The increasing focus on sustainable building practices is a major catalyst for change in this market. Innovations in wood treatment technology and composite material manufacturing have significantly improved the durability and lifespan of decking solutions. Products today are engineered to resist decay, pests, and environmental wear, making them ideal for modern outdoor applications. Composite decking has gained traction for combining wood aesthetics with enhanced resilience, reducing the need for upkeep. This shift has positioned composite materials as a preferred choice among consumers aiming for long-term performance with a minimal environmental footprint.

In 2024, pressure-treated wood held the largest market share, contributing USD 3 billion due to its affordability, accessibility, and high resistance to moisture, rot, and insects. Pressure-treated wood remains a preferred option in decking projects thanks to its improved strength and extended lifespan, enabled by continuous technological improvements in treatment methods. Despite the emergence of more modern alternatives, its practical advantages have helped it retain popularity in commercial and residential applications.

The residential sector dominated the market with a 76% share in 2024 and is projected to maintain steady growth at a 3% CAGR through 2034. As more homeowners focus on wellness and relaxation within their living environments, outdoor spaces have become essential. Wooden decking helps in this transformation by offering an elegant, eco-conscious solution that aligns with contemporary design preferences. The market has seen increased adoption of certified sustainable wood and composites, particularly those verified for low environmental impact, further supporting the green home movement.

United States Wooden Decking Market held a 20% share in 2024. With a strong culture of homeownership and appreciation for outdoor recreational space, the U.S. continues to drive market momentum. Builders are increasingly incorporating wooden decks in new housing and renovation projects, with materials like redwood and treated lumber being favored for their durability and compatibility with regional climates.

Leading companies such as James Latham, Fiberon, Kebony, AZEK Building Products, Trex Company, UPM, Alfresco Floors, Inovar Floors, West Fraser, and DuraLife are using several strategies to enhance their market standing. They are heavily investing in R&D to create longer-lasting, eco-friendly decking options and adopting green certification standards to appeal to sustainability-driven consumers. Partnerships with large retailers and digital marketing campaigns are employed to expand brand visibility. Some firms localize manufacturing operations to reduce costs and improve delivery timelines. Customization offerings and advanced surface technologies are key differentiators to meet evolving customer preferences and competitive dynamics.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Wooden Decking market report include:- Alfresco Floors

- AZEK Building Products

- DuraLife

- Fiberon

- Humboldt Redwood Company

- Inovar Floors

- James Latham

- Kebony

- Metsa Group

- Trex Company

- United Construction Products

- Universal Forest Products

- UPM

- West Fraser

- Weyerhaeuser Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 220 |

| Published | May 2025 |

| Forecast Period | 2024 - 2034 |

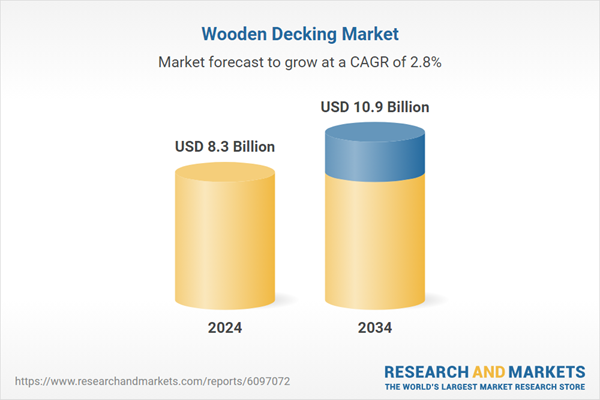

| Estimated Market Value ( USD | $ 8.3 Billion |

| Forecasted Market Value ( USD | $ 10.9 Billion |

| Compound Annual Growth Rate | 2.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |