Company officials recalled how earlier trade restrictions, particularly the tariffs on imported aluminum and steel, disrupted the aerospace value chain. These policy changes elevated raw material prices, complicating budgeting for OEMs and major tier-1 suppliers. Additionally, international retaliatory tariffs disrupted sourcing operations, leading to instability in pricing and procurement of vital cabling materials. Firms with globally integrated supply chains faced the most severe setbacks, as sourcing delays and elevated costs strained manufacturing timelines. As noted by engineers, electrical aircraft and eVTOL platforms today demand sophisticated wiring for systems like avionics, battery propulsion, and thermal control. These applications require cables that can withstand extreme conditions while keeping weight minimal. Analysts emphasized that advanced aircraft design trends have driven aerospace firms to invest more in developing robust and compact cable systems that align with next-gen aviation goals.

The aircraft wire segment in the wire and cable product segment held a 38.3% share in 2024, attributed to its essential role in transmitting power, control signals, and data throughout various aircraft systems. Industry suppliers emphasized that demand is growing for heat-resistant, lightweight wiring solutions, particularly as aircraft programs transition toward next-generation electric architectures and increased automation. Regulatory pressures around electromagnetic interference and fire resistance also shape design parameters, making advanced wire configurations vital for airworthiness certifications and fleet retrofits.

The fixed-wing aircraft segment is anticipated to reach USD 1.3 billion by 2034, driven by expanding production lines and continued upgrades to aging fleets. Aviation engineers pointed out that fixed-wing designs generally require more intricate cabling systems than rotary-wing or unmanned aerial vehicles, as they host a greater concentration of avionics, flight control, and cabin systems. These aircraft typically demand dense, modular wiring harnesses that support long-range operations and advanced safety features.

United States Aircraft Wire and Cable Market generated USD 562.6 million in 2024, underpinned by strong funding for the commercial aerospace and defense sectors. Industry insiders noted that U.S.-based programs prioritize reliability and survivability under harsh conditions, prompting the development of specialized wire materials and shielding technologies. The country remains a testing ground for high-voltage and fiber-optic cabling systems designed for more electric aircraft platforms, signaling long-term growth potential.

Companies operating in the Global Aircraft Wire and Cable Market are adopting multiple strategies to bolster their market footprint. Key players such as Ametek, Eaton, Aerospace Wire & Cable, Bergen Cable Technology, Amphenol, and Collins Aerospace have prioritized R&D investments to develop lighter, more thermally stable cable solutions. Many firms are expanding their global manufacturing capabilities to improve supply chain agility and meet growing demand. Collaborations with aircraft OEMs and system integrators are also rising, enabling tailored wiring architectures that align with evolving aircraft designs. In addition, companies are focusing on strategic acquisitions and certifications that enhance their product portfolios and competitive standing. These moves aim to ensure resilience and sustained growth in a highly technical and regulation-driven market.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Aircraft Wire and Cable market report include:- Aerospace Wire & Cable

- Ametek

- Amphenol

- Bergen Cable Technology

- Collins Aerospace

- Eaton

- HUBER+SUHNER

- Lexco Cable

- Miracle Electronics Devices

- Molex

- Nexans

- PIC Wire & Cable

- Prysmian Group

- Radiall

- Sanghvi Aerospace

- TE Connectivity

- Tyler Madison

- WL Gore and Associates

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | May 2025 |

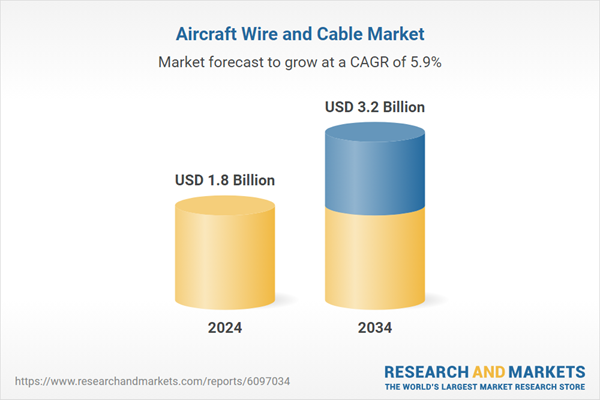

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 1.8 Billion |

| Forecasted Market Value ( USD | $ 3.2 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 19 |