Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Rapid Growth of the Foodservice and Hospitality Industry

The expansion of India’s foodservice and hospitality sector is a primary driver for the commercial kitchen appliances market. With more people opting for dining out and food delivery, there’s a notable rise in quick-service restaurants, cafés, hotels, and cloud kitchens across both major and smaller cities. The Indian food services industry is projected to grow at a CAGR of 8.1% from 2024 to 2028.Chains such as McDonald’s and Domino’s, along with local brands, are rapidly scaling up, requiring advanced appliances like combi-ovens, dishwashers, grillers, and freezers to meet operational demands. Post-pandemic recovery has led to renewed investment in hospitality, creating new opportunities for equipment suppliers. The surge in food delivery platforms like Swiggy and Zomato has also fueled the growth of cloud kitchens, which depend on efficient, high-capacity kitchen solutions. This evolution in the foodservice landscape is solidifying the demand for reliable and scalable commercial kitchen appliances.

Key Market Challenges

High Initial Investment and Cost of Advanced Equipment

A significant barrier in the Indian commercial kitchen appliances market is the high upfront cost associated with advanced and energy-efficient equipment. Appliances such as blast chillers, combi-ovens, and smart dishwashers entail substantial capital outlays, often beyond the reach of SMEs, start-ups, and budget-conscious cloud kitchens. While these appliances offer long-term operational benefits, the initial purchase, along with installation and training, poses a financial strain. Many foodservice operators, particularly in unorganized segments, continue to use low-cost or locally fabricated equipment that lacks safety and efficiency standards. This cost sensitivity restricts the uptake of premium appliances, especially in Tier-II and Tier-III regions, and impedes market expansion for high-end manufacturers and service providers.Key Market Trends

Rising Adoption of Smart and Connected Kitchen Equipment

A transformative trend in the India commercial kitchen appliances market is the growing preference for smart and connected equipment. Operators are turning to appliances that incorporate automation, real-time monitoring, and predictive maintenance to streamline kitchen workflows. IoT-enabled ovens, refrigerators, fryers, and dishwashers are increasingly sought after for their ability to minimize waste, track performance, and reduce downtime.Integration with cloud platforms and mobile applications allows for centralized control and data-driven decision-making across multiple locations. These smart solutions ensure consistency, improve energy efficiency, and enhance operational transparency. The arrival of global players with AI and ML-powered appliances is further raising the innovation bar. This trend aligns with evolving consumer expectations for quality, particularly in premium dining and hospitality spaces.

Key Market Players

- Middleby Celfrost Innovations Private Limited

- Butler Hotel Supermarket India Private Limited

- Trufrost Cooling Private Limited

- Chefline Equipments India Private Limited

- Sammic India Foodservice Equipment Private Limited

- Steel Craft Equipments Private Limited

- Elan Professional Appliances Private Limited

- Toan’s Kitchen Equipments Private Limited

- Hindustan Refrigeration Stores Private Limited

- S.K. Commercial Kitchen Equipment Private Limited

Report Scope:

In this report, the India Commercial Kitchen Appliances Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Commercial Kitchen Appliances Market, By Product Type:

- Refrigerators

- Cooking Appliances

- Cooktop and Cooking Ranges

- Ovens

- Dishwashers

- Others

India Commercial Kitchen Appliances Market, By Distribution Channel:

- Online

- Offline

India Commercial Kitchen Appliances Market, By Region:

- North

- South

- East

- West

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Commercial Kitchen Appliances Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Middleby Celfrost Innovations Private Limited

- Butler Hotel Supermarket India Private Limited

- Trufrost Cooling Private Limited

- Chefline Equipments India Private Limited

- Sammic India Foodservice Equipment Private Limited

- Steel Craft Equipments Private Limited

- Elan Professional Appliances Private Limited

- Toan’s Kitchen Equipments Private Limited

- Hindustan Refrigeration Stores Private Limited

- S.K. Commercial Kitchen Equipment Private Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 82 |

| Published | June 2025 |

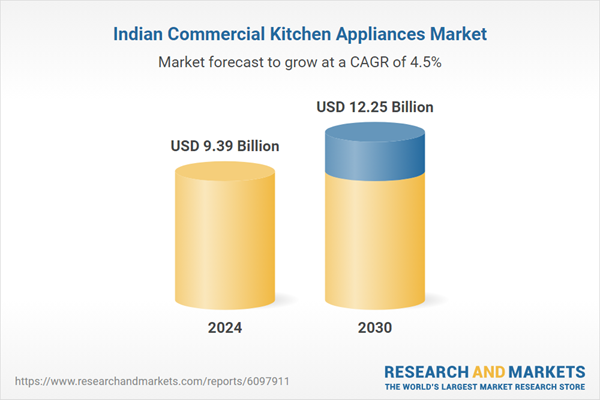

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 9.39 Billion |

| Forecasted Market Value ( USD | $ 12.25 Billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |