These advanced features not only reduce downtime and maintenance costs but also support predictive maintenance strategies, which are crucial for minimizing operational disruptions. The transition to Industry 4.0 reinforces the need for more robust and responsive circuit protection systems, particularly in sectors such as automotive, electronics, and heavy machinery. In tandem, rising investments in infrastructure projects - including commercial complexes, data centers, and renewable energy installations - are further stimulating market growth. Governments play a pivotal role by implementing stricter regulations and offering incentives for upgrading outdated electrical infrastructure.

The miniature circuit breaker (MCB) segment is projected to reach USD 14 billion by 2034, fueled by its ability to automatically disconnect circuits during overloads or short circuits, thereby mitigating the risks of electrical fires. This feature has become essential across residential, commercial, and industrial settings, aligning with rapid urbanization and infrastructure development worldwide. As global urban areas grow and electricity demand rises, MCBs are becoming critical components in electrical installations, ensuring safe power distribution in both new constructions and renovated spaces.

The commercial end-use segment held a 42% share in 2024 and is anticipated to grow at a CAGR of 8.5% through 2034. Innovations in electrical safety at home and the advancement in smart home technologies drive the growth of highly advanced circuit protection systems. Commercial sectors, including offices and retail, are adopting automation alongside energy-saving technologies, which increases the need for reliable circuit breakers to protect equipment and ensure a continuous power supply. The enhancement of industrial activities, new manufacturing plants, and the addition of renewable energy resources are creating notable expansion in the industrial market.

U.S. Low Voltage Circuit Breaker Market generated USD 1.8 billion in 2024. Rising electricity demand across residential, commercial, and industrial sectors, alongside population growth and urbanization, underscores the need for reliable and efficient electrical systems, thereby driving demand for low-voltage circuit breakers. Investments in upgrading the U.S. aging electrical infrastructure further support market expansion as regions focus on improving system safety and reliability. Overall, the low-voltage circuit breaker market is set for significant growth, driven by infrastructure development, heightened safety standards, and the global trend toward modernization and automation.

Texas Instruments, L&T Electrical and Automation, Efacec, Tesco Automation, Hitachi Energy, Locamation, Rockwell Automation, Schneider Electric, CG Power, Siemens, Eaton, General Electric, ABB, and Open System International are key players driving innovation and growth in the low voltage circuit breaker market. Leading manufacturers in the low voltage circuit breaker market purchase a blend of innovation, expansion, and digital integration strategies to strengthen their market position. Many companies invest heavily in R&D to develop smarter, more energy-efficient circuit breakers that support predictive maintenance and remote monitoring. Strategic collaborations with tech firms are helping enhance product automation and IoT compatibility. Several players are expanding their global footprint by entering emerging markets and establishing local manufacturing or service facilities to meet regional demand. Others focus on mergers and acquisitions to consolidate their market share and diversify their product portfolios.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Low Voltage Circuit Breaker market report include:- ABB

- CG Power

- Eaton

- Efacec

- General Electric

- Hitachi Energy

- L&T Electrical and Automation

- Locamation

- Open System International

- Rockwell Automation

- Schneider Electric

- Siemens

- Tesco Automation

- Texas Instruments

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 125 |

| Published | May 2025 |

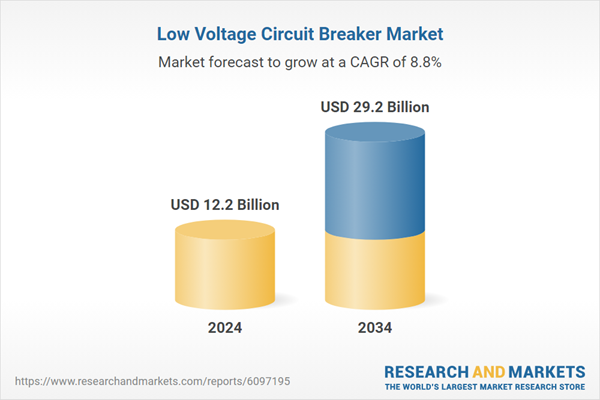

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 12.2 Billion |

| Forecasted Market Value ( USD | $ 29.2 Billion |

| Compound Annual Growth Rate | 8.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |