This increasing reliance on radial techniques drives strong demand for transradial access devices worldwide, including components such as sheaths, guidewires, hemostasis bands, and catheters. The clinical advantages of the radial approach - such as lower bleeding risk, faster patient mobilization, and shorter hospital stays - continue to shape procedural protocols in interventional cardiology. As healthcare providers aim to optimize efficiency and patient satisfaction, adopting radial-first strategies is expanding not only in developed markets but also gaining momentum in emerging economies with improving cardiovascular infrastructure.

Catheters currently lead the product segment with a commanding market share of 49.4% in 2024. Their effectiveness in navigating complex vascular networks and facilitating accurate device delivery makes them vital in diagnostic and therapeutic cardiac procedures. Innovation in catheter designs, such as improved torque response, enhanced flexibility, and hydrophilic coatings, has significantly boosted procedural success rates and overall patient outcomes. Furthermore, next-generation catheters designed specifically for transradial interventions contribute to reduced access site complications and increased procedural efficiency.

Additionally, the drug administration segment holds a 36.8% market share in 2024 and is forecasted to reach USD 1.8 billion by 2034. The ability of these devices to deliver targeted medications directly to affected areas not only enhances therapeutic results but also shortens recovery times. This capability is important in acute cardiovascular events, where rapid drug delivery can be life-saving. Transradial access is now being increasingly explored for broader applications, thanks to its precision and minimally invasive nature. Its growing role in delivering pharmacological agents for cardiac and non-cardiac conditions reflects the adaptability and expanding scope of transradial solutions.

U.S. Transradial Access Devices Market generated USD 881.8 million in 2024, driven by the number of cardiovascular interventions, supportive reimbursement policies, and operator preference for radial access, which is accelerating adoption. Increased awareness of the benefits of transradial procedures is leading to greater integration across healthcare systems. Hospitals are rapidly transitioning to outpatient-based PCI models, taking advantage of the reduced recovery time and procedural simplicity of radial access. Regulatory support, clinical training programs, and investment in advanced cath lab infrastructure further reinforce the widespread use of these devices. This progressive environment ensures that transradial access remains at the forefront of interventional cardiology innovation in the region.

Key players operating in this space include Boston Scientific, Alvimedica, Becton Dickinson and Company, Terumo, Medtronic, Teleflex, Palex Medical, ICU Medical, InnoMedica, Cardinal Health, Merit Medical System, Edward Lifesciences, NIPRO Medical, Ameco Medical Industries, AngioDynamics, and Oscor. To secure a competitive edge, leading companies are focusing on product innovation and technological upgrades. They invest in advanced materials, ergonomic designs, and improved functionality to boost clinician usability and patient comfort. Many firms expand their geographic footprint through strategic partnerships, mergers, and acquisitions. Collaborations with hospitals and healthcare networks help in early adoption and market penetration.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Transradial Access Devices market report include:- Alvimedica

- Ameco Medical Industries

- AngioDynamics

- Becton Dickinson and Company

- Boston Scientific

- Cardinal Health

- Edward Lifesciences

- ICU Medical

- InnoMedica

- Medtronic

- Merit Medical System

- NIPRO Medical

- Oscor

- Palex Medical

- Teleflex

- Terumo

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 130 |

| Published | May 2025 |

| Forecast Period | 2024 - 2034 |

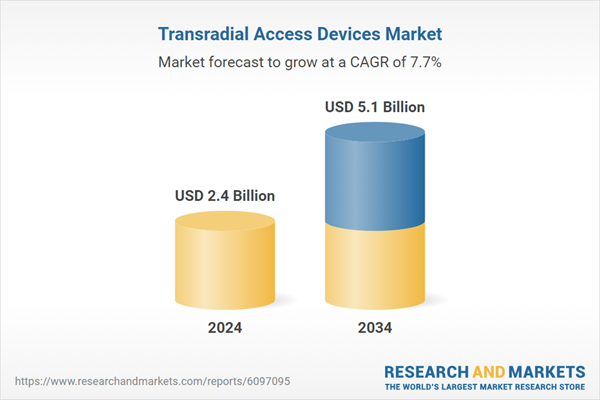

| Estimated Market Value ( USD | $ 2.4 Billion |

| Forecasted Market Value ( USD | $ 5.1 Billion |

| Compound Annual Growth Rate | 7.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |