, and online platforms dedicated to offering a diverse range of processed meat products contribute significantly to the accessibility and availability of these products, thereby driving market growth.Growing demand for high-value animal protein

As consumers increasingly prioritise protein-rich diets for various health and wellness reasons, processed meat products, known for their protein content, are witnessing heightened popularity, leading to an upswing in the demand for processed meat in North America.Demand for convenience food products

North America processed meat market development is driven by the escalating demand for convenience food products. With changing lifestyles and an emphasis on time-saving solutions, there is a notable rise in the preference for processed meat as a quick and easy meal option. This shift in consumer behaviour towards convenience is a key factor propelling the growth of the market in the region.North America Processed Meat Market Trends

As per the North America processed meat market analysis, continuous technological advancements in the production techniques of processed meat support market growth. Innovations in processing methods, packaging technologies, and preservation techniques contribute to enhancing the quality, safety, and shelf life of processed meat products.This trend not only meets consumer expectations for high-quality products but also fosters efficiency and sustainability in the overall production process, influencing the dynamics of the processed meat market in North America. Cargill, a global food corporation, launched the “BeefUp Sustainability Initiative” in April 2023 to build a more sustainable supply chain for beef in North America. Through this initiative, Cargill partners with farmers to cut greenhouse gas emissions from the North American supply chain.

Market Segmentation

North America Processed Meat Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments.Market Breakup by Meat Type:

- Poultry

- Beef

- Pork

- Others

Market Breakup by Product Type:

- Frozen

- Chilled

- Canned

Market Breakup by Application:

- HoReCa and Institutional

- Retail

Market Breakup by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Retail Stores

- Online

- Others

Market Breakup by Region:

- United States of America

- Canada

The market is predominantly led by the beef due to the increasing consumer preference for well-known brands like Tyson, Gardein, and Hormel, along with a rising demand for grass-fed beef products due to their recognised nutritional benefits. Notably, frozen ground beef in a boneless form emerges as a particularly popular choice among consumers in this category. The U.S. beef industry is the largest cattle-fed industry, and the United States is also the largest consumer of beef in the world.

The North America processed meat market share of pork is also significant, as a result of developing meat processing equipment to process pork in different ways. Pork ham, sausages, and meatballs, are some of the processed pork products preferred by consumers for their flavours and nutritional value.

The poultry segment is seeing an expansion due to its lower price and high nutritional content. It is especially preferred by the gym-going populace who accommodate lean proteins in their diet. In Canada, chicken is the most consumed meat.

North America processed meat market share is dominated by chilled products due to their longer shelf life

Chilled packaged meat is popular among consumers in North America owing to its longer shelf life and original taste. It is also sought after by people who like to cook their meat as per their requirements. On average, 86% of the world population has meat in their diet.

Canned products are seeing an increased demand in line with the rising preference for ready-to-eat products. Along with convenience, canned products also offer longer shelf life and high-value protein. Canned cooked meat Spam, a subsidiary of Hormel, hit record high sales for the seventh year in a row in 2021.

Frozen products have a long shelf life, and are available in a variety of options, allowing individuals to stock up on their favourite items without concerns about spoilage. The diverse range also caters to different dietary choices, which impacts buying behaviour. The stocks of frozen and chilled meats in cold storage amounted to 132, 269 tons in October 2021.

Competitive Landscape

The North America processed meat market outlook is characterised by production expansion, government funding, and enhanced research initiatives across the sector.Cargill, Incorporated

Cargill, Incorporated founded in 1865, has headquarters in Minnesota, United States. It is one of the leading players in North America processed meat market, providing food, ingredients, agricultural solutions, and industrial products. It specialises in the origination, processing and distribution of grain and oilseeds, customised animal nutrition solutions, bio-industrial applications, and more.American Foods Group, LLC

American Foods Group, LLC, founded in 1949, is headquartered in Wisconsin, United States. The company specialises in meat processing and provides a wide range of meat products, including USDA-graded beef, pork, and other protein-based offerings. They supply fresh and processed meat to retailers, food services, and international clients.Sysco

Sysco is a global leader in food distribution, marketing, and services, offering a diverse range of food and related products to restaurants, healthcare, educational facilities, and more. The company was founded in Texas, United States in 1969. It provides a selection of innovative ingredients and products and connects businesses with its distribution network.JBS S.A.

JBS S.A. was founded in 1953 in Brazil and is one of the world's largest meat processing companies, involved in the production and distribution of beef, chicken, pork, and lamb products globally. The company prioritises sustainability and environmental management across its organisation. It invests in technology research to assure food safety.

The other key players in the market include Tyson Foods, Inc., Smithfield Foods, Inc., Hormel Foods Corporation, Koch Foods, National Beef Packing Company LLC, and OSI Group, among others.

North America Processed Meat Market Analysis by Region

United States dominates the processed meat market in North America due to high production capacity

The largest share of revenue was held by the United States, a prominent global meat producer, particularly beef. The USDA reports an annual beef production of approximately 11.4 million tons in the United States, complemented by substantial imports from nations like Canada, Australia, Mexico, and New Zealand.In the United States, the consistent demand for these products has persisted over recent years. This stability is attributed to the competitive pricing of such foods compared to the cost of preparing meals with raw meat.

Canada also has a noteworthy revenue share within the North American processed meat market. As per the Organisation for Economic Co-operation and Development (OECD), Canada ranked among the top producers of pork and beef in 2019, experiencing significant demand both domestically and internationally. The country's robust consumption patterns and substantial expenditures have further contributed to fostering market growth.

Table of Contents

Companies Mentioned

- Cargill, Incorporated

- American Foods Group, LLC

- Sysco

- JBS S.A.

Table Information

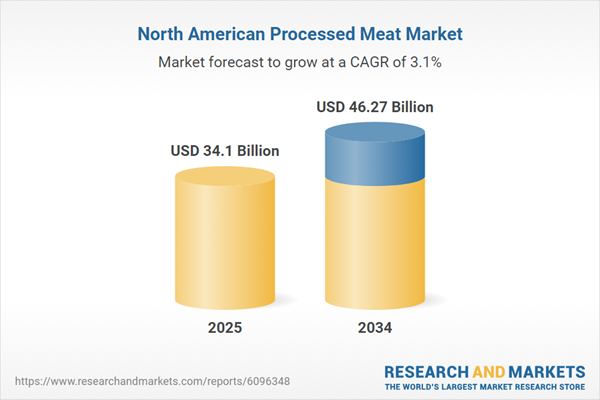

| Report Attribute | Details |

|---|---|

| No. of Pages | 99 |

| Published | May 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 34.1 Billion |

| Forecasted Market Value ( USD | $ 46.27 Billion |

| Compound Annual Growth Rate | 3.1% |

| Regions Covered | North America |

| No. of Companies Mentioned | 4 |