Pharmaceutical firms invest in research and development, focusing on novel biologics, gene therapies, and targeted drugs designed to improve clinical outcomes. Personalized medicine is becoming a key area of interest, allowing for more precise and effective treatment approaches. Stroke therapeutics includes medications, from antiplatelet agents and anticoagulants to thrombolytics and neuroprotective drugs. Substantial financial backing for R&D is helping expand the development pipeline, with new therapies aimed at improving outcomes for both ischemic and hemorrhagic stroke types.

Ischemic stroke, which occurs when a blood vessel to the brain is blocked, dominates the therapeutic market. This segment generated USD 13.1 billion in 2024 and is forecasted to hit USD 28.5 billion by 2034, growing at a CAGR of 8.1%. Given that ischemic strokes account for the majority of total cases globally, this demand trajectory remains strong. The rising prevalence of contributing conditions like high cholesterol, atrial fibrillation, and diabetes continues to push the need for more effective treatments. Drug innovations, especially in thrombolytic therapy and antiplatelet development, are helping improve survival rates and recovery outcomes.

When segmented by age group, individuals aged 60 and above have the largest share at 46.8% in 2024. The risk of stroke significantly increases with age due to declining vascular health and common comorbidities. Aging also affects neurovascular responsiveness, making seniors a key demographic for therapeutic intervention. The ongoing improvement of healthcare infrastructure and age-focused health initiatives are expected to sustain segment growth through 2034.

United States Stroke Therapeutics Market was valued at USD 6.5 billion in 2024, supported by advanced healthcare systems, high R&D intensity, and strong pharmaceutical presence. Rapid innovations, including stem cell therapies and AI-based diagnostic integration, reinforce the country’s leadership. The growing focus on precision medicine and digital health platforms is further enhancing early detection and improving treatment efficacy. Robust public and private sector collaboration is fueling the expansion of clinical trials and pipeline development.

Key players such as Lupin, Pfizer, Boehringer Ingelheim, Sanofi, Genentech, Novartis, Bayer, AstraZeneca, Daiichi Sankyo, Johnson & Johnson Services, Cadrenal Therapeutics, Prestige Consumer Healthcare, Merck, Eisai, and Bristol-Myers Squibb are adopting aggressive growth strategies. These include expanding clinical pipelines, forming R&D partnerships, pursuing regulatory approvals for breakthrough drugs, and exploring personalized medicine to deliver targeted therapies. Many invest in AI platforms and biologics innovation to optimize treatment delivery and patient outcomes.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Stroke Therapeutics market report include:- AstraZeneca

- Bayer

- Boehringer Ingelheim

- Bristol-Myers Squibb (BMS)

- Cadrenal Therapeutics

- Daiichi Sankyo

- Eisai

- Genentech

- Johnson & Johnson Services

- Lupin

- Merck

- Novartis

- Pfizer

- Prestige Consumer Healthcare

- Sanofi

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 130 |

| Published | May 2025 |

| Forecast Period | 2024 - 2034 |

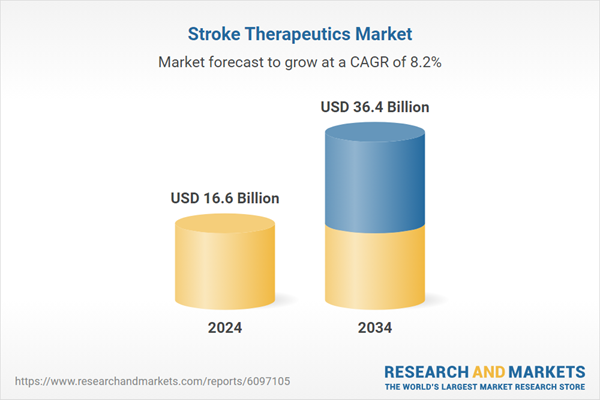

| Estimated Market Value ( USD | $ 16.6 Billion |

| Forecasted Market Value ( USD | $ 36.4 Billion |

| Compound Annual Growth Rate | 8.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |