Increased global demand for timber and expanded regulated forestry practices have encouraged manufacturers to develop trailers offering higher capacity and environmental compatibility. The integration of high-grade materials, hydraulic mechanisms, and load monitoring systems has elevated the functionality and safety of these trailers. With global sustainability targets in mind, governments are reinforcing policies that promote responsible forestry and support the adoption of advanced transportation tools. Trailer manufacturers are responding by introducing eco-efficient products with enhanced endurance and operational versatility, driving continued market expansion across various regions.

In 2024, log hauler trailers made up roughly a 74% share, and this segment is projected to generate USD 155 million by 2034. These trailers, designed to transport logs without onboard cranes, are especially popular with small to mid-sized operators. By using separate equipment for loading and unloading, companies reduce overall equipment costs and benefit from lower maintenance requirements. The simpler design also offers quicker permitting, making these trailers a practical choice for operators focused on affordability and flexibility.

Tandem-axle logging trailers accounted for a 45% share in 2024, largely due to their durability and even weight distribution. This design supports larger payloads while maintaining vehicle balance on uneven terrain, vital in dense forest environments. These trailers also deliver reduced tire wear and improved fuel economy, ultimately helping operators lower operational costs. Their ability to minimize ground pressure makes them an environmentally responsible choice for companies mindful of forest floor preservation.

U.S. Logging Trailer Market held 23% share in 2024, supported by its large timber industry and well-developed infrastructure. Domestic trailer manufacturers continue to lead in innovation, meeting demands for higher capacity, reliability, and greener operations. With emphasis on sustainable practices, the U.S. market is positioned as a key contributor to both global supply chains and environmental stewardship.

Companies such as PALMS, Elphinstone Engineering, RABAUD, KESLA, BWS Manufacturing, Tajfun, Vitli KRPAN, Binderberger Maschinenbau, DOLL Fahrzeugbau, and FORS MW are focusing on expanding product lines with enhanced structural integrity, modular design, and smart technology integration. To strengthen their market presence, they’re also forming distribution partnerships, localizing production for quicker delivery, and aligning with eco-certifications to appeal to sustainability-conscious buyers. Many invest in digital platforms for customer engagement and post-sales support to build long-term client relationships.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Logging Trailer market report include:- Binderberger Maschinenbau

- BMF Production

- BWS Manufacturing

- Deloupe

- DOLL Fahrzeugbau

- Elphinstone Engineering

- FORS MW

- FTG Källefal

- IGLAND

- Kerr Trailers

- KESLA

- MAX Trailer

- McLendon Trailers

- PALMS

- Peerless

- Pfanzelt Maschinenbau

- RABAUD

- Tajfun

- Trejon

- Vitli KRPAN

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | May 2025 |

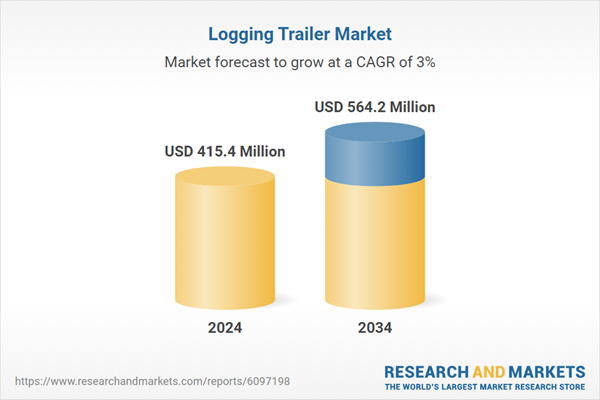

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 415.4 Million |

| Forecasted Market Value ( USD | $ 564.2 Million |

| Compound Annual Growth Rate | 3.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |