Additionally, the development of advanced surface treatments that enhance corrosion resistance, durability, and aesthetic appeal is expanding the application range of galvanized and coated iron and steel sheets. Manufacturers incorporate eco-friendly coating formulations that reduce toxic emissions and energy consumption during production. This aligns with growing regulatory pressures and customer demand for greener building and manufacturing materials. As a result, these innovations not only improve performance but also support compliance with sustainability standards, making them more appealing for use in construction, automotive, and industrial applications globally.

Within the market, hot-dip galvanized steel continues to be the most widely used coating technique. This segment generated USD 95.7 billion in 2024 and is projected to reach USD 147.9 billion by 2034. Its dominance stems from superior durability, long-term corrosion protection, and affordability. The hot-dip process creates a zinc-steel bond that acts as a shield in aggressive environments, making it an ideal material for high-impact use in agriculture, infrastructure, transportation, and industrial projects.

Galvanized and coated steel in coil form remains a popular choice among large-scale users due to its ease of transportation and reduced inventory costs. In 2024, the coils segment accounted for a 39.9% share. Coils can be processed into specific dimensions on-site, minimizing waste and optimizing material usage. These characteristics make them ideal for streamlined operations in automotive production lines, modular housing projects, and prefabricated structures. Additionally, galvanized coils are seeing heightened demand as key raw materials in painted and aesthetic-grade building components, aligning with growing interest in green and energy-efficient construction.

United States Galvanized And Coated Iron and Steel Sheets Market stood at USD 17.4 billion in 2024 and is expected to register a CAGR of 4.9% through 2034. Robust demand is driven by the country’s expanding automotive and infrastructure sectors, where corrosion resistance and extended material lifespan are critical requirements. Projects in bridges, commercial buildings, and transport networks continue to adopt these steel products due to their resilience and performance in various environments.

Key players in this market include POSCO, ArcelorMittal, Baowu Steel Group, TATA Steel, and Nippon Steel Corporation. These companies are strengthening their competitive edge by investing in advanced galvanizing technology, expanding production capacities, and forming strategic partnerships with end-use industries. A strong emphasis is placed on environmentally responsible methods and automation in manufacturing to reduce costs and support long-term scalability.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Galvanized and Coated Iron and Steel Sheets market report include:- ArcelorMittal

- Nippon Steel Corporation

- POSCO

- Tata Steel

- Baowu Steel

- JFE Steel Corporation

- Nucor Corporation

- ThyssenKrupp

- United States Steel

- Cleveland-Cliffs

- Steel Dynamics

- Hyundai Steel

- BlueScope Steel

- Jindal Steel & Power

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 225 |

| Published | May 2025 |

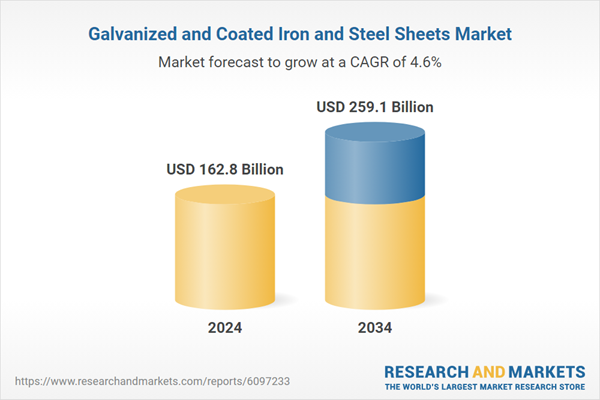

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 162.8 Billion |

| Forecasted Market Value ( USD | $ 259.1 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |