Growing emphasis on precision breeding and sustainability is contributing to market growth. Producers are increasingly adopting AI to enhance reproductive efficiency, reduce the spread of diseases, and improve overall herd health. The rise of mobile veterinary AI services is also noteworthy, as they provide on-site breeding solutions, particularly in rural areas, thereby increasing accessibility to advanced reproductive technologies. For example, CVM Ranch at Oklahoma State University is a horse and cattle reproductive research hub, offering hands-on learning and conducting studies to improve livestock reproductive health.

Opportunities in the market are abundant, particularly in underserved regions where access to advanced breeding technologies is limited. The expansion of mobile AI services and the establishment of veterinary AI service stations can bridge this gap, providing high-quality breeding solutions to a broader range of producers. Moreover, the increasing focus on sustainable and efficient livestock production presents avenues for innovation in breeding practices, such as selecting traits that improve feed conversion and adaptability to varying climates. Companies like Select Sires are leading the way with initiatives like the Elite Sexed Fertility product line, which identifies sires with superior fertility and sex-sorted semen, catering to the evolving needs of the industry.

The swine industry is increasingly adopting AI to enhance reproductive efficiency and genetic quality, driven by rising pork consumption and advancements in reproductive technologies. Companies like Shipley Swine Genetics are leading the way by offering high-quality semen and comprehensive breeding programs. In the equine sector, research institutions are exploring innovative techniques, such as comparing stallion sperm mixing methods, to improve semen quality and longevity. These developments present significant growth prospects for the veterinary AI market as producers seek to leverage advanced reproductive technologies to meet the growing demand for high-quality animal products.

U.S. Veterinary Artificial Insemination Market Report Highlights

- Based on solutions, the services segment dominated the market with a share of 41.87% in 2024. On the other hand, the semen segment is anticipated to grow the fastest at a rate of 6.4% in the coming years.

- Artificial insemination (AI) offers a safe and regulated environment for breeding, lowering the possibility of mishaps or injuries that could happen during natural mating. Furthermore, AI gives breeders more control over the breeding process, ensuring that mating takes place under the best possible circumstances and raising the likelihood of viable pregnancies.

- Based on distribution channel, the private segment accounted for the largest revenue share of the market in 2024 and is also projected to grow at the fastest CAGR over the forecast period.

- In 2024, the bovine segment accounted for the largest share of the market by animal type. The swine segment is estimated to grow at the fastest CAGR of 7.4%.

- As the U.S. population continues to grow, there is an increasing demand for animal protein, including meat, milk, and eggs. This drives the need for efficient breeding practices to optimize livestock production, which includes the use of artificial insemination to improve genetics and reproductive efficiency.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listings for you to stay ahead of the curve

Why Should You Buy This Report?

- Comprehensive Market Analysis: Gain detailed insights into the market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The major companies featured in this U.S. Veterinary Artificial Insemination market report include:- Genus

- URUS Group LP

- CRV

- SEMEX

- IMV Technologies

- Select Sires Inc.

- Swine Genetics International

- Shipley Swine Genetics

- Stallion AI Services Ltd

- Stgenetics

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | May 2025 |

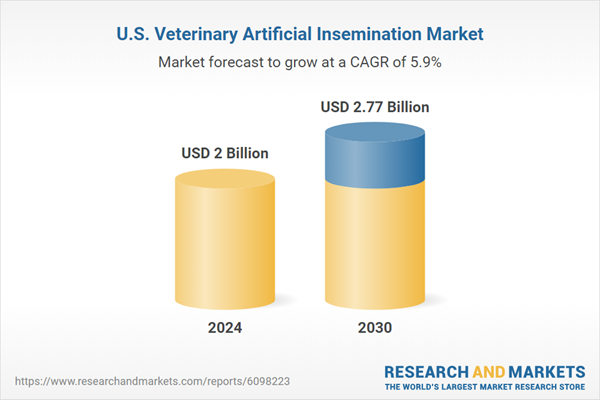

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2 Billion |

| Forecasted Market Value ( USD | $ 2.77 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | United States |

| No. of Companies Mentioned | 11 |