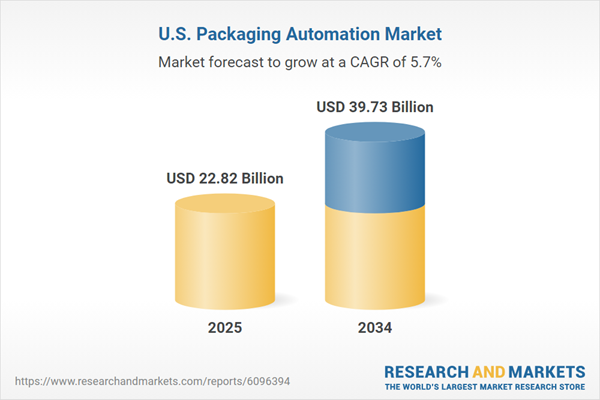

United States Packaging Automation Market Growth

The growth of the United States packaging automation industry is driven by improved efficiency, accuracy, and safety, alongside reduced costs, and waste. It provides scalability, enhanced data collection, and superior product quality. Automation also increases flexibility, ensures regulatory compliance, and promotes environmental sustainability by optimising material use and reducing waste.Moreover, the introduction of PET bottle manufacturing machines has transformed the food and beverage industry by enabling them to provide sustainable packaging solutions to consumers while improving product quality simultaneously. This is expected to drive the United States packaging automation industry growth over the forecast period.

United States Packaging Automation Market Analysis

With the proliferation of new cosmetics, pharmaceutical products, and consumer electronics brands, the need for a variety of packaging solutions is expected to become increasingly important for attracting and retaining consumer attention. Hence, the growing demand for intelligent packaging machines across a wide range of industries is expected to drive the United States packaging automation market demand in the forecast period.The demand for secondary packaging machines is expected to witness a significant surge over the forecast period. This is because manual packaging is a time-consuming exercise and is also prone to human error, which can have significant cost overruns for a business. Secondary packaging machines help companies react to changes in market demand quickly, which saves essential business resources. It also helps companies in optimising their space and labour requirements effectively. This is expected to accelerate the United States packaging automation market revenue.

United States Packaging Automation Industry Outlook

According to the International Federation of Pharmaceutical Manufacturers & Associations, in 2019, the United States led global retail pharmaceutical expenditure.According to the European Federation of Pharmaceutical Industries and Associations, pharmaceutical R&D expenditure in the United States grew at an annual rate of 8.5% between 2018 and 2024, significantly outpacing the previous periods, which saw growth rates of 1.8% from 2007-2011 and 7.7% from 2012-2016. This rising investment in the pharmaceutical sector is fuelling the growth of the United States packaging automation market revenue, driven by the increasing demand for precise, tamper-evident, and sterile packaging.

As per the U.S. Department of Defence, in the analysis of defence spending across the top ten U.S. states in 2021, Virginia leads with a substantial USD 62.7 billion. California followed closely with USD 57.4 billion in spending. Texas, with USD 47.3 billion in spending, indicates a strong focus on military installations and defence manufacturing, supporting the state's large military presence. New York and Florida, followed with expenditures of USD 30.9 billion and USD 30.1 billion respectively. Maryland followed with USD 26.3 billion in spending and Massachusetts spent USD 21.3 billion. Connecticut's spending of USD 19.3 billion highlighted its historical significance in submarine and aerospace manufacturing. Washington's expenditure of USD 19.1 billion highlighted its role in naval operations and defence logistics, while Pennsylvania spent USD 16.5 billion. This demand is fuelling the growth of the United States packaging automation industry revenue, as the defence budget allocates funds for military equipment, munitions, and supplies that require specialised, durable packaging to withstand harsh conditions.

According to the U.S. Census Bureau, in the U.S., the total adjusted retail sales for the third quarter of 2022 reached USD 1.79 trillion, showing a slight increase from the second quarter's USD 1.78 trillion. E-commerce continued to play a pivotal role in retail, with adjusted online sales reaching USD 262.2 billion in the third quarter of 2022. Depicting a slight increase from the second quarter's USD 258.2 billion. The rapid growth in online retail has led to a surge in demand for automated packaging solutions, as companies look to streamline operations and efficiently handle higher shipment volumes.

Rapid innovations in automation technology enhance efficiency and precision, thus, driving the United States packaging automation market growth.

- The rising need for cost-effective and high-speed production processes fuels adoption.

- Established players and a robust supply chain contribute to market stability and growth.

- Challenges in integrating new systems with existing infrastructure may lead to increased downtime.

- Limited availability of skilled workforce for maintenance and operation can affect system performance.

- Opportunities for developing tailored solutions to meet diverse industry needs.

- Growing focus on eco-friendly packaging solutions creates demand for advanced automation technologies.

- Fast-paced advancements may lead to the obsolescence of current systems.

- Stringent regulations and standards could increase compliance costs and complexity.

Key Players in the United States Packaging Automation Market and Their Key Initiatives

Rockwell Automation Inc.- Introduced the FactoryTalk Optix™ platform.

- Expanded digital transformation offerings with PTC.

- Introduced advanced robotic packaging solutions to meet the growing demand of the United States packaging automation market.

- Launched a new training program in the U.S.

- Invested USD 22 million to establish a Packaging & Logistics Headquarters in Atlanta.

- Expanded the Auburn Hills, Michigan facility with a $20 million investment.

United States Packaging Automation Industry Segmentation

United States Packaging Automation Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Offering

- Software

- Services

Market Breakup by Function

- Filling

- Labelling

- Palletising

- Capping

- Wrapping

- Bagging

- Case Packaging

- Others

Market Breakup by Product Type

- Automated Packagers

- Packaging Robots

- Automated Conveyor and Sortation Systems

Market Breakup by End Use

- E-commerce and Logistics

- Healthcare and Pharmaceuticals

- Food and Beverage

- Automotive

- Aerospace and Defence

- Others

Market Breakup by Region

- New England

- Mideast

- Great Lakes

- Plains

- Southeast

- Southwest

- Rocky Mountain

- Far West

United States Packaging Automation Market Share

Automated packagers and packaging robots provide substantial advantages in meeting the United States packaging automation demand growth. Automated packagers enhance efficiency by speeding up production and reducing labour costs while ensuring consistent and accurate packaging. This minimizes errors and wastage.Packaging robots provide flexibility by handling various tasks and adapting to different product types, improving workplace safety by reducing manual labour injuries, and offering scalability to accommodate changes in production needs. These technologies streamline operations, enhance productivity, and foster business growth, thereby further propelling the growth of the United States packaging automation industry.

Leading Companies in the United States Packaging Automation Market

The companies specialise in providing all-encompassing automation solutions that improve efficiency and productivity in manufacturing operations across diverse industries.- Rockwell Automation Inc.

- Mitsubishi Electric Corp.

- ABB Ltd.

- Emerson Electric Co.

- Siemens AG

- ATS Corp.

- JLS Automation

- Dover Corporation (DESTACO)

- Harpak-ULMA Packaging, LLC

- Massman Companies, Inc.

Table of Contents

Companies Mentioned

- Rockwell Automation Inc.

- Mitsubishi Electric Corp.

- ABB Ltd.

- Emerson Electric Co.

- Siemens AG

- ATS Corp.

- JLS Automation

- Dover Corporation (DESTACO)

- Harpak-ULMA Packaging, LLC

- Massman Companies, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 119 |

| Published | May 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 22.82 Billion |

| Forecasted Market Value ( USD | $ 39.73 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |