With rising demand for portable, microwaveable, and resealable containers, thin wall formats have become indispensable across urban food consumption. These packages align with consumers’ preference for on-the-go meals and instant snacks, especially in high-density regions. Thanks to their barrier properties and structural integrity, thin wall containers help extend shelf life while supporting sustainability goals. They’re now widely chosen for packaging dairy, frozen entrees, and snack foods. Consumers gravitate toward these options for practicality, especially as packaging trends lean more toward minimalism and eco-consciousness. Jars are popular for their reusable nature and suitability across personal care, household goods, and food applications. They offer an effective seal that maintains freshness while being easy to handle.

The jars segment generated USD 9 billion in 2024, marking its dominance within the thin wall packaging landscape. These containers are extensively used across food, personal care, and household product categories due to their lightweight structure, reduced material usage, and cost-effective production. Jars offer an ideal packaging solution for a wide range of applications, providing both manufacturers and consumers with versatility and functionality. Their growing popularity stems not only from their affordability but also from consumer-driven preferences for convenience, ease of use, and sustainability. Reusability and easy storage make jars a preferred option, especially for products that require repeated access or portion control. I

The polypropylene (PP) segment held a 37.8% share in 2024. This polymer’s blend of strength, light weight, and affordability makes it ideal for thin wall packaging, especially in fast-cycle injection molding. Its moisture resistance and chemical stability make it a preferred choice for food-grade applications. Enhanced PP formulations allow thinner walls without compromising durability, enabling companies to reduce carbon footprints while meeting regulatory pressures.

United States Thin Wall Packaging Market generated USD 9.2 billion in 2024. Increased consumption of prepared meals and snacks has fueled demand for lightweight, protective packaging solutions. Additionally, the rise of e-commerce and home delivery services has prompted packaging innovations that prioritize material reduction and environmental compliance. This trend is further accelerated by growing consumer awareness and government-led sustainability initiatives.

Leading companies in the Global Thin Wall Packaging Industry comprise ILIP S.r.l., Paccor GmbH, Amcor plc, Greiner Packaging International GmbH, and Berry Global Inc. Key players in the Global Thin Wall Packaging Market are investing heavily in sustainable innovation, strategic mergers, and regional expansion to enhance market presence. Companies are focusing on lightweight design technologies and adopting recyclable materials like bio-based polypropylene to align with green packaging mandates. Several have partnered with food and beverage brands to offer customized solutions that improve shelf appeal and extend freshness. Expanding production capacity in high-growth regions such as North America and Asia-Pacific is a top priority, alongside adopting advanced injection molding machinery to improve speed and efficiency.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Thin Wall Packaging market report include:- ALPLA Group

- Akshar Plastic

- Amcor Plc

- Berry Global Inc.

- Borouge

- Chemco Plast

- Cosmo Films

- Double H Plastics

- EVCO Plastics

- Greiner Packaging International GmbH

- ILIP S.r.l.

- IPL Plastics Inc.

- Mold-Masters

- Paccor

- Prabhoti Plastic Industries

- SABIC

- SP International Industries Pvt. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 177 |

| Published | May 2025 |

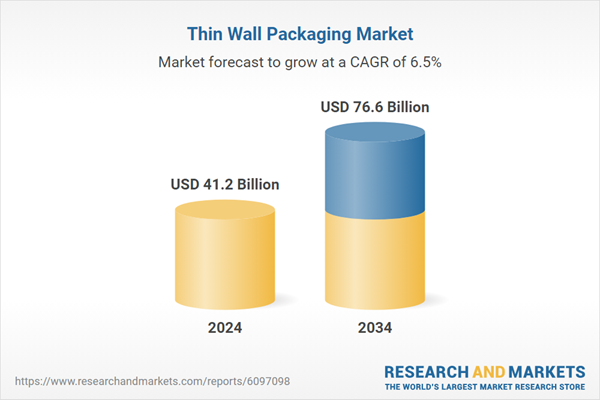

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 41.2 Billion |

| Forecasted Market Value ( USD | $ 76.6 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 18 |