RTD coffee continues to rise in popularity not only in traditional retail locations such as supermarkets and convenience stores but also through online platforms, where consumers can quickly access their favorite beverages. Cold brew coffee has carved out a significant market share due to its smoother taste, health benefits, and premium positioning. Nitrogen-infused varieties are also gaining traction, offering a creamy texture that aligns with a more upscale product experience. Sustainability initiatives are increasingly shaping the industry, with companies focusing on eco-friendly packaging, responsible sourcing, and better environmental practices. The new ingredients, such as nootropics and functional mushrooms, influence RTD coffee formulations, further diversifying product offerings.

The cold brew coffee segment held 30.2% share in 2024 and is projected to grow at a CAGR of 7.5% by 2034. Cold brew coffee’s smooth, slightly sweet flavor and its lower acidity make it a favorite among health-conscious consumers who prefer a milder and more enjoyable coffee experience. Its growing popularity is also driven by its appeal to younger generations, who use beverages that align with their wellness-focused lifestyles. On the other hand, iced coffee maintains a strong presence in the market due to its refreshing qualities and convenience. Iced coffee is typically a quick and easy option, making it a staple for many consumers who seek a chilled coffee drink that is easy to prepare and consume on the go.

In terms of packaging, PET bottles continue to dominate the RTD coffee market, holding 31.8% share in 2024. PET bottles are favored for their lightweight, durable, and cost-effective qualities, which make them ideal for large-scale distribution. Their resealable nature adds to the convenience, allowing consumers to enjoy their coffee in multiple sittings, which enhances product appeal. Additionally, the recyclability of PET bottles aligns with the growing consumer demand for sustainable packaging solutions, further fueling their popularity.

China RTD Coffee Market generated USD 3.1 billion in 2024 and is expected to grow at a 7.1% CAGR through 2034. The country’s growing urbanization, younger working population, and increasing adoption of on-the-go products have positioned RTD coffee as a fashionable and convenient drink. The popularity of sugar-free and health-focused options is also contributing to market growth. With the increasing availability of RTD coffee in convenience stores and the expansion of e-commerce platforms, access to these products has never been easier.

Companies in the Global RTD Coffee Market are adopting varied strategies to strengthen their market positions. Leading brands like Starbucks Corporation, Nestlé S.A., The Coca-Cola Company, Suntory Holdings Limited, and Califia Farms LP focus on expanding their product offerings to shift consumer preferences for healthier, more sustainable beverages. Innovations such as new flavors, functional ingredients, and energy-boosting additives are becoming integral to product development. These companies focus on improving sustainability through eco-friendly packaging solutions and transparent supply chains. Enhanced e-commerce presence and distribution partnerships with convenience stores improve product accessibility.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this RTD Coffee market report include:- CalifiaFarms,LP

- DanoneS.A.

- HighBrewCoffee

- Lotte Chilsung Beverage Co.

- KeurigDrPepperInc.

- LaColombeCoffeeRoasters

- NestléS.A.

- PepsiCo,Inc.

- RiseBrewingCo.

- StarbucksCorporation

- SuntoryHoldingsLimited

- SuperCoffee(KituLife,Inc.)

- TheCoca-ColaCompany

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 220 |

| Published | May 2025 |

| Forecast Period | 2024 - 2034 |

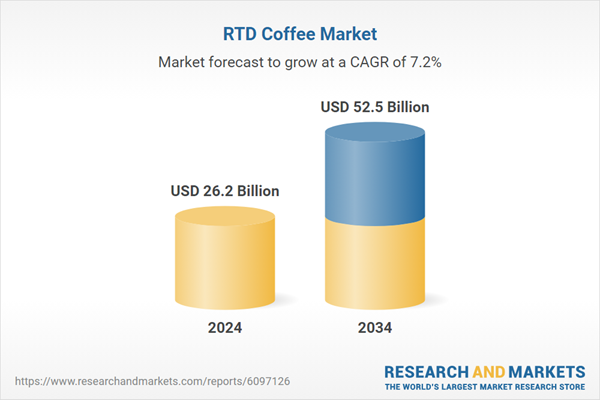

| Estimated Market Value ( USD | $ 26.2 Billion |

| Forecasted Market Value ( USD | $ 52.5 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |