As additive manufacturing expands its industrial footprint, processes that enhance the structural integrity of 3D-printed parts are becoming essential. Isostatic pressing is widely recognized for its ability to minimize internal flaws and improve the reliability of precision components, which makes it indispensable across multiple industries. Its uniform pressure application enables consistent density and strength throughout complex parts, making it particularly valuable in applications requiring structural integrity and dimensional stability. The technique is essential in manufacturing sectors where performance and precision are non-negotiable, including aerospace, medical devices, energy, and automotive production.

The hot isostatic pressing (HIP) segment generated USD 4.6 billion in 2024 due to its effectiveness in refining complex components exposed to extreme operating conditions. HIP’s capacity to eliminate porosity and enhance mechanical properties has made it the preferred method for consolidating metal powders, densifying castings, and repairing turbine blades and 3D-printed parts. Its growing usage in improving the physical properties of intricate structures has contributed to its dominance. The technology plays a pivotal role in supporting the transition from conventional to digital manufacturing by ensuring uniformity, repeatability, and performance consistency across production runs, crucial in sectors adopting additive manufacturing techniques.

Among the key market segments, aerospace and defense held the largest share at 33.3% in 2024, supported by strong demand for defect-free, durable materials in critical load-bearing applications. High-performance metals such as titanium and superalloys benefit significantly from HIP processes, which improve fatigue resistance and ensure compliance with rigorous safety and quality standards. This demand is further amplified by evolving safety standards and increasing production volumes of aircraft engines, structural components, and space systems, all require reliability under extreme conditions.

U.S. Isostatic Pressing Market generated USD 1.5 billion in 2024, bolstered by high adoption rates of advanced manufacturing processes and investments in state-of-the-art HIP facilities. The country’s established industrial ecosystem, paired with a strong focus on innovation, has helped solidify its role as a major contributor to global market expansion. Public-private partnerships and defense modernization initiatives have further accelerated the deployment of HIP technologies. Moreover, increased focus on domestic supply chain resilience prompts local manufacturers to integrate HIP into their workflows, ensuring superior component quality while reducing reliance on international production networks.

Key players shaping the competitive landscape in the Global Isostatic Pressing Market include Kobe Steel, Ltd., Kennametal Inc., Nikkiso Co., Ltd., and Bodycote. These companies focus on facility expansion, collaborative innovation, and technology upgrades to strengthen their market foothold. Kobe Steel, Ltd. is investing in advanced equipment to improve production efficiency, while Bodycote continues to broaden its service capabilities through acquisitions and partnerships. Kennametal Inc. is expanding its product portfolio with next-generation materials, aiming to meet evolving customer needs. Nikkiso Co., Ltd., on the other hand, is focused on enhancing process reliability and energy efficiency, targeting industries with strict quality requirements.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Isostatic Pressing market report include:- American Isostatic Presses Inc

- Bodycote

- DORST Technologies GmbH

- EPSI

- Fluitron

- Hedrich Group

- Hiperbaric

- Hoganas AB

- Isostatic Pressing Services, LLC

- Kennametal Inc.

- Kittyhawk Inc.

- Kobe Steel, Ltd.

- MTI Corporation

- Nikkiso Co., Ltd.

- Pressure Technology, Inc.

- PTC Industries Ltd.

- Quintus Technologies AB.

- Sandvik AB

- Shanxi Golden Kaiyuan Co., Ltd.

- Wallwork Group

- Warner Brothers Foundry

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | May 2025 |

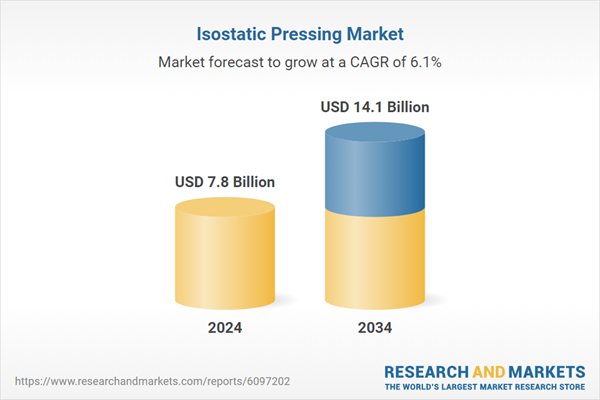

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 7.8 Billion |

| Forecasted Market Value ( USD | $ 14.1 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |