As businesses increasingly prioritize sustainability, they are adopting energy solutions that are both efficient and environmentally friendly, fueling market growth. These service models provide cost-effective options that eliminate the need for upfront investments in energy infrastructure, enabling businesses to access renewable energy and advanced technologies without bearing all the financial burden. Moreover, the rising implementation of grid-scale battery energy storage systems is expected to increase the demand for EaaS, particularly in commercial spaces. The growing electrification of various sectors such as heating, cooling, and transportation further complements the uptake of these services.

The energy efficiency and optimization services segment is anticipated to grow at a robust CAGR of 8.7% from 2025 to 2034, driven by the increasing pressure on commercial facilities to lower operational expenses while aligning with ambitious sustainability goals. As businesses aim to reduce their carbon footprint and optimize energy use, these services are becoming integral to facility management strategies. Innovations such as energy monitoring software, intelligent sensors, real-time energy dashboards, and predictive analytics enable precise control and performance optimization of HVAC systems, lighting, and electrical infrastructure.

The operations and maintenance (O&M) services segment is poised to generate USD 63.2 billion by 2034, underpinned by the rising complexity and digitalization of modern energy infrastructure. Commercial buildings now incorporate smart meters, on-site renewables, battery storage, and integrated energy management systems, all with ongoing technical support and predictive maintenance to ensure peak performance. The shift from reactive to proactive servicing models, powered by IoT-enabled diagnostics and AI-based fault detection, is helping reduce downtime and extend asset life.

North America Commercial Energy as a Service (EaaS) Market held a 31% share in 2024, supported by the aggressive push toward carbon neutrality and the rising need to modernize aging commercial infrastructure. The U.S. is seeing increased adoption of EaaS solutions that integrate renewable generation, energy storage, and demand-side management, supported by favorable regulatory policies and clean energy tax incentives. The emergence of virtual power plants (VPPs), which enable commercial consumers to monetize excess energy capacity or flexible load, is gaining traction and further enhancing the value proposition of EaaS.

Companies like Schneider Electric, Siemens, and Honeywell focus on offering integrated, customizable energy solutions. By developing advanced technologies and energy-efficient products, they meet the growing demand for sustainable commercial energy services. Strategic partnerships and collaborations also play a crucial role in expanding their market footprint. Players in the industry are increasingly investing in smart grids, battery storage, and renewable energy solutions to offer comprehensive EaaS offerings. Furthermore, they are enhancing their customer service models and adopting data-driven solutions for better energy performance management, which helps to strengthen their presence in the market.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Commercial Energy as a Service (EaaS) market report include:- Ameresco

- Bernhard Energy Solutions

- Budderfly

- Capstone Green Energy Corporation

- Centrica Business Solutions

- Enel X

- ENGIE Impact

- GridX

- Honeywell

- Jakson Group

- Johnson Controls

- Schneider Electric

- Siemens

- WGL Energy

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 123 |

| Published | May 2025 |

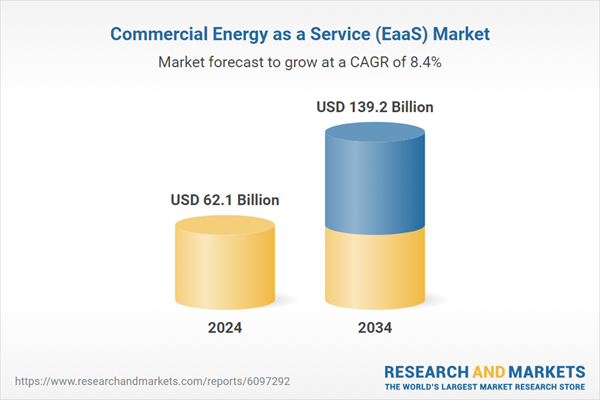

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 62.1 Billion |

| Forecasted Market Value ( USD | $ 139.2 Billion |

| Compound Annual Growth Rate | 8.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |