The market has been shaped by growing interest in fortified, organic, and lactose-free milk variants. These preferences are reshaping product development strategies as manufacturers respond to changing health and lifestyle trends. Technological innovations, especially in processing methods, are also contributing to market expansion. Advancements in Ultra-High Temperature (UHT) treatment and high-temperature short-time (HTST) techniques, combined with aseptic packaging, have improved the safety, quality, and durability of non-perishable milk. These factors are enabling broader distribution and increased consumption, especially in areas with limited access to refrigerated goods. In parallel, there’s a rise in awareness regarding calcium-rich diets, which plays into higher milk consumption patterns. Even plant-based alternatives are gaining space in the non-perishable segment, reflecting evolving consumer priorities toward sustainability and wellness.

In terms of product segmentation, the non-perishable milk market includes UHT milk, evaporated milk, sweetened condensed milk, powdered milk, and others. Among these, UHT milk led the category in 2024 with a market share of 29.5%, representing USD 59.2 billion. Its dominance is attributed to its versatility and ability to remain fresh without refrigeration for extended periods, making it a preferred option in both urban and rural settings. Powdered and evaporated variants are also well-established, particularly where affordability and long-term storage are essential. Sweetened condensed milk maintains its relevance in culinary applications, though health concerns are slightly dampening its growth rate in some areas.

When evaluated by source, the market is segmented into cow milk, goat milk, buffalo milk, plant-based milk, and others. Cow milk accounted for 29.7% of the total market in 2024 and is expected to grow at a CAGR of 5.3% through 2034. Its continued popularity is supported by its availability in UHT and powdered forms, which align well with current consumer demands for convenient, ready-to-use dairy options. Goat milk is steadily gaining traction among consumers seeking lactose-intolerant-friendly or easily digestible alternatives. Meanwhile, buffalo milk retains niche appeal due to its higher fat content and regional preferences.

Distribution channels for non-perishable milk include supermarkets and hypermarkets, specialty stores, convenience stores, online retail, food service outlets, direct B2B sales, and others. Supermarkets and hypermarkets commanded the largest share of the market in 2024, accounting for 31.5%. Their popularity stems from their ability to offer a wide selection of products in one location, making them a go-to choice for everyday consumers. Specialty stores are increasingly favored for premium offerings, especially for health-centric or plant-based milk variants. Convenience stores play a key role in fulfilling demand for single-serve or on-the-go formats. Online retail is experiencing rapid growth, driven by the convenience of doorstep delivery and the expansion of e-commerce platforms. Food service channels continue to rely on UHT and powdered milk for consistent supply and ease of storage. Direct sales to businesses remain robust, particularly in institutional and commercial sectors. Additional distribution methods include vending and export-focused channels that are helping brands tap into untapped markets.

Regionally, North America held the largest share of the non-perishable milk market in 2024, contributing 34.3% of the total revenue. The regional market has seen increasing adoption of UHT milk and other long-lasting dairy products, thanks to evolving consumer lifestyles and greater interest in shelf-stable nutrition options. Europe follows closely with a strong preference for UHT milk due to its convenience and reduced reliance on cold chains.

Major industry players such as Lactalis International, Nestlé S.A., Fonterra Co-operative Group Limited, Danone S.A., and Arla Foods are instrumental in driving market growth. Their influence is particularly evident in innovation, processing technology, and global distribution capabilities. These companies are consistently investing in product development and expanding their presence to meet the growing global demand for non-perishable milk products.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Non-Perishable Milk market report include:- Nestle S.A.

- Danone S.A.

- Lactalis Group

- Fonterra Co-operative Group Limited

- FrieslandCampina

- Arla Foods amba

- Dean Foods (Dairy Farmers of America)

- Saputo Inc.

- Parmalat S.p.A. (Lactalis)

- Amul (Gujarat Cooperative Milk Marketing Federation)

- China Mengniu Dairy Company Limited

- Inner Mongolia Yili Industrial Group Co., Ltd.

- Morinaga Milk Industry Co., Ltd.

- Meiji Holdings Co., Ltd.

- Savencia Fromage & Dairy

- DMK Deutsches Milchkontor GmbH

- Muller Group

- Dairy Farmers of America, Inc.

- Almarai Company

- Grupo LALA

- Vinamilk (Vietnam Dairy Products JSC)

- Borden Dairy Company

- Dairy Partners Americas (DPA)

- Darigold, Inc.

- California Dairies, Inc.

- Sodiaal

- Glanbia plc

- Schreiber Foods Inc.

- Land O'Lakes, Inc.

- Dairy Crest Group plc (Saputo)

Table Information

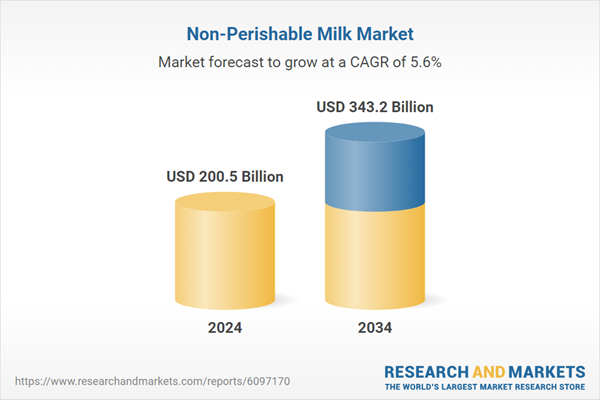

| Report Attribute | Details |

|---|---|

| No. of Pages | 220 |

| Published | May 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 200.5 Billion |

| Forecasted Market Value ( USD | $ 343.2 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |