Dual ovenable trays and containers offer the flexibility to store, cook, and serve food without transferring it to other cookware, making them an ideal fit for modern eating habits. As demand for frozen, chilled, and ready-made meals continues to grow, so does the need for packaging that can withstand oven and microwave use. The global food logistics and cold chain sectors support this rise, enabling broader distribution of temperature-sensitive products that require reheating in their original containers.

The trays segment led the product landscape in 2024 with a market valuation of USD 752.3 million. These trays are widely favored across ready meal categories, providing a practical solution for commercial and institutional food service needs. The combination of lightweight design and advanced heat-resistant materials like CPET and PP has made trays particularly popular, especially for single-portion meals. As innovation in material science continues, the trays offer superior durability, thermal resistance, and packaging efficiency, driving widespread use in airline catering, hospitals, and foodservice operations.

By end use, the meat, seafood, and poultry segment secured the largest share of the dual ovenable trays and containers market, reaching USD 493 million in 2024. This growth is largely driven by rising consumer interest in convenient, ready-to-cook protein options that require minimal preparation. Dual ovenable packaging solutions cater perfectly to this demand by offering a versatile, heat-resistant format that allows products to move seamlessly from freezer to microwave or oven. These containers not only extend shelf life and enhance food safety but also offer clear visibility for better merchandising, which is especially important in refrigerated and frozen retail aisles.

United States Dual Ovenable Trays and Containers Market was valued at USD 446.2 million in 2024, owing to the growing popularity of heat-and-eat meals and the expansion of the frozen and chilled food segments. Consumers increasingly prioritize speed, nutrition, and portion control-needs that are well met by dual ovenable packaging. Rising health consciousness has led to an uptick in single-serve, protein-rich frozen entrees, which are often housed in these functional containers. Moreover, busy lifestyles and a sharp rise in e-commerce grocery sales have accelerated the adoption of packaging formats that balance convenience, durability, and food quality retention.

Key players in the Global Dual Ovenable Trays and Containers Market, such as Sonoco Products, Amcor, Sealed Air, Genpak, and Pactiv, are focusing on enhancing product durability and heat resistance through innovations in materials like advanced polymers. To strengthen market positioning, companies are expanding their geographic reach and increasing investments in sustainable packaging to align with regulatory trends and eco-conscious consumer preferences. Strategic partnerships with foodservice and meal kit brands are also helping boost their presence across fast-growing markets like the U.S., Europe, and Asia.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Dual Ovenable Trays and Containers market report include:- Amcor Plc

- Genpak LLC

- MCP Performance Plastic Ltd.

- Nicholl Food Packaging Limited

- Pavtiv LLC

- Prairie West

- Sabert Corporation

- Sealed Air Corp.

- Sonoco Products Company

- Southern Cross Packaging

- Teinnovations LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | May 2025 |

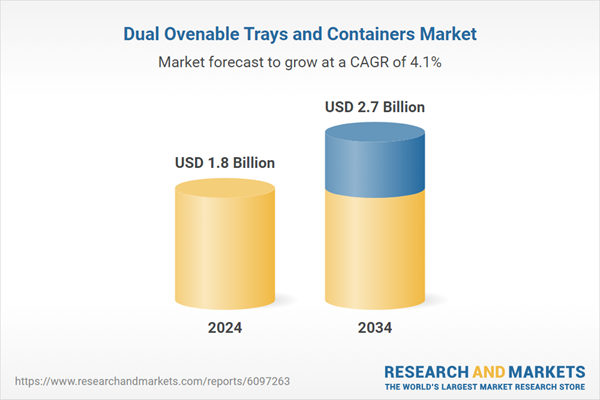

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 1.8 Billion |

| Forecasted Market Value ( USD | $ 2.7 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |