RTD tea serves as a healthier, low-calorie option compared to soft drinks and sugary juices, making it a favorite among office workers, athletes, and health-conscious individuals. It is widely accessible through supermarkets, convenience stores, vending machines, and online platforms, catering to people of all ages. Depending on the variant, RTD tea offers various health benefits, from boosting mental alertness with green and black teas to aiding digestion with herbal or kombucha options. Its portability, variety of flavors, and health advantages make it an ideal choice for many consumers looking for a tasty, convenient drink.

The bottle-based packaging segment commands the largest portion of the RTD tea market, holding a substantial 45.2% share in 2024 and projected to grow steadily at a 6% CAGR through 2034. Bottled RTD teas are preferred by consumers largely due to their user-friendly design, particularly the resealable caps that make them ideal for active, on-the-go lifestyles. These bottles offer superior protection against external elements, preserving the product’s taste, freshness, and nutritional integrity over time. Their sturdy build, easy handling, and storage, especially in retail and vending environments.

The sweetened RTD tea segment generated USD 15.7 billion in 2024. This category resonates strongly with a wide consumer base, offering a variety of flavors that cater to both mildly sweet and heavily sweetened preferences. Its popularity stems from its refreshing taste and familiarity, making it a go-to beverage for those seeking instant gratification in flavor. Despite its dominance, the segment is gradually evolving as more health-conscious consumers demand reduced sugar content and better-for-you options. This shift has prompted brands to innovate with naturally sweetened and low-calorie formulations to balance indulgence with wellness.

Asia-Pacific RTD Tea Market generated USD 7.2 billion in 2024 and is anticipated to have a CAGR of 5.6% through 2034. China's leadership in the market is deeply rooted in its cultural affinity for tea, strong domestic production capabilities, and increasing consumer awareness around the benefits of functional teas. As the nation's urban population grows and lifestyles become more fast-paced, the convenience and portability of RTD teas are becoming essential for on-the-go hydration. Additionally, the fusion of traditional flavors with modern health benefits has positioned RTD teas as a preferred beverage among the younger, health-aware population.

Companies like Unilever PLC, Nestlé S.A., Suntory Holdings, PepsiCo Inc., and The Coca-Cola Company focus on expanding their product ranges, particularly in the functional tea segment. These companies are investing in sustainable packaging solutions, offering flavors, and partnering with local distributors to strengthen their presence in key markets. By improving accessibility through retail and online channels and focusing on health-focused innovations, these players aim to capture more of the growing RTD tea market.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this RTD Tea market report include:- The Coca-Cola Company

- PepsiCo, Inc

- Unilever PLC

- Nestlé S.A.

- Suntory Holdings Limited

- ITO EN, Ltd.

- Danone S.A.

- Arizona Beverages USA

- Keurig Dr Pepper Inc.

- Tata Consumer Products Limited

- Starbucks Corporation

- Honest Tea (Coca-Cola)

- Lipton (Unilever/PepsiCo)

- Tejava (Crystal Geyser Water Company)

- Harney & Sons

- The Republic of Tea

- Numi Organic Tea

- Pokka Corporation

- Oi Ocha (ITO EN)

- Vita Coco

- GT's Living Foods (Kombucha)

- Health-Ade Kombucha

- Steaz

- Pure Leaf (Unilever/PepsiCo)

- Gold Peak (Coca-Cola)

- Snapple (Keurig Dr Pepper)

- Tazo (Unilever)

- Fuze Tea (Coca-Cola)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 210 |

| Published | May 2025 |

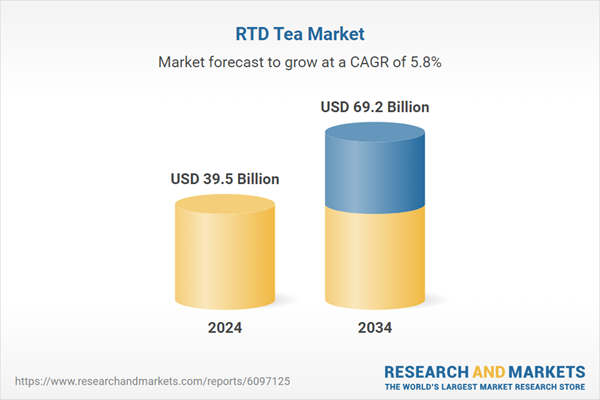

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 39.5 Billion |

| Forecasted Market Value ( USD | $ 69.2 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 29 |