Furthermore, emerging manufacturing technologies are widening the scope for tantalum carbide, offering opportunities for greater design flexibility and custom applications. However, the market still faces challenges related to the environmental impact of tantalum mining, alongside high mining and production costs. Despite these constraints, ongoing research and advancements in manufacturing efficiencies are expected to enhance the cost-effectiveness and scalability of tantalum carbide solutions, thereby creating a favorable outlook for future market development.

In 2024, the industrial grade segment dominated the market with a substantial 79.2% share, valued at USD 151.1 million. This segment is widely adopted across industries that operate under high temperatures or require materials with exceptional resistance to abrasion. Applications in construction and mass manufacturing rely heavily on the thermal and mechanical strength of industrial grade TaC, particularly for tools, dies, and structural elements that must perform under stress. Meanwhile, research grade TaC is gaining modest but important traction, driven by its use in experimental work related to advanced ceramics and new-age electronic materials. This growing niche is fueled by academic and industrial R&D initiatives focused on innovation in material science.

By form, the powder segment is showing strong performance, projected to reach USD 154.2 million by 2034 with a CAGR of 6.4% during the forecast period. The powder form is a preferred input for sintering processes, thermal spray coatings, and additive manufacturing applications. Its fine texture allows for high precision in developing intricate components, particularly those used in environments prone to extreme friction and temperature fluctuations. The adaptability of the powder form makes it ideal for crafting components with complex geometries, making it a critical material in multiple advanced production settings.

Production-wise, the carbothermal reduction segment stood at USD 74 million in 2024 and is expected to grow at a 6.3% CAGR, accounting for 38.7% of the market. This method remains favored for its cost-effectiveness and scalability, particularly in the production of industrial-grade TaC. While traditional in nature, this approach remains prevalent in large-scale manufacturing due to its reliability and ability to deliver consistent material quality. At the same time, other production techniques are gaining ground as industries seek ultra-pure TaC compositions for specific applications. In this context, the demand for alternative deposition methods is on the rise, especially among manufacturers focused on meeting stringent technical specifications.

In terms of application, cutting tools and wear-resistant components contributed over USD 55.7 million to the market in 2024. These components are crucial for operations involving milling, shaping, and other high-stress industrial processes. The high hardness and thermal resilience of tantalum carbide make it ideal for tools and parts that are subject to intense mechanical wear and heat exposure. Additionally, high-temperature parts continue to find increased usage, particularly where long-term thermal shock resistance is essential to operational efficiency.

Looking at end-user industries, the aerospace and defense sector is forecasted to surpass USD 109.5 million by 2034, advancing at a 6.8% CAGR. This segment remains one of the most dynamic contributors to market growth. The need for durable, heat-resistant materials in advanced defense systems and aerospace components ensures continued demand for TaC. The metal processing sector also leans heavily on TaC’s performance benefits to enhance efficiency, reduce equipment downtime, and maintain consistent output under challenging conditions.

Regionally, the U.S. tantalum carbide market reached a valuation of USD 47.6 million in 2024 and is projected to grow at a 6.2% CAGR through 2034. The country’s robust industrial infrastructure, along with its leadership in aerospace, defense, and technological innovation, supports strong domestic demand. The U.S. continues to be a prominent consumer of high-performance materials like TaC, with a growing focus on research-driven applications and technological development across sectors.

Major players shaping the competitive landscape include Hunan Fushel Technology, Edgetech Industries, ABSCO, H.C. Starck Tungsten, and Ningxia Orient Tantalum Industry. These companies leverage a combination of large-scale manufacturing capabilities and technical expertise to maintain their foothold. The competitive environment is marked by the emphasis on technological advancement, production capacity, and the ability to serve a wide spectrum of end-use industries, from industrial-grade manufacturing to customized applications.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Tantalum Carbide market report include:- ABSCO

- ALB Materials

- Edgetech Industries

- H.C. Starck Tungsten

- Hunan Fushel Technology

- Ningxia Orient Tantalum Industry

- Otto Chemie

- Reade

- Semicera Semiconductor

- Stanford Advanced Materials

- Treibacher

- Yanling Jincheng Tantalum & Niobium

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 235 |

| Published | May 2025 |

| Forecast Period | 2024 - 2034 |

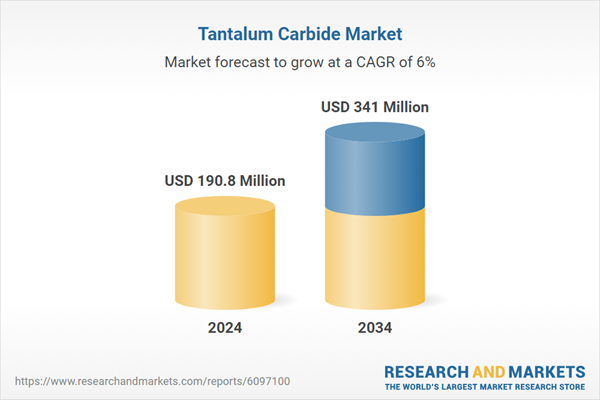

| Estimated Market Value ( USD | $ 190.8 Million |

| Forecasted Market Value ( USD | $ 341 Million |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |