Slag cement, especially ground granulated blast furnace slag (GGBFS), is increasingly preferred in modern construction due to its exceptional performance characteristics. It not only delivers enhanced compressive strength and reduced permeability but also significantly improves resistance to chemical attacks, making it ideal for aggressive environmental conditions. These attributes contribute to longer-lasting infrastructure, reducing the frequency and expense of repairs over time. Additionally, GGBFS reduces the heat of hydration, which helps prevent thermal cracking in large concrete pours, thereby increasing structural integrity. Its use in concrete mixtures also improves workability and finish quality, benefiting both the construction process and the result. As sustainability becomes a priority in building practices, the low-carbon footprint of slag cement further amplifies its value in residential and large-scale infrastructure projects.

The GGBFS segment accounted for 64.5% of the market share in 2024. Its superior strength, decreased permeability, and increased durability make it ideal for critical infrastructure projects, including bridges, tunnels, and marine structures. Additionally, GGBFS contributes to reducing the carbon footprint of concrete, promoting its use in sustainable building practices.

The residential construction segment held a 40.2% market share in 2024. As demand for housing increases, there is a need for durable, long-lasting building materials. Slag cement is gaining popularity in residential projects due to its superior strength, reduced shrinkage, and fire resistance, aligning with the trend towards sustainable housing.

North America Slag Cement Market held 85% share and was valued at USD 1.8 million in 2024, attributed to expanding infrastructure investments and a strong interest in sustainable construction. Policies like the Infrastructure Investment and Jobs Act (IIJA) have driven high demand for high-performance building materials like slag cement. Furthermore, the construction industry's push for carbon reduction is accelerating the adoption of slag cement, reducing the overall carbon footprint of concrete finishes.

Key players in the Global Slag Cement Market include JSW Cement, CEMEX S.A.B. de C.V., Ecocem Materials, Holcim Group, and Heidelberg Materials. These companies are adopting various strategies to strengthen their market presence. They are investing in research and development to improve the performance characteristics of slag cement, such as enhancing its durability and reducing production costs. Additionally, they are expanding their production capacities to meet the growing demand in emerging markets. Strategic partnerships and collaborations are also being pursued to access new markets and leverage local expertise. Furthermore, these companies focus on sustainability initiatives, aligning their operations with environmental regulations and consumer preferences for eco-friendly products.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Slag Cement (GGBFS) market report include:- Ambuja Cements Ltd

- Boral Limited

- Buzzi Unicem

- CEMEX S.A.B. de C.V.

- Ecocem Materials

- Heidelberg Materials

- Holcim Group

- JFE Mineral & Alloy

- JSW Cement

- Lafarge

- Nippon Steel Corporation

- Royal White Cement

- Tarmac (CRH)

- Texas Lehigh Cement Company LP

- Titan America

- UltraTech Cement Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 220 |

| Published | May 2025 |

| Forecast Period | 2024 - 2034 |

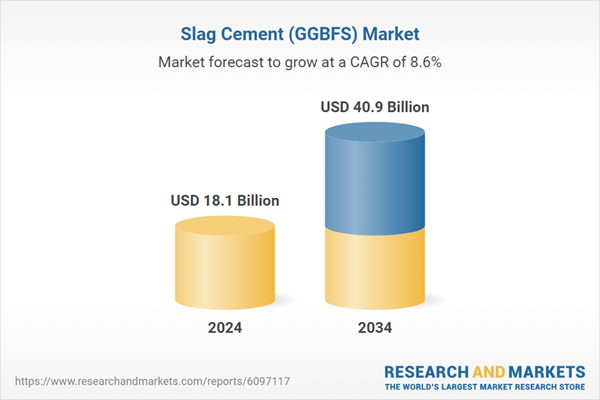

| Estimated Market Value ( USD | $ 18.1 Billion |

| Forecasted Market Value ( USD | $ 40.9 Billion |

| Compound Annual Growth Rate | 8.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |