U.S. policy decisions have also played a major role in reshaping the market landscape. Tariffs imposed on Chinese electronics under the Trump administration significantly impacted global supply chains. Costs of essential components like RF modules, connectors, and circuit boards escalated, straining production timelines. Defense contractors within the United States faced procurement delays and rising expenses, which forced a pivot toward domestic suppliers and allied manufacturing partnerships. While the original goal was to boost national security and domestic capability, these actions temporarily disrupted access to critical military-grade parts, highlighting the vulnerability of international dependency.

Among the frequency segments, ultra-high frequency (UHF) antennas led the market in 2024 with a valuation of USD 1.6 billion. These antennas are widely adopted for their reliability in high-mobility military communication systems, particularly in areas with signal obstruction like dense terrain or complex urban landscapes. Their operational flexibility and compatibility with short-to-mid-range communication needs continue to drive demand across multiple platforms. Additionally, standardized frequency protocols are encouraging further investment in UHF technologies.

Dipole antennas topped the product type segment, generating revenues of USD 1 billion in 2024. Their simple design, omnidirectional radiation, and broad frequency compatibility make them a preferred option in communication systems integrated into mobile and ground-based military platforms. These antennas are also cost-efficient and easy to integrate, supporting long-standing systems and new deployments.

Germany Military Antenna Market generated USD 243.4 million in 2024, driven by advancing its focus on software-defined and multi-standard communication architectures, creating robust demand for adaptive and secure antenna systems. This evolution is fueled by modernization efforts across both aerial and terrestrial defense platforms, where high-performance, frequency-agile antennas are essential for real-time situational awareness and interoperability. The push toward digital battlefield capabilities and enhanced electronic warfare resilience encourages domestic R&D in advanced antenna technologies.

Leading companies in the Global Military Antenna Market focus on innovation, partnerships, and product expansion to secure their market position. Lockheed Martin and RTX invest heavily in advanced communication systems for future combat environments. Thales and BAE Systems are expanding their product lines to support interoperability and modularity. Viasat and L3Harris Technologies are strengthening their satellite-based antenna portfolios. Meanwhile, Cobham Advanced Electronic Solutions and Rohde & Schwarz are forming strategic partnerships to increase production efficiency. MTI Wireless Edge and Antcom are developing compact, rugged antenna systems to meet tactical demands.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Military Antenna market report include:- Antcom

- BAE Systems

- Cobham Advanced Electronic Solutions

- Comrod Communication

- Eylex

- General Dynamics Mission Systems

- Hascall-Denke

- Honeywell International

- L3Harris Technologies

- Lockheed Martin

- MTI Wireless Edge

- Rohde and Schwarz

- RTX

- Saab

- Thales

- Viasat

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 170 |

| Published | May 2025 |

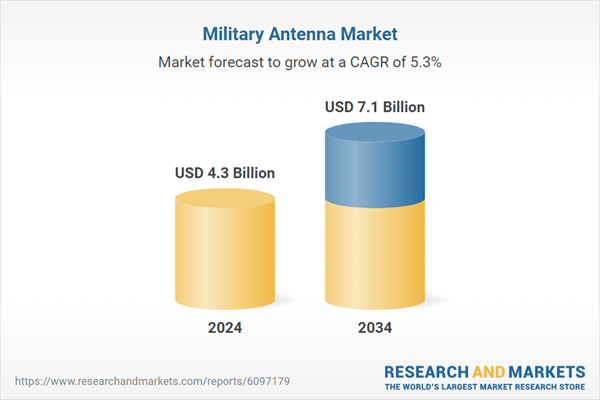

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 4.3 Billion |

| Forecasted Market Value ( USD | $ 7.1 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |