Another crucial factor contributing to market expansion is the growing shift toward cloud-based PACS platforms. Cloud deployment allows for seamless remote access, reduced IT infrastructure costs, greater scalability, and more convenient image sharing across locations. These advantages are particularly valuable to diagnostic centers, outpatient facilities, and healthcare networks. Additionally, ongoing public and private sector investments in health IT are further accelerating PACS adoption. In particular, initiatives promoting the integration and interoperability of electronic health records are encouraging healthcare organizations to transition from traditional imaging systems to digital solutions. This evolution is shaping a more connected and efficient diagnostic environment.

Specialty PACS (Picture Archiving and Communication Systems) are tailored for specific clinical fields such as cardiology, orthopedics, dermatology, oncology, and others. These platforms deliver unique diagnostic tools and workflow optimizations to meet the demands of each specialty. As a result, they enhance diagnostic accuracy and support smooth collaboration between departments. The market segmentation by type includes cardiology PACS, radiology PACS, orthopedics PACS, pathology PACS, oncology PACS, ophthalmology PACS, neurology PACS, dermatology PACS, women’s health PACS, endoscopy PACS, and other specialty PACS. Among these, radiology PACS led the market with a valuation of USD 1.2 billion in 2024.

Radiology PACS is seeing widespread adoption in hospitals, clinics, and imaging centers due to the increased demand for modalities like X-rays, MRIs, CT scans, and ultrasounds. These systems are critical for organizing large volumes of imaging data and facilitating real-time access for healthcare teams. Their ability to integrate with other clinical platforms, such as EHRs and hospital information systems, supports improved data accuracy and workflow efficiency. The rise of remote care and the digital transformation of healthcare is also strengthening the demand for radiology PACS, especially as regulations continue to promote digitization.

By component, the market is segmented into software, hardware, and services. Software led the market with a 44.2% share in 2024. This dominance stems from the essential role software plays in managing and distributing medical imaging data across specialties. The surge in digital healthcare systems has increased the demand for advanced PACS software solutions that optimize workflows and enhance diagnostic capabilities. Innovations such as cloud-based platforms and AI-powered image analysis are further propelling this segment, offering flexibility, automation, and improved decision-making tools to healthcare providers.

Regarding deployment models, the specialty PACS market is classified into on-premise and web/cloud-based solutions. The on-premise segment is expected to grow at a CAGR of 5.3% over the forecast period. This model appeals to healthcare organizations seeking greater control over data privacy, security, and system performance. On-premise solutions also allow for better customization and regulatory compliance, particularly for facilities handling high volumes of sensitive patient data. Moreover, established hospitals with dedicated IT teams often find these systems more cost-effective in the long term due to existing infrastructure investments.

The end-user segmentation includes hospitals and clinics, ambulatory surgical centers, diagnostic imaging centers, and other healthcare facilities. Hospitals and clinics dominated the market in 2024 and are anticipated to reach USD 3.1 billion by 2034. These institutions typically operate multiple departments that depend on efficient PACS integration to streamline image sharing and enhance interdisciplinary collaboration. The rise in chronic conditions, the aging population, and increasing inpatient volumes have heightened the need for reliable imaging solutions in these settings. Consequently, hospitals are investing heavily in specialized PACS technologies to ensure timely and accurate diagnostics.

Regionally, North America held the largest share of the global specialty PACS market at 38.7% in 2024 and is forecasted to grow at a CAGR of 5.4% through 2034. The US accounted for USD 1.2 billion of this share in 2024, showing a steady growth trajectory over the past few years. This growth is primarily attributed to consistent investment in imaging infrastructure and a strong emphasis on healthcare digitization. As providers continue enhancing their existing PACS capabilities, the region remains a hub for technological advancement and innovation in the medical imaging field.

The competitive landscape is marked by continuous product development, strategic collaborations, and global expansion efforts. Key players hold a combined 42% market share, driven by their robust product offerings, extensive industry experience, and integration capabilities with core healthcare IT systems. As the focus on data accuracy, security, and diagnostic efficiency increases, competition is expected to intensify, encouraging further innovation and consolidation across the global specialty PACS market.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Specialty PACS market report include:- Agfa Healthcare

- Canon

- Carestream Health

- EyePACS

- Fujifilm Holdings Corporation (Fujifilm Medical Systems)

- IBM Corporation

- INFINITT Healthcare

- Intelerad Medical Systems

- McKesson Corporation

- Novarad

- Philips Healthcare

- Sectra

- Siemens

- Sonomed Escalon

- Topcon Corporation

- Visbion

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 132 |

| Published | May 2025 |

| Forecast Period | 2024 - 2034 |

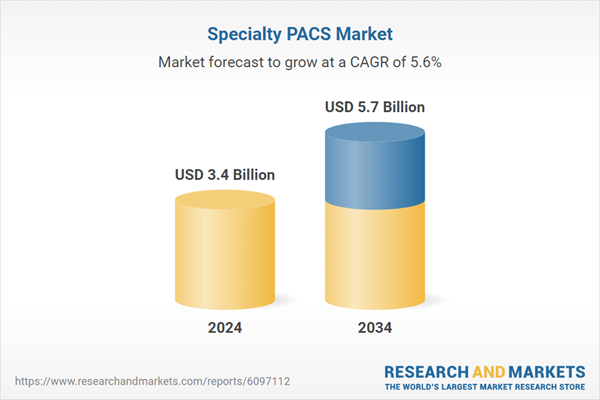

| Estimated Market Value ( USD | $ 3.4 Billion |

| Forecasted Market Value ( USD | $ 5.7 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |