Technological advancements have improved the availability of devices such as glucose monitors and insulin pumps, which help manage diabetes in pets. The development of these innovative products has helped veterinarians and pet owners provide better care and more effective treatments. As diabetes among pets becomes more common, especially in aging or obese animals, the demand for effective management solutions grows. This trend is supported by higher disposable income in developed regions, where pet owners are more likely to invest in advanced healthcare devices.

The market is divided into two main segments: insulin delivery devices and glucose monitoring devices. In 2024, insulin delivery devices held the largest market share, valued at USD 2 billion. This segment is further divided into insulin syringes and insulin pens, which are essential for managing diabetes in pets. Given that diabetes in pets often requires lifelong insulin therapy, insulin delivery devices are crucial for ensuring effective treatment. The widespread availability and affordability of these devices have solidified their dominance in the market, providing a key driver for growth.

The pet diabetes care devices market is further segmented by animal type, with dogs, cats, and horses being the primary categories. The dogs segment held a 54.9% share in 2024. The higher prevalence of diabetes in dogs, driven by obesity, aging, and genetic factors, makes them the most common recipients of diabetes management devices. Pet owners are increasingly aware of the importance of managing their dogs' health, leading to an uptick in the adoption of specialized devices like glucose monitors and insulin delivery systems.

North American Pet Diabetes Care Devices Market held a 41% share in 2024, attributed to several factors, including the high rate of pet ownership across the region and a growing awareness among pet owners regarding the importance of diabetes management for their pets. With more individuals recognizing the significance of proactive health management for their animals, demand for specialized care devices such as glucose monitors and insulin delivery systems has surged. Additionally, North America benefits from a robust veterinary infrastructure, with numerous veterinary clinics and hospitals offering state-of-the-art technologies for diagnosing and treating conditions like diabetes in pets.

Key players in the Global Pet Diabetes Care Devices Market are actively employing strategies like product innovation, strategic partnerships, and expanding their distribution channels to strengthen their presence. Companies like Zoetis, Merck Animal Health, and Becton, Dickinson and Company are investing in research and development to introduce new products that cater to the evolving needs of pet owners. In addition, firms such as i-SENS and TaiDoc are focusing on enhancing the accessibility and affordability of diabetes management devices to cater to a broader customer base.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Pet Diabetes Care Devices market report include:- Allison Medical

- ALR Technologies

- Becton, Dickinson and Company

- Boehringer Ingelheim

- FitBark

- Henry Schein Animal Health

- Merck Animal Health

- TaiDoc

- Ulticare

- Zoetis

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 130 |

| Published | May 2025 |

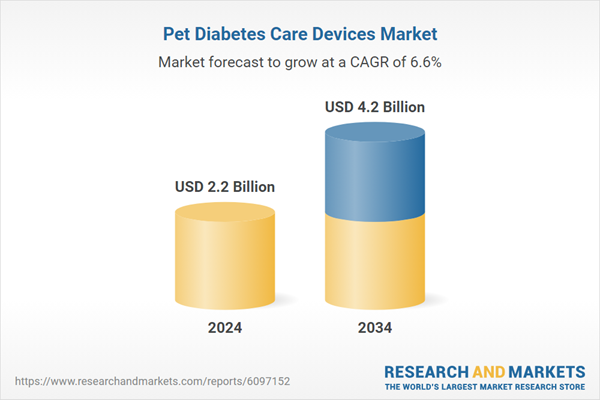

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 2.2 Billion |

| Forecasted Market Value ( USD | $ 4.2 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |