Technological development has transformed the approach to treating congenital defects like valve stenosis and septal malformations. Rather than relying on invasive open-heart procedures, healthcare providers now favor catheter-based interventions tailored to pediatric anatomical requirements. Devices designed specifically for young patients offer better control and significantly improve procedural outcomes compared to adapted adult tools. Catheters remain essential in these interventions, helping clinicians perform tasks such as balloon angioplasty, valvuloplasty, defect closure with minimal trauma and quicker recovery times. Innovations like steerable, highly flexible catheters with superior biocompatibility drive their widespread adoption in neonatal and infant care.

The catheters segment led the market with a 30.3% share in 2024. Increasing demand for next-generation pediatric-specific catheters supports this dominance. The ability to minimize surgical complexity and shorten hospital stays continues to make these tools a preferred choice among specialists. These devices are designed with improved flexibility, smaller diameters, and enhanced biocompatibility, allowing safer navigation through delicate vascular systems in neonates and infants. Their precision supports interventions, from balloon valvuloplasty to defect closures, all while reducing trauma and recovery time.

The congenital heart defects application segment generated USD 1.8 billion in 2024, supported by earlier and more accurate diagnosis through enhanced neonatal screening tools. Timely intervention through non-surgical methods contributes to improved infant survival, making catheter-based treatments the standard approach for many CHD cases. Advancements in fetal echocardiography and postnatal diagnostic tools allow clinicians to detect abnormalities sooner, often enabling procedures to be planned and performed in early infancy.

U.S. Pediatric Interventional Cardiology Market stood at USD 1.2 billion in 2024 and is expected to reach USD 2.4 billion by 2034. The U.S. benefits from an advanced network of pediatric specialty hospitals and academic centers that conduct high volumes of interventional cardiology procedures. Comprehensive insurance coverage, including Medicaid and private health plans, improves access to cutting-edge treatments and expands the reach of pediatric-focused cardiovascular services globally.

To gain a competitive edge, companies like Abbott Laboratories, Osypka, Cordis, SMT, Terumo, Medtronic, and Lifetech Scientific are investing heavily in R&D to launch pediatric-specific interventional tools. Key strategies include regulatory approvals for new device types, international distribution partnerships, and education & training programs for pediatric cardiologists. Custom-designed catheter systems and closure devices are a major focus area, enhancing product portfolios and market reach globally.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Pediatric Interventional Cardiology market report include:- Abbott Laboratories

- B. Braun

- Balton

- Biotronik

- Boston Scientific

- Cordis

- Edwards Lifesciences

- Lepu Medical

- Lifetech Scientific

- Medtronic

- Meril Life Sciences

- Osypka

- Renata Medical

- Terumo

- W. L. Gore & Associates

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | May 2025 |

| Forecast Period | 2024 - 2034 |

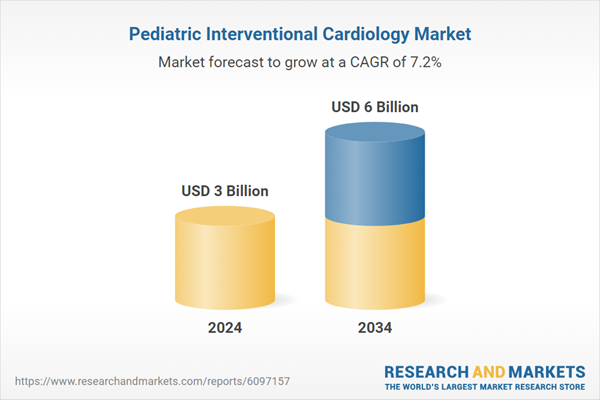

| Estimated Market Value ( USD | $ 3 Billion |

| Forecasted Market Value ( USD | $ 6 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |