The shift toward combination therapies is also influenced by updates in international clinical guidelines, which now recommend combination inhalers even for patients with mild symptoms. This has led to a noticeable uptick in inhaler usage across all severity levels. These fixed-dose inhalers enhance treatment efficacy by reducing inflammation through corticosteroids while simultaneously improving airflow using bronchodilators. The convenience of single-device administration plays a critical role in increasing adherence to prescribed treatments. With the growing burden of chronic respiratory diseases, healthcare providers are prioritizing combination therapies to deliver better clinical outcomes and minimize the risk of exacerbations. The market is also benefiting from ongoing innovations in inhaler designs that simplify usage for both patients and caregivers.

In terms of combination types, the market is categorized into corticosteroid and bronchodilator combination inhalers, long-acting beta-agonist (LABA) and inhaled corticosteroid (ICS) inhalers, triple combination inhalers, and other combinations. In 2024, corticosteroid and bronchodilator combination inhalers held the largest revenue share at 56.8%, driven by widespread clinical preference for these formulations in managing persistent respiratory symptoms. These inhalers are particularly effective in reducing airway inflammation and improving airflow, which are central to managing both asthma and COPD. The dual action not only improves symptom control but also reduces the need for rescue medications, making them a preferred choice among healthcare providers.

Based on indication, the market is segmented into asthma, chronic obstructive pulmonary disorder, and other conditions. The asthma segment accounted for the largest share at 57.4% in 2024 and is projected to reach a value of USD 13 billion by 2034. The increasing number of individuals diagnosed with asthma globally, especially among children, is significantly contributing to this segment’s dominance. Asthma is a chronic and relapsing illness that often requires continuous therapy even during periods of symptom stability. This drives repeat purchases of fixed-dose inhalers and supports consistent revenue generation. Additionally, the updated clinical approach of prescribing combination inhalers for as-needed use has expanded the eligible patient base, further propelling growth in this segment.

The distribution of these inhalers is primarily through retail pharmacies, hospital pharmacies, and online pharmacies. Among these, retail pharmacies dominated the market and are anticipated to reach a value of USD 11.6 billion by 2034. Chronic respiratory diseases necessitate regular medication refills, and retail pharmacies offer the convenience and accessibility required to meet these ongoing needs. Their widespread presence in urban and suburban regions ensures patients have easy access to their prescriptions and pharmacist consultations, which improves adherence and supports steady market growth.

Regionally, North America continues to be a leading market, with the U.S. playing a major role. The fixed-dose combination inhalers market in the U.S. was valued at USD 4.5 billion in 2024 and is projected to grow to USD 8.7 billion by 2034. The high prevalence of asthma and COPD, along with strong compliance with clinical treatment protocols, is fueling demand. Physicians in the U.S. follow evidence-based treatment strategies that prioritize combination inhalers, leading to higher prescription rates. Furthermore, extensive pharmacy networks across the country enhance product availability and refill convenience, contributing to increased usage.

Globally, the market maintains an oligopolistic structure, with a few key players dominating the competitive landscape. Around 75% of the total market share is held by four major pharmaceutical companies with strong respiratory portfolios and device expertise. These firms continue to invest heavily in research and development to maintain their competitive edge. Meanwhile, generic and regional manufacturers are gaining traction in emerging economies by offering cost-effective alternatives, catering to the needs of price-sensitive populations. The market is also witnessing a growing inclination toward once-daily dosing options and triple therapy combinations, supported by innovations in inhaler devices that enhance usability and patient outcomes.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Fixed-dose Combination Inhalers market report include:- AstraZeneca

- Boehringer Ingelheim

- Chiesi Farmaceutici

- Cipla

- GlaxoSmithKline

- Glenmark Pharmaceuticals

- Hikma Pharmaceuticals

- Lupin

- Mylan (Viatris)

- Novartis

- Orion

- Sun Pharmaceutical Industries

- Teva Pharmaceuticals

- Vectura Group

- Zydus Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 130 |

| Published | May 2025 |

| Forecast Period | 2024 - 2034 |

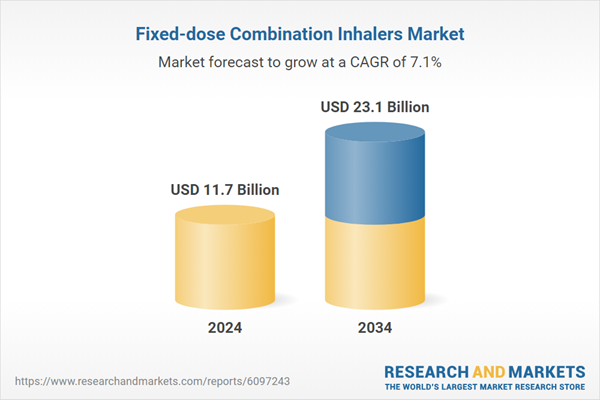

| Estimated Market Value ( USD | $ 11.7 Billion |

| Forecasted Market Value ( USD | $ 23.1 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |