Rising infrastructure investments in clean energy, the shift toward electrification of industrial operations, and grid upgrades have all pushed demand for HVDC capacitors. The use of these systems helps utilities manage peak loads, stabilize grid operations, and optimize energy distribution. However, global trade tensions and import tariffs previously disrupted the supply chain, especially for materials sourced from overseas markets. To mitigate these impacts, the industry has focused on strengthening local supply chains, investing in domestic manufacturing capacity, and increasing R&D to enhance component efficiency and reduce reliance on foreign sources.

Based on technology, the line-commutated converter (LCC) segment was valued at USD 4.8 billion in 2024. LCC systems are widely used in large-scale transmission projects because of their cost efficiency and ability to handle bulk power transmission over extended distances. Their proven performance in high-capacity applications makes them a trusted choice for many power grid developers. Demand for LCC technology remains high, especially in regions undergoing rapid energy infrastructure expansion.

The energy and power application segment in the high voltage direct current (HVDC) capacitor market captured 57.1% in 2024, underscoring its dominant role in shaping the industry. This strong market position stems from significant grid reinforcement initiatives, large-scale deployment of renewable energy assets, and continued replacement of legacy transmission systems. Countries across all continents are increasingly investing in HVDC technologies to overcome the limitations of conventional alternating current (AC) systems. These capacitors help stabilize voltage levels, balance power flow, and reduce transmission losses across long distances, crucial for connecting remote solar and wind farms to urban demand centers.

United States High Voltage Direct Current (HVDC) Capacitor Market generated USD 1.7 billion in 2024, driven by a nationwide push for energy transition and smarter grid operations. Federal and state-level programs promoting clean energy development, including offshore wind and utility-scale solar, fuel high-voltage transmission investments. HVDC systems, supported by advanced capacitor solutions, enable seamless interconnection of renewable generation with existing grid frameworks, helping to balance load and mitigate intermittency.

Leading players in the Global High Voltage Direct Current (HVDC) Capacitor Market-such as Eaton Corporation, Siemens AG, TDK Corporation, and Hitachi Energy Ltd-are pursuing strategic initiatives to strengthen their position. These include establishing localized production hubs to reduce dependency on global supply chains, developing high-performance dielectric materials to enhance product efficiency, and collaborating with governments and utilities on large-scale transmission projects. Companies invest in advanced capacitor design for modular and scalable HVDC systems tailored to evolving energy demands.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this High Voltage Direct Current (HVDC) Capacitor market report include:- API Capacitors

- Condis

- Eaton Corporation

- ELECTRONICON Kondensatoren GmbH

- General Atomics

- GE Vernova

- Hitachi Energy Ltd

- Isofarad Kft.

- KYOCERA AVX Components Corporation

- LIFASA

- Samwha Capacitor Group

- Siemens AG

- Sieyuan Electric Co., Ltd.

- TDK Corporation

- Vishay Intertechnology, Inc.

- ZEZ SILKO

Table Information

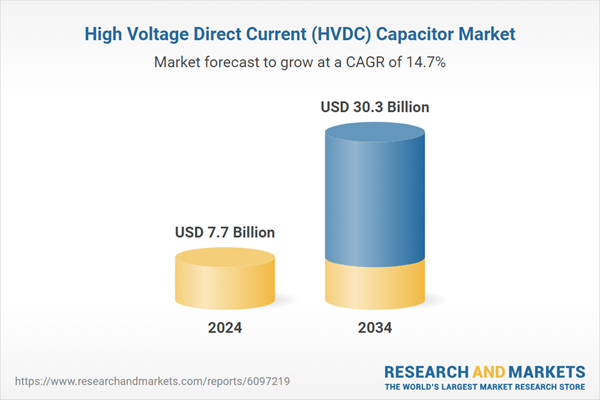

| Report Attribute | Details |

|---|---|

| No. of Pages | 170 |

| Published | May 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 7.7 Billion |

| Forecasted Market Value ( USD | $ 30.3 Billion |

| Compound Annual Growth Rate | 14.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |