India Mobile Payment Market Growth

The Reserve Bank of India is expected to introduce the facility of cash deposits in banks through the Unified Payments Interface (an instant payments platform developed by NPCI). This is expected to accelerate market development in the forecast period.The National Payments Corporation of India is also assisting emergingfintechcompanies in promoting the usage of their digital apps for UPI transactions. This is expected to increase the India mobile payment market value.

The volume of digital payments has recorded an annual growth rate of 50% in India, the highest in the world. The number of transactions reached 5.86 billion in June 2022, while the number of banks providing instant money transfer services on mobiles recorded a y-o-y increase of 44%. To further the scope of financial accessibility, the RBI introduced a UPI facility for feature phones. This is expected to enable 400 million rural people to adoptdigital payments, thereby aiding the India mobile payment market expansion.

India Mobile Payment Market Trends

Increasing government attention on curbing terrorist financing, corruption, and illegal money laundering through measures such as demonetisation is expected to increase the adoption of digital payments. As per India mobile payment market dynamics and trends, enhanced security measures such as biometric verification are expected to build consumer confidence and lead to the market growth in upcoming years.Industry Outlook

As per the India mobile payment industry analysis, the trend of luxury shopping is gradually becoming more popular inIndia's retailsector. Established businesses in India, like Darveys, have emerged as the new upscale shelter for fashion buyers as travel has become more restricted and offline shopping has lost its appeal. Luxury online players have seen a rise in sales as a result of consumers switching from offline to online purchasing; they continue to be open to exploring new avenues for obtaining rare and luxurious items. For example, the Indian e-commerce sector is predicted by India brand Equity Foundation (IBEF) to reach USD 200 billion by 2026. Digitally educated Indian consumers have an intense desire for foreign goods and brands, placing large orders for sophisticated computerized warehouses to manage the influx of more generic commodities. Such a rise in online shopping is expected to drive the demand of India mobile payment market.Mobile Payment Industry Statistics in India

Over the past five years, India's digital payment volume has increased at an average annual rate of almost 50%. Since National Payments Corporation of India (NPCI) launched UPI (Unified Payments Interface) in 2016, the country has experienced a considerable increase in its use. With nearly INR 4.3 trillion worth of transactions conducted by December 2020, UPI saw a YoY rise of 63% in 2020. With more than 1.49 billion transactions valued INR 5.6 trillion completed in June 2021, the YoY growth in 2021 was 72%. According to the NPCI, UPI's total transaction value at the end of the 2022 calendar year was INR 125.95 trillion, an increase of 1.75% year over year (YoY), thus increasing the India mobile payment industry revenue. It's interesting to note that in FY22, the entire amount of UPI transactions represented almost 86% of India's GDP. The total amount of transactions made through UPI as of the end of 2023 is 83.75 billion.Recent Developments

Leading international provider of technology-driven services, Lytus Technologies Holdings PTV. Ltd., introduced its payments gateway for Indian customers in July 2023. The company's strategic goal of increasing its market share in India by providing a range of services to Indian customers is being furthered by the deployment of the payment gateway. Initially, the new payment gateway will make transactions easier for Lytus customers who use IPTV and broadband services.Razorpay, the top full-stack payments and banking platform in India for businesses, stated in December 2022 that it is now equipped to handle credit card transactions using the Unified Payments Interface (UPI). With its debut, Razorpay becomes the first payment gateway in India to accept credit cards using UPI. Customers of Indian Bank, Union Bank, Punjab National Bank, and HDFC Bank would be the first to benefit from this innovation as of right now. This product aligns with the Reserve Bank of India's (RBI) and the National Payments Corporation of India's (NPCI) most recent digital innovation. Every day, almost 250 million Indians utilize UPI for their transactions, and 50 million of those users hold one or more credit cards.

India Mobile Payment Industry Segmentation

India Mobile Payment Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Technology:

- Direct Mobile Billing

- Near Field Communication

- Mobile Web Payment

- SMS

- Mobile Application

- Others

Market Breakup by Payment Type:

- B2B

- B2C

- B2G

Market Breakup by Location:

- Remote Payment

- Proximity Payment

Market Breakup by End Use:

- BFSI

- Healthcare

- IT and Telecom

- Media and Entertainment

- Retail and E-Commerce

- Transportation

- Others

Market Breakup by Region:

- North India

- East and Central India

- West India

- South India

Digital Transformation and Government Initiatives are Increasing the India Mobile Payment Market Share

- Digital Transformation: Rapid digitalization and increased smartphone penetration drive the growth of the mobile payment market in India.

- Government Initiatives: Government initiatives like Digital India and demonetization policies have boosted the adoption of mobile payments and driving the mobile payment demand growth in India.

- Convenience: Mobile payments offer convenience and ease of transactions, promoting their widespread use among consumers.

- Fintech Innovation: Continuous innovation by fintech companies provides advanced and user-friendly mobile payment solutions.

Challenges Impacting the Growth of the Market Include Security Concerns and Limited Digital Literacy

- Security Concerns: Concerns about data security and fraud can hinder the adoption of mobile payment systems.

- Digital Literacy: Limited digital literacy, especially in rural areas, can affect the widespread adoption of mobile payment technologies and will negatively impact the mobile payment demand forecast in India.

- Infrastructure: Inadequate digital infrastructure in some regions can impede the seamless use of mobile payment services.

- Regulatory Compliance: Navigating the regulatory landscape and ensuring compliance with financial regulations can be challenging.

Opportunities in the Mobile Payment Market Driven by E-commerce Growth and Financial Inclusion

- E-commerce Growth: The booming e-commerce sector in India provides significant opportunities for mobile payment adoption while also increasing the India mobile payment market revenue.

- Financial Inclusion: Mobile payments can enhance financial inclusion by providing banking and payment services to the unbanked population.

- Contactless Payments: The growing preference for contactless payments due to health and safety concerns presents new India mobile payment market opportunities.

- Partnerships: Forming strategic partnerships with banks, telecom operators, and retailers can expand the reach of mobile payment services.

- Market Competition: Intense competition from established players and new entrants can impact market share and profitability.

- Technological Challenges: Addressing technological challenges related to interoperability and user experience is crucial for growth of India mobile payment industry.

- Cash Dominance: The continued preference for cash transactions in certain segments can limit the growth of mobile payments.

Competitive Landscape

The key players in the mobile payment market in India are Alphabet Inc., Walmart Inc. (PhonePe), Amazon.com Inc., One 97 Communications Ltd. (Paytm), Samsung Electronics Co. Ltd., ICICI Bank Ltd., PayPal Holdings Inc., Apple Inc., Meta Platforms Inc., HDFC Bank Ltd., and Visa Inc., among others.Strategic Initiatives of Key Players

One 97 Communications Ltd. (Paytm)

- Market Expansion: Expanding its market reach through partnerships with merchants, service providers, and financial institutions.

- Financial Services: Diversifying its offerings to include financial services such as loans, insurance, and wealth management, thus increasing the mobile payment demand.

- User Engagement: Enhancing user engagement through loyalty programs, cashback offers, and personalized services.

Alphabet Inc. (Google Pay)

- Seamless Integration: Providing seamless integration with other Google services and products to enhance user experience is a key trend of India mobile payment market.

- Partnerships: Forming strategic partnerships with banks, fintech companies, and retailers to expand its user base.

- Security Enhancements: Continuously improving security features to protect user data and transactions.

PhonePe Private Limited

- Digital Ecosystem: Building a comprehensive digital ecosystem that includes payments, insurance, and financial services.

- Rural Penetration: Focusing on increasing penetration in rural and semi-urban areas to increase mobile payment market share in India.

- Innovation: Investing in innovation to develop new features and improve the overall user experience.

Amazon.com Inc. (Amazon Pay)

- E-commerce Integration: Leveraging its strong presence in e-commerce to promote the use of Amazon Pay for online purchases.

- Customer Loyalty: Offering rewards and incentives to build customer loyalty and encourage repeat usage.

- Service Expansion: Expanding its services to include utility payments, ticket bookings, and other everyday transactions.

BHIM-UPI

- Government Support: Benefiting from strong government support and promotion to drive adoption across the country and propel the growth of the India mobile payment market.

- Simplicity: Emphasizing ease of use and simplicity to attract users from diverse demographic backgrounds.

- Interoperability: Ensuring interoperability with other payment systems to provide a seamless user experience.

India Mobile Payment Market Report Snapshots

India Mobile Payment Market Size

India Mobile Payment Market Growth

India Mobile Payment Market Trends

India Mobile Payment Companies

Table of Contents

Companies Mentioned

- Alphabet Inc.

- Walmart Inc. (PhonePe)

- Amazon.com Inc.

- One 97 Communications Ltd. (Paytm)

- Samsung Electronics Co. Ltd.

- ICICI Bank Ltd.

- PayPal Holdings Inc.

- Apple Inc.

- Meta Platforms Inc.

- HDFC Bank Ltd.

- Visa Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 168 |

| Published | May 2025 |

| Forecast Period | 2025 - 2034 |

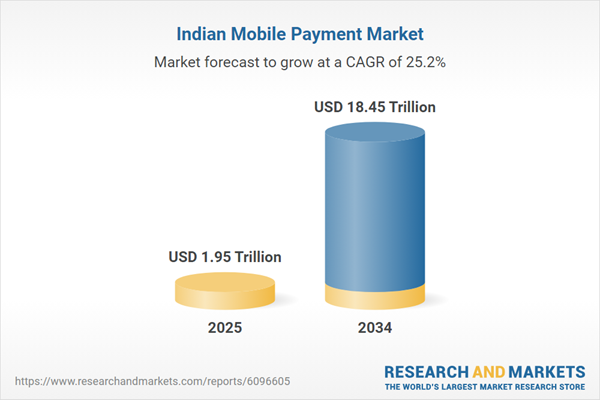

| Estimated Market Value ( USD | $ 1.95 Trillion |

| Forecasted Market Value ( USD | $ 18.45 Trillion |

| Compound Annual Growth Rate | 25.2% |

| Regions Covered | India |

| No. of Companies Mentioned | 11 |