Ongoing technological improvements have further enhanced the performance of these materials, making them suitable for heavy-duty and moisture-prone environments. Their strength, stability, and ability to withstand warping and cracking have extended their appeal across construction, furniture design, and prefabricated building modules. Enhanced moisture and fire resistance, coupled with innovations in adhesive formulation, make reconstituted wood a competitive choice for projects traditionally dominated by metal or plastic. Moreover, green building certifications and rising consumer awareness have encouraged manufacturers to focus on low-emission, bio-based alternatives. This transition not only aligns with environmental standards but also boosts consumer trust in brands that prioritize sustainable sourcing and low-impact production.

The particleboard segment generated USD 38.4 billion in 2024 owing to the affordability, widespread utility, and ease of production. Particleboard’s consistent structure and smooth finish make it highly suitable for surface treatments and decorative applications. It remains the preferred material for mass-market furniture and fixtures, particularly where uniform appearance and lower costs are prioritized over the aesthetics of solid wood.

The construction sector held a notable 35.7% share in 2024, maintaining its leading position due to high demand for lightweight and quick-to-install components. Reconstituted wood products have become essential in building frameworks, wall partitions, roofing, and flooring, especially in fast-paced construction markets where efficiency and material performance are critical. Their benefits in thermal insulation and soundproofing make them valuable in contemporary urban development.

China Reconstituted Wood Market generated USD 22.3 billion in 2024, attributed to favorable housing policies, including reduced mortgage rates and financial incentives for property buyers, which have boosted the demand for building materials. Additionally, China's focus on green construction and sustainable building practices has further accelerated the adoption of reconstituted wood in the country. As the demand for environmentally friendly materials rises, the reconstituted wood market benefits from this shift toward more sustainable alternatives.

To solidify their market positions in regions like China, the US, and Europe, leading players in the Global Reconstituted Wood Market, such as Kronospan, Egger Group, Georgia-Pacific, Duratex S.A., and Arauco, are investing heavily in expanding production capacity and automating manufacturing processes. Firms develop low-emission adhesives and recyclable wood composites to align with rising environmental regulations. Strategic acquisitions and geographic diversification are also prominent, enabling better market penetration and enhanced supply chain resilience. Some companies are entering collaborative research initiatives focused on smart manufacturing and digital tracking to ensure quality and traceability in sustainable material production.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Reconstituted Wood market report include:- Arauco North America, Inc.

- Boise Cascade Company

- EGGER Group

- Georgia-Pacific LLC

- Huber Engineered Woods LLC

- Kronospan Limited

- Louisiana-Pacific Corporation

- Norbord Inc.

- Pfleiderer Group

- Sonae Arauco

- Stella-Jones Inc.

- Swiss Krono Group

- West Fraser Timber Co. Ltd.

- Weyerhaeuser Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 215 |

| Published | May 2025 |

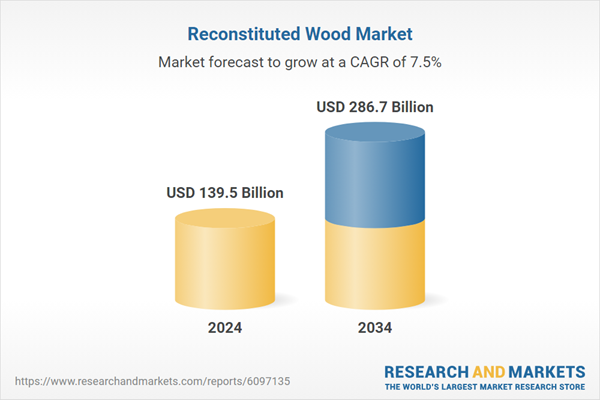

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 139.5 Billion |

| Forecasted Market Value ( USD | $ 286.7 Billion |

| Compound Annual Growth Rate | 7.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |