The rising number of endoscopic procedures in the U.S. highlights the essential need for ensuring the safety and optimal functioning of equipment. For instance, according to Gastroenterology Associates, PC., a provider of digestive healthcare in New York, 75 million endoscopic procedures are performed annually in the U.S., of which 51.5 million are gastrointestinal endoscopies. As more patients opt for these procedures, there is a corresponding need for reliable maintenance and repair services that ensure the efficacy and safety of endoscopes. This trend drives demand for various cleaning and reprocessing devices and services, propelling market growth.

Furthermore, according to the American Society for Gastrointestinal Endoscopy, "any facility where gastrointestinal endoscopy is conducted must implement a robust quality assurance program to ensure the proper reprocessing of endoscopes. Quality assurance programs for endoscopy should encompass systems that provide the consistent availability of the necessary equipment and supplies, and stringent procedures for reporting any potential issues." Thus, the stringent regulations imposed by regulatory authorities further boost the market's growth.

A growing number of successful clinical trials are anticipated to increase product approvals. For instance, in January 2023, Agilis Robotics, a developer of flexible robotic instruments, completed its second round of live animal testing for its proprietary endoscopic surgery robot. The results of these tests were satisfactory, showcasing the device's accuracy, efficacy, and safety. As a result, the increasing incorporation of robotics into endoscopic surgery is expected to contribute to a higher volume of procedures, thus fueling market growth.

The growing adoption of minimally invasive surgery (MISs) is expected to boost the U.S. endoscopes industry over the forecast period. Key advantages include high patient acceptance rates, reduced pain, cost-effectiveness, and lower chances of complications. Surgeons are increasingly favoring robotic & endoscopic surgeries over conventional open surgeries due to the numerous benefits they offer.

U.S. Endoscopes Services Market Report Segmentation

This report forecasts revenue growth and provides U.S. level an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, the analyst has segmented the U.S. endoscopes services market report based on product and origin:Product Outlook (Revenue, USD Million, 2018-2030)

- Flexible Endoscopes

- By Indication and Product

- Urological Endoscope

- Flexible Cystoscopes

- Fiber

- Video

- Flexible Ureteroscopes

- Fiber

- Video

- ENT Endoscope

- Flexible Rhinolaryngoscopes

- Fiber

- Video

- Bronchoscope

- Flexible Bronchoscopes

- Fiber

- Video

- GI Endoscope

- Colonoscopes

- Gastroscopes

- Enteroscopes

- Gastroscopes

- Enteroscopes

- Duodenoscopes

- Ultrasound Endoscopes

- Sigmoidoscopes

- Gynecological Endoscope

- Rigid Endoscopes

- By Indication and Product

- Laparoscope

- Rod Lens Laparoscopes

- Video Laparoscopes

- Arthroscope

- Large-Joint Arthroscopes

- Small-Joint Arthroscopes

- Urological Endoscope

- ENT (Ear, Nose, Throat) Endoscope

- Rigid Rhinoscopes

- Rigid Laryngoscopes

- Bronchoscope

- Rigid Bronchoscopes

- Gynecological Endoscope

- Rigid Hysteroscopes

Origin Outlook (Revenue, USD Million, 2018-2030)

- OEM (Original Equipment Manufacturer) Service Providers

- Third-Party / Refurbished Service Providers

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listings for you to stay ahead of the curve

Why Should You Buy This Report?

- Comprehensive Market Analysis: Gain detailed insights into the market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The major companies featured in this U.S. Endoscopes Services market report include:- Olympus Corporation

- Fujifilm Holdings Corporation

- Steris

- Pentax Medical (Hoya Corporation)

- MD Endoscopy

- Probo Medical

- United Endoscopy

- Wassenburg Medical, Inc.

- Boston Scientific Corporation

- Surgical Solutions, LLC.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | May 2025 |

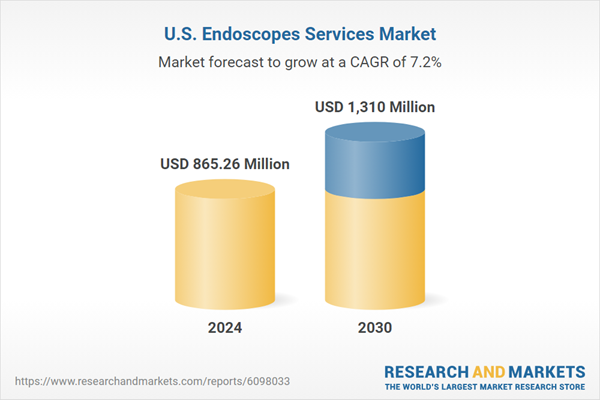

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 865.26 Million |

| Forecasted Market Value ( USD | $ 1310 Million |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | United States |

| No. of Companies Mentioned | 11 |