Additionally, incorporating artificial intelligence (AI)-powered platforms and digital health technologies has enhanced symptom tracking and management, enabling more personalized care approaches. The shift towards non-invasive treatments, such as neuromodulation and biofeedback, indicates a growing acceptance of holistic frameworks. Cross-industry collaboration among pharmaceutical companies, academic institutions, and clinical practitioners has catalyzed the development of advanced therapeutics, changing the course of treatment approaches and outcomes. The market encompasses pharmaceutical and non-pharmacological treatments aimed at managing chronic pain, fatigue, and associated symptoms of fibromyalgia, including medications like analgesics and antidepressants, as well as alternative therapies.

The medication segment generated USD 1.7 billion in 2024 due to increased patient expectations regarding pain, fatigue, and subsequent symptom management. Demand is rising for pharmacological approaches, which explains why the medication segment dominates the market. Key drug classes include antidepressants, anticonvulsants, and analgesic drugs that help patients enjoy a better quality of life. The growth in this segment is supported by the launch of new drugs and their reformulations, along with increased marketing authorizations of existing ones, such as pregabalin, one of the first FDA-approved drugs specifically for fibromyalgia.

Based on gender, the fibromyalgia treatment market is divided into male and female segments. The female segment accounted for a significant market share of 80.5% in 2024. The female segment represents a market share, as the condition disproportionately affects women. As reported by the National Center for Biotechnology Information (NCBI), fibromyalgia syndrome has a high female predominance, comprising 80%-96% of cases. These differences have been explained based on hormonal factors, greater pain perception, and variations in the functions of the nervous system.

U.S. Fibromyalgia Treatment Market was valued at USD 907.2 million in 2024 due to its quality healthcare system, high disease prevalence, and extensive pharmaceutical industry. FDA-approved drugs such as duloxetine, milnacipran, and pregabalin dominate the prescription landscape. Patients are further motivated to seek treatment due to awareness programs and insurance coverage. Emerging trends include telemedicine for diagnosis and a shift toward a more personalized approach to medicine. Clinical research for new therapy approaches includes non-pharmaceutical options such as cognitive behavioral therapy and lifestyle changes.

Major players operating in the Global Fibromyalgia Treatment Industry include Abbott Laboratories, AbbVie, Amneal Pharmaceuticals, AstraZeneca, Colorado Fibromyalgia Center, Eli Lilly and Company, Lupin, Mayo Clinic, Novartis, Pfizer, Sun Pharmaceutical, Teva Pharmaceutical, The General Hospital Corporation, UT Health Austin, Viatris, and Zydus Lifesciences. To strengthen their market foothold, companies in the fibromyalgia treatment sector are emphasizing innovation through robust investments in research and development. This includes advancing drug formulations, optimizing dosage regimens, and improving delivery technologies to increase patient adherence and therapeutic effectiveness. Many leading firms are also forming strategic alliances with academic institutions and research organizations to accelerate the discovery and commercialization of next-generation treatments.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Fibromyalgia Treatment market report include:- Abbott Laboratories

- AbbVie

- Amneal Pharmaceuticals

- AstraZeneca

- Colorado Fibromyalgia Center

- Eli Lilly and Company

- Lupin

- Mayo Clinic

- Novartis

- Pfizer

- Sun Pharmaceutical

- Teva Pharmaceutical

- The General Hospital Corporation

- UT Health Austin

- Viatris

- Zydus Lifesciences

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 135 |

| Published | May 2025 |

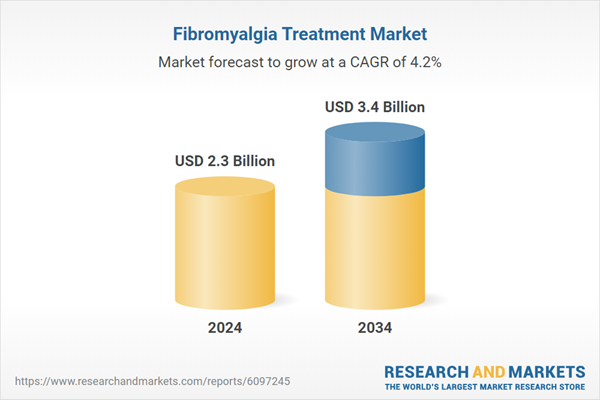

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 2.3 Billion |

| Forecasted Market Value ( USD | $ 3.4 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |