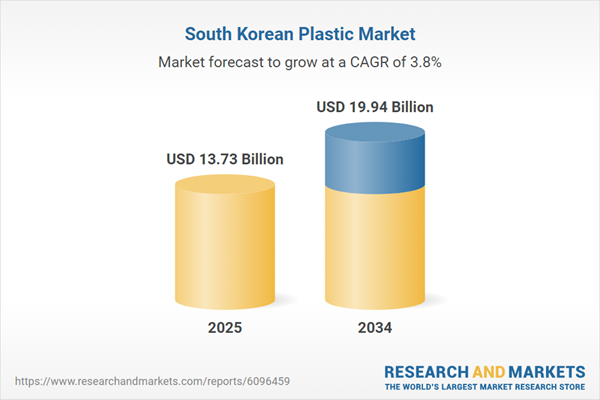

South Korea Plastic Market Growth

The shift towards sustainability is prompting major market players to manufacture eco-friendly polycarbonates by mixing recycled plastics with new raw material without compromising on its inherent properties (such as heat and impact resistance, and transparency). This process results in 3,200 tons of reduction in carbon dioxide emissions while producing 1000 tons of polyurethane. The potential use cases of such plastics include decorative gadgets and small electronic devices such as laptops and smartphones. Such plastics have also received recognition from the Underwriters Laboratories, a certification science establishment in the United States which is engaged in the development of safety standards.The introduction of transparent polypropylene compounds is expected to increase the use of plastic in South Korea's automotive industry. By eliminating component boundaries and integrating hidden sensors and lightings, these solutions can greatly minimise air resistance (thereby ensuring efficient fuel utilisation and carbon reduction) and enhance the visual appeal of the vehicle. By integrating these compounds into the vehicle's exterior panels, an environment of seamless interaction can be created, which can lead to an increase in the demand for autonomous driving technologies. Thus, the automative industry is expected to remain one of the main end users of the market.

South Korea Plastic Industry Segmentation

South Korea Plastic Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Product:

- Polyethylene

- Polypropylene

- Polyurethane

- Polyvinyl Chloride

- Polyethylene Terephthalate

- Polystyrene

- Acrylonitrile Butadiene Styrene

- Polybutylene Terephthalate

- Polycarbonate

- Others

Market Breakup by Application:

- Injection Moulding

- Blow Moulding

- Roto Moulding

- Compression Moulding

- Casting

- Thermoforming

- Extrusion

- Calendering

- Others

Market Breakup by End Use:

- Packaging

- Construction

- Electrical and Electronics

- Automotive

- Medical Devices

- Agriculture

- Furniture and Bedding

- Consumer Goods

- Utility

- Others

South Korea Plastic Market Share

Based on product, the market is divided into polyethylene, polypropylene, polyurethane, polyvinyl chloride, polyethylene terephthalate, polystyrene, acrylonitrile butadiene styrene, polybutylene terephthalate, and polycarbonate, among others. Polyurethane is expected to be one of the leading market segments over the forecast period due to its growing demand for home furnishings like beddings, furniture, and carpets, among others. Additionally, the expansion of the construction sector is expected to influence the demand for PVC due to its favourable characteristics.Leading Companies in the South Korea Plastic Market

The report provides a detailed analysis of the following key players in the market, covering their competitive landscape and latest developments like mergers and acquisitions, investments, and capacity expansion.- BASF SE

- LG Chem, Ltd.

- Others

Table of Contents

Companies Mentioned

- BASF SE

- LG Chem, Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | May 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 13.73 Billion |

| Forecasted Market Value ( USD | $ 19.94 Billion |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | South Korea |

| No. of Companies Mentioned | 2 |