As the industry evolves, the focus remains on reducing energy losses, enhancing system performance, and ensuring sustainability. Despite ongoing progress, the market is facing challenges related to raw material cost fluctuations and disruptions in global supply chains. These factors are creating a volatile environment for manufacturers, who are also navigating rising material prices while trying to maintain product quality and delivery timelines. Even with these constraints, innovation in component design, particularly in core construction, insulation, and cooling technologies, is helping companies stay competitive and meet growing demand.

Asia-Pacific holds the leading position in the global transformer component market and is projected to exceed USD 11.5 billion by 2034. The region’s growth is strongly tied to accelerating investments in electrical infrastructure, driven by expanding urban populations and increased industrial activity. Across this region, efforts to enhance grid reliability and capacity are generating sustained demand for transformer components. Meanwhile, North America is also witnessing strong momentum as the region modernizes its aging power infrastructure and expands its renewable energy footprint. Upgrades in grid architecture and the adoption of smart grid systems are boosting the need for high-performance transformer components that can support stable and efficient energy distribution. These changes are pushing utilities and power companies to adopt new technologies aimed at reducing operational losses and enhancing service reliability.

The transformer component market is seeing widespread improvements in areas such as winding assemblies, tap changers, insulation materials, and core structures. These developments are a direct response to growing expectations for energy-efficient and long-lasting systems. In 2024, the core component segment accounted for 33.5% of the overall market and is expected to grow at a CAGR exceeding 9% through 2034. This segment continues to evolve with the introduction of advanced materials that are designed to minimize energy losses and optimize performance. Materials such as amorphous and silicon-based steels are being adopted to reduce core losses and contribute to the overall efficiency of transformer units.

In cooling systems, new technologies and conductive materials are being introduced to reduce energy waste and improve operational safety. Innovations like Continuous Transposed Conductors (CTC) are gaining popularity due to their ability to support high-performance cooling while lowering losses. These advancements are critical for meeting the growing power demands of industrial and utility networks and for ensuring the long-term reliability of the electrical grid.

The transformer component market in the United States has shown consistent growth over recent years. In 2022, the market was valued at USD 2.6 billion, rising to USD 2.9 billion in 2023 and USD 3.2 billion in 2024. By 2034, this figure is projected to surpass USD 7 billion. This growth is largely attributed to the nation’s increasing investment in renewable energy and grid upgrade initiatives. The push to develop smart grid systems and enhance energy resilience is generating significant demand for improved winding cores, efficient insulation materials, and modern component assemblies. Utility providers and commercial operators are focusing on strengthening infrastructure to ensure uninterrupted service and efficient energy flow.

Leading players in the global transformer component market continue to maintain a strong foothold due to their broad product offerings and reliable distribution frameworks. In 2024, the top five companies collectively held over 35% of the market share. Their success is rooted in their ability to provide end-to-end solutions, foster long-term relationships with utility providers, and continually invest in research and innovation to meet evolving market needs.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Transformer Component market report include:- Alamo Transformer Supply Company (ATSCO)

- Amran Inc.

- BHEL

- Eaton

- EIS Legacy, LLC

- ELSCO Transformers

- Emerald Transformer

- ERMCO

- Hitachi Energy

- Howard Industries

- Johnson Bros. Roll Forming Co.

- LCS Company

- Magnetics

- Mapes & Sprowl Steel

- Metglas Inc.

- Power Asset Recovery Corporation

- Renco Electronics

- TC Metal

- Tempel

- The H-J Family of Companies

- Triad Magnetics

- VoltageShift Engineering Solutions LLP

- Von Roll USA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 125 |

| Published | May 2025 |

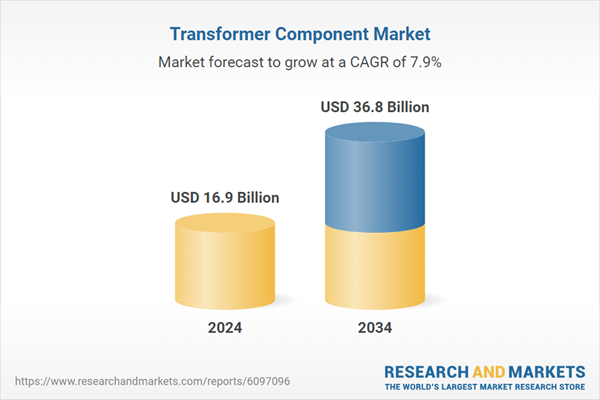

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 16.9 Billion |

| Forecasted Market Value ( USD | $ 36.8 Billion |

| Compound Annual Growth Rate | 7.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 24 |