Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key components include cybersecurity risk platforms, identity and access controls, compliance management systems, threat detection technologies, and managed security services. The digital acceleration across both government and private sectors has amplified the urgency for comprehensive risk management infrastructures. Regulatory pressure remains a central growth factor, driven by GDPR, the Cyber Resilience Act, and DORA, compelling organizations to strengthen their security frameworks. These mandates carry strict penalties for non-compliance, making security governance a critical priority across industries.

Key Market Drivers

Stringent Regulatory Landscape and Compliance Mandates

Europe’s complex and evolving regulatory environment has been instrumental in shaping security strategies across industries. The enforcement of GDPR catalyzed widespread enhancements in data governance and incident response practices. With the introduction of the Cyber Resilience Act and DORA, regulatory expectations now extend to continuous risk monitoring, resilience testing, and supply chain security.These measures require organizations to adopt comprehensive governance, risk, and compliance (GRC) platforms capable of real-time auditing, cross-border reporting, and integrated policy enforcement. Compliance is no longer a secondary concern but a core operational imperative, particularly as penalties and reputational consequences become more severe. This regulatory momentum is driving increased adoption of adaptive, auditable, and scalable security risk management systems across all sectors.

Key Market Challenges

Regulatory Complexity and Fragmentation Across Member States

Navigating Europe’s fragmented cybersecurity and risk management regulations remains a considerable challenge for businesses operating in multiple jurisdictions. A growing patchwork of directives - including NIS2, DORA, and the Cyber Resilience Act - presents overlapping and sometimes conflicting requirements. Variations in implementation, enforcement timelines, and compliance thresholds across EU Member States create operational inefficiencies and compliance fatigue.For example, differing deadlines and obligations for reporting incidents and conducting resilience assessments make it difficult to standardize risk procedures across regions. This complexity drives up costs for legal, technical, and operational compliance, especially for multinational firms, and undermines investment in long-term security frameworks. Without regulatory harmonization, organizations are likely to continue allocating disproportionate resources to compliance instead of proactive threat management and innovation.

Key Market Trends

Convergence of Cybersecurity and Enterprise Risk Management Platforms

A key trend shaping the Europe Security Risk Management Market is the merging of cybersecurity with broader enterprise risk management systems. Businesses are increasingly adopting unified platforms that not only address cyber threats but also integrate them into organizational risk matrices, enhancing transparency and strategic decision-making. This integration is being driven by evolving regulations such as DORA and NIS2, which require risk-based security controls and cross-functional visibility. These platforms support functions like asset classification, business impact analysis, compliance tracking, and threat detection - enabling C-level executives to better understand the business implications of cyber risks. In highly regulated industries like finance and energy, cross-functional collaboration between Chief Risk Officers and Chief Information Security Officers is becoming the norm, fostering a more cohesive and agile response to emerging threats.Key Market Players

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Cisco Systems Inc.

- Check Point Software Technologies Ltd.

- BAE Systems plc

- Palo Alto Networks Inc.

- Capgemini SE

- Atos SE

Report Scope

In this report, the Europe Security Risk Management Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Europe Security Risk Management Market, By Components:

- Solutions

- Financial risk management

- Compliance risk management

- Cybersecurity risk management

- Enterprise risk management

- Operational risk management

- Others

- Services

- Consulting & advisory

- Integration & deployment

- Support & maintenance

- Managed services

Europe Security Risk Management Market, By Deployment Model:

- On-Premise

- Cloud-Based

Europe Security Risk Management Market, By Organization Size:

- Large Enterprises

- Small and Medium Enterprises (SMEs)

Europe Security Risk Management Market, By Industry Vertical:

- BFSI

- IT and Telecom

- Government and Defense

- Healthcare

- Energy and Utilities

- Retail and E-commerce

- Manufacturing

- Transportation and Logistics

- Others

Europe Security Risk Management Market, By Country:

- Germany

- United Kingdom

- Italy

- Spain

- France

- Netherlands

- Poland

- Sweden

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Europe Security Risk Management Market.Available Customizations

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Cisco Systems Inc.

- Check Point Software Technologies Ltd.

- BAE Systems plc

- Palo Alto Networks Inc.

- Capgemini SE

- Atos SE

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 122 |

| Published | June 2025 |

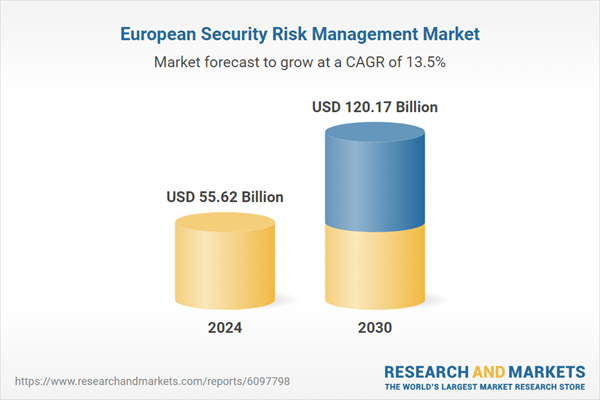

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 55.62 Billion |

| Forecasted Market Value ( USD | $ 120.17 Billion |

| Compound Annual Growth Rate | 13.5% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 10 |