Greater awareness of the harmful effects of oxidative stress and its links to chronic diseases and aging has led to an upsurge in demand for drinks that counteract these effects. Health-conscious buyers now look for beverages that not only taste good but also align with clean-label trends, favoring transparency and natural ingredients. The market has seen a marked shift toward low-calorie, sugar-free, and plant-based options, helping functional drinks become mainstream. Additionally, improved availability of antioxidant beverages across retail channels such as supermarkets, specialty stores, convenience outlets, and online platforms is making it easier for consumers to access their preferred products, thereby fueling market expansion.

Market performance varies by region, with North America and Europe demonstrating strong product penetration. Meanwhile, the Asia-Pacific region is witnessing rapid growth as traditional wellness drinks gain renewed popularity. Across all demographics, online retail is increasingly preferred, especially among younger buyers who value convenience and direct-to-consumer accessibility. This changing retail dynamic is creating new opportunities for brands to engage customers with personalized and innovative offerings.

Innovation is a defining trait of this market, with companies developing new formulations to meet the growing demand for functional, health-enhancing beverages. As wellness becomes an integral part of consumer lifestyles, manufacturers are expected to experiment with new ingredients and technologies to stay competitive. The use of naturally functional ingredients, particularly those associated with holistic wellness, is likely to gain traction as consumers continue to prioritize health benefits over synthetic additives.

By product type, the antioxidant drinks market is divided into natural and fortified categories. Natural antioxidant drinks captured a significant market share, recording a value of USD 13.6 billion in 2024. These beverages, which are made with minimal processing and sourced from whole ingredients, are preferred by consumers seeking clean-label, nutrient-dense options. Natural products are perceived as safer and healthier, offering essential antioxidants that support immune function and overall wellness.

In terms of sources, the market segments include fruits, vegetables, herbs and botanicals, and others. Fruit-based beverages led the segment with a 59% share in 2024 and are expected to grow at a CAGR of 5.8% through the forecast period. Fruit sources remain central to antioxidant beverages due to their high nutrient content and favorable consumer perception, making them a dominant force in the market.

When categorized by product category, the market comprises RTD teas, fruit and vegetable blends, enhanced waters, energy and sports drinks, kombucha and fermented drinks, functional coffee and cocoa-based beverages, and others. Among these, RTD teas are projected to reach USD 6.2 billion in 2025 and are anticipated to grow at a CAGR of 6.2%. These beverages are valued for their metabolic benefits and stress-relief properties, with consumers gravitating toward their convenience and perceived health benefits.

In terms of distribution channels, the market includes supermarkets and hypermarkets, convenience stores, specialty outlets, online retail, food service, and others. Supermarkets and hypermarkets accounted for a projected value of USD 7.9 billion in 2025, with an estimated CAGR of 5.5% over the forecast period. These outlets remain a leading distribution method due to their widespread accessibility, large consumer footfall, and diverse product offerings that appeal to both value-conscious and premium shoppers.

The United States is the dominant player in the antioxidant drinks market, contributing USD 3.4 billion in revenue in 2024. Growing interest in functional beverages and increasing awareness of health benefits are key factors driving the surge in demand. Consumers in the U.S. are gravitating toward products with transparent labeling and proven wellness benefits. This shift has encouraged manufacturers to innovate and expand their portfolios to cater to a more health-focused audience.

Major companies shaping the competitive landscape include The Coca-Cola Company, Danone S.A., Nestlé S.A., Suntory Holdings, and Tata Consumer Products. These firms maintain a strong global presence with comprehensive product portfolios and robust production and distribution infrastructure, allowing them to meet rising demand efficiently and consistently across diverse markets.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Antioxidant Drinks market report include:- Bai Brands LLC (Dr Pepper Snapple Group)

- Danone S.A.

- GT's Living Foods

- Hint, Inc.

- ITO EN, Ltd.

- Karma Culture LLC

- Keurig Dr Pepper Inc.

- Lemon Perfect

- Monster Beverage Corporation

- Nestlé S.A.

- Ocean Spray Cranberries, Inc.

- PepsiCo, Inc.

- POM Wonderful LLC

- Red Bull GmbH

- Suntory Holdings Limited

- Tata Consumer Products Limited

- The Coca-Cola Company

- Unilever PLC

- Vita Coco

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 263 |

| Published | May 2025 |

| Forecast Period | 2024 - 2034 |

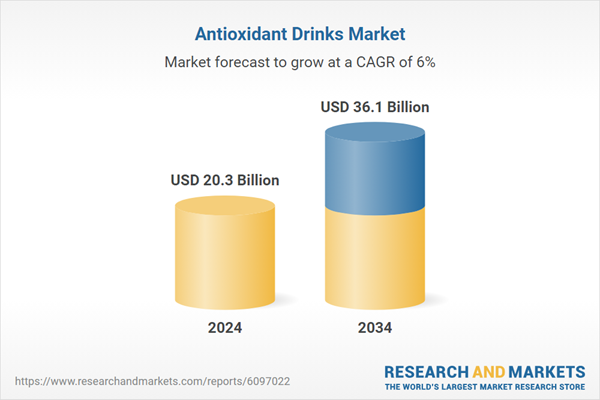

| Estimated Market Value ( USD | $ 20.3 Billion |

| Forecasted Market Value ( USD | $ 36.1 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |