Past geopolitical developments also shaped the market's trajectory. Trade tensions and tariff policies affected pricing and procurement strategies across several security equipment categories. These cost pressures forced companies to reassess supply chain dynamics and pushed security providers to reconfigure their sourcing and deployment strategies, impacting how airports and agencies plan and roll out new systems. Despite those challenges, the focus on digitized and contactless security technologies remained strong. Airports around the world are now actively shifting toward touchless systems, AI-driven monitoring, and robust threat detection capabilities. Solutions that integrate biometric recognition, smart access control, and real-time video surveillance are becoming essential components of comprehensive passenger security frameworks.

The market is segmented based on solution type into hardware, software, and services. Hardware emerged as the dominant category, accounting for USD 10 billion in 2024. The increasing rollout of security infrastructure-especially in transportation hubs in Asia, the Middle East, and Africa-has driven the procurement of sophisticated hardware, including full-body scanners, CT-based baggage scanners, walk-through detectors, and biometric access systems. These high-precision tools play a critical role in streamlining passenger flow while adhering to strict safety and compliance protocols.

By security solution, the market includes explosive trace detectors, baggage inspection systems, hand-held scanners, perimeter intrusion detection systems, walk-through metal detectors, full-body scanners, video management systems, boarding pass scanners, biometric/access control systems, and cybersecurity technologies. The baggage inspection systems segment held the largest share, valued at USD 3.7 billion in 2024. This growth reflects the rising demand for high-throughput, low-error baggage handling systems amid soaring passenger volumes. The adoption of computed tomography (CT) and dual-energy scanning technologies has significantly improved detection precision, minimized false alarms, and increased screening speed.

Based on airport type, the market is divided into domestic and international categories. International airports led the segment with a value of USD 11.3 billion in 2024. These airports face heightened scrutiny due to cross-border compliance regulations and dynamic threat environments, prompting the need for advanced surveillance, access control, and automated screening technologies. Adoption of biometric identity verification, facial recognition, and digital passport authentication is growing rapidly, with security upgrades aiming to improve both passenger experience and adherence to global health and safety norms.

Regionally, the United States led the market with a valuation of USD 5.8 billion in 2024. This dominance is driven by continued focus on counterterrorism, cybersecurity, and stringent regulatory enforcement across the aviation sector. Major airports are increasingly deploying AI-powered analytics, biometric-based access control, and modular screening technologies to ensure swift and secure processing of travelers. Regional stakeholders are also allocating substantial budgets to security infrastructure modernization, with support from government agencies committed to upgrading detection, screening, and surveillance capabilities at national transportation hubs.

The competitive landscape is defined by a mix of emerging startups and established multinational players, each offering specialized technologies tailored for both large-scale airports and compact urban terminals. Innovation is at the core of market expansion, with companies investing heavily in modular, lightweight security systems and eco-friendly solutions that comply with global aviation standards. There's a growing focus on miniaturized devices suitable for urban mobility and regional travel infrastructure. As operational efficiency and sustainability take center stage, hybrid security platforms combining biometric data, behavioral analytics, and credential validation are being integrated to optimize passenger flow, reduce wait times, and improve overall threat detection.

Furthermore, several application sectors-including commercial aviation, military transit facilities, and unmanned transport networks-are prioritizing technology that supports real-time responsiveness, minimizes disruptions, and ensures operational continuity in both routine and emergency scenarios. The evolving landscape highlights a strategic shift toward unified platforms capable of adapting to a broad range of travel environments, user volumes, and security challenges.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Passenger Security market report include:- Analogic Corporation

- Bosch

- CEIA

- Garrett Metal Detectors

- Hart Security

- Honeywell

- ICTS International

- IDEMIA

- OSI Systems

- Siemens

- SITA

- Smiths Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 170 |

| Published | May 2025 |

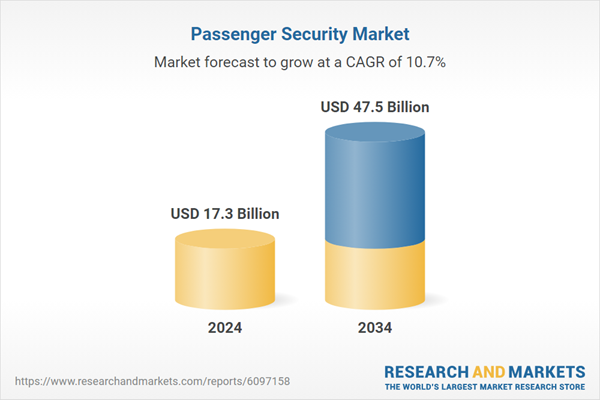

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 17.3 Billion |

| Forecasted Market Value ( USD | $ 47.5 Billion |

| Compound Annual Growth Rate | 10.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |