One key market driver is the increasing preference for disposable medical devices. Single-use tubing is now favored for reducing cross-contamination and hospital-acquired infections. The surge in home healthcare services accelerates this demand, especially for patients needing regular dialysis, IV therapies, or respiratory assistance. Advancements in elastomer-based tubing and sensor-integrated structures have expanded medical tubing applications in modern biomedicine and surgical technologies. These trends, along with ongoing innovation in polymer formulations and tubing design, continue to reshape the landscape of the medical tubing industry.

PVC segment accounted for USD 3.3 billion in 2024, reflecting its role as a highly preferred material in the industry. Its flexibility, chemical stability, and compatibility with sterilization make it a go-to choice for manufacturers across drug delivery, dialysis, and catheter products. Market interest has been boosted by the emergence of DEHP-free PVC variants, which comply with regulatory standards while maintaining performance. PVC’s ability to support intricate tubing configurations, including multi-lumen and thin-wall types, makes it invaluable for modern healthcare applications.

The bulk disposable tubing segment in the medical tubing market is forecast to maintain its lead with a CAGR of 8.2%, generating USD 8.1 billion by 2034. This segment’s strength lies in its extensive use across a wide range of critical healthcare procedures, including respiratory therapy, IV fluid delivery, and various fluid management systems. These tubing solutions are indispensable in hospital and home care environments, where sterility, safety, and single-use functionality are paramount. Their cost-effectiveness and reduced risk of cross-contamination make them ideal for high-frequency usage, particularly in infection-sensitive settings.

United States Medical Tubing Market reached USD 3.8 billion in 2024 and is projected to grow at a CAGR of 7.3% through 2034. The country’s leadership in healthcare innovation supports robust adoption of sophisticated tubing technologies, especially in diagnostic imaging, catheterization, minimally invasive procedures, and long-term chronic care. The presence of key industry players such as Gore, Freudenberg, and Tekni-Plex bolsters this growth. These companies focus on R&D investments, leading to advancements in multi-lumen, microbore, and sensor-integrated tubing systems. Hospitals and outpatient centers adopt such systems to support advanced surgeries, precise fluid management, and tailored patient therapies.

To maintain a strong position in the Global Medical Tubing Market, key players like Trelleborg, Zeus, Saint-Gobain, Putnam Plastics, and Spectrum are actively enhancing their capabilities. These companies invest significantly in material science to create tubing with improved durability, biocompatibility, and performance under various conditions. Strategic collaborations with medical device OEMs, along with expanding production sites and cleanroom facilities, allow them to meet global demand efficiently. Several firms focus on sustainability by developing recyclable or DEHP-free options to align with regulatory shifts and hospital procurement preferences. Additionally, robust R&D pipelines and IP protections for proprietary extrusion technologies are helping them differentiate in a competitive market.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Medical Tubing market report include:- AdvantaPURE

- AngioDynamics

- AP Technologies

- mdc

- FREUDENBERG

- Nordson

- Parker

- POLYZEN

- Putnam Plastics

- raumedic

- SAINT-GOBAIN

- SPECTRUM

- TRELLEBORG

- GORE

- ZEUS

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | May 2025 |

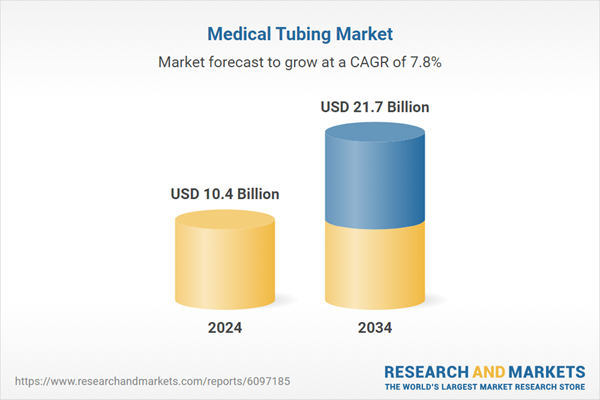

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 10.4 Billion |

| Forecasted Market Value ( USD | $ 21.7 Billion |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |