Adoption of AI and automation has improved test turnaround time and accuracy. Modern laboratories now integrate machine learning and robotics into workflows to reduce manual errors, boost operational efficiency, and manage rising sample volumes. The move toward personalized medicine pushes demand for precise diagnostics and multi-analyte tests. Clinical testing has become a regular part of preventive healthcare strategies worldwide, and regular health screenings are becoming increasingly common, even in emerging economies.

In 2024, HbA1c tests accounted for the largest market share, contributing 13.9% of total revenue. These tests are essential for monitoring long-term blood glucose control, particularly in patients with diabetes. Technological improvements such as portable analyzers and automated systems have made HbA1c testing more accessible and efficient. Growing public awareness around early diagnosis and disease management has also pushed the frequency of these tests. With diabetes cases rising globally, demand for regular monitoring continues to surge, driving sustained growth for this segment.

The central laboratories segment held the largest share in 2024, accounting for USD 47.2 billion, supported by high-throughput diagnostic capabilities, well-established infrastructure, and strong integration with hospitals and research institutions. These labs are equipped to handle complex tests, including genetic and molecular diagnostics, and maintain consistency in results across wide geographical networks. Their cost-effective solutions and reliability make them the preferred option for large-scale testing needs.

U.S. Clinical Laboratory Tests Market was valued at USD 50.8 billion in 2024 and is projected to reach USD 119.3 billion by 2034, driven by multiple structural and technological factors. High per capita healthcare spending enables widespread integration of cutting-edge diagnostic technologies across hospitals, clinics, and research labs. The rising incidence of chronic illnesses, infectious diseases, and age-related health conditions further amplifies the need for timely and accurate laboratory testing. Increasing reliance on molecular diagnostics, personalized medicine, and early disease detection tools is reshaping clinical workflows nationwide.

Key players in this space include Siemens Healthineers, bioMérieux, Agilent Technologies, Illumina, Thermo Fisher Scientific, Abbott Laboratories, Hologic, Bio-Rad Laboratories, QIAGEN, Danaher, and PerkinElmer. To strengthen market presence, companies are focusing on partnerships with healthcare providers, expanding laboratory automation, and investing in AI-based platforms. They also aim to diversify test menus, acquire smaller diagnostic firms, and increase their global distribution networks. Regulatory compliance, product innovation, and cost-effective solutions remain critical to staying competitive in the evolving diagnostic landscape.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Clinical Laboratory Tests market report include:- Abbott Laboratories

- Agilent Technologies

- Beckman Coulter

- Becton, Dickinson and Company

- bioMérieux

- Bio-Rad Laboratories

- F. Hoffmann-La Roche

- Grifols

- Hologic

- Illumina

- PerkinElmer

- QIAGEN

- QuidelOrtho

- Siemens Healthineers

- Thermo Fisher Scientific

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 130 |

| Published | May 2025 |

| Forecast Period | 2024 - 2034 |

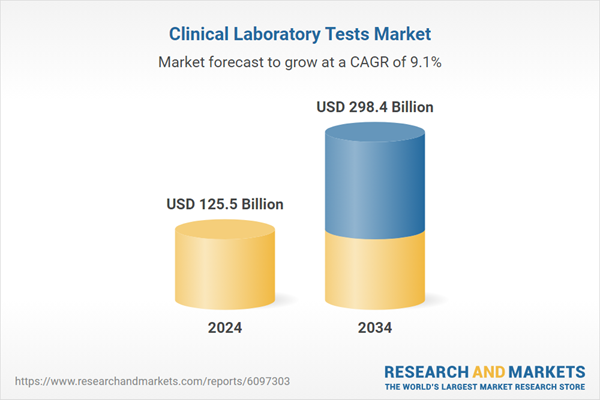

| Estimated Market Value ( USD | $ 125.5 Billion |

| Forecasted Market Value ( USD | $ 298.4 Billion |

| Compound Annual Growth Rate | 9.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |