As the incidence of chronic illnesses continues to rise globally, the demand for properly calibrated devices used in long-term care also surges. Equipment used in patient monitoring and disease management must deliver performance, making calibration services vital in mitigating diagnostic mistakes. Inadequate calibration can compromise patient safety, which makes timely maintenance not only a technical necessity but also a strategic healthcare imperative. Moreover, advances in imaging and monitoring systems require more sophisticated calibration processes to maintain functionality and ensure safety, driving up the value of specialized services.

Third-party service providers are gaining popularity for offering flexible, cost-effective solutions without in-house capabilities. The third-party calibration segment generated USD 2.6 billion by 2034, growing at a CAGR of 12.2%. Many healthcare facilities prefer to work with external vendors, as they provide customized calibration for a wide range of devices while helping facilities stay compliant with guidelines set by regulatory bodies. By adopting a multi-vendor outsourcing model, healthcare organizations can enhance service efficiency and simplify their maintenance operations.

The diagnostic equipment held the largest share at 39.7% in 2024. Increasing reliance on high-precision systems in medical imaging has elevated the demand for calibration. Equipment used in diagnostic settings requires frequent and precise adjustments to maintain optimal function. Regulatory mandates further reinforce the importance of calibration, especially as medical technology becomes more complex and integrated with advanced software and automation features.

United States Medical Equipment Calibration Services Market generated USD 781.9 million in 2024, as the leadership stems from strict compliance norms and widespread adoption of advanced healthcare technologies. The frequent introduction of new devices and an established regulatory framework make calibration services essential for ongoing clinical operations across hospitals, diagnostic labs, and research institutions.

Key players in the Global Medical Equipment Calibration Services Market-including Trescal, Fluke Biomedical, Transcat, Tektronix, and SIMCO Electronics-are pursuing several strategic initiatives to enhance their competitive edge. Many are expanding their geographic presence through acquisitions and partnerships, enabling them to offer localized services while meeting international quality standards. Companies invest in AI-based calibration technologies and automated tracking systems to improve accuracy and efficiency. By offering bundled maintenance packages and 24/7 service contracts, they aim to deepen customer relationships and differentiate themselves in a service-intensive industry.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Medical Equipment Calibration Services market report include:- Advanced Instruments

- Agilent Technologies

- Allied Biomedical Services

- Ametek Test & Calibration

- Calibrationhouse

- Calyx

- Essco Calibration Lab

- Fluke Biomedical

- JM Test Systems

- MedEquip Biomedical

- SIMCO Electronics

- Technical Maintenance Inc.

- Tektronix

- Transcat

- Trescal

Table Information

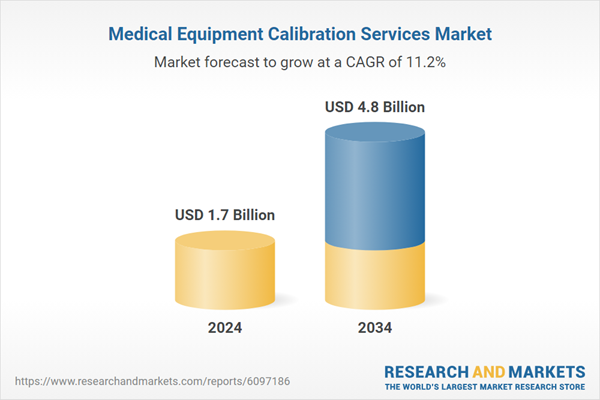

| Report Attribute | Details |

|---|---|

| No. of Pages | 145 |

| Published | May 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 1.7 Billion |

| Forecasted Market Value ( USD | $ 4.8 Billion |

| Compound Annual Growth Rate | 11.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |