Global Space Logistics Market - Key Trends & Drivers Summarized

What Role Does Logistics Play in the Expanding Space Economy?

Space logistics encompasses the planning, transportation, and servicing of payloads, satellites, and spacecraft from Earth to orbit and within space itself. As orbital activity increases - driven by satellite constellations, human spaceflight, lunar exploration, and future Mars missions - logistics is becoming a critical pillar of the space economy. This includes launch logistics, satellite deployment, in-orbit refueling, debris removal, cargo transport to space stations, and robotic servicing of satellites and habitats.Traditionally, logistics ended with a satellite reaching orbit, but now it extends to maintaining, relocating, or extending the life of assets in space. The commercialization of low Earth orbit (LEO) and the emergence of planned lunar gateways are expanding logistical requirements across geographies and altitudes. With NASA, ESA, and private firms investing in orbital outposts, reusable cargo modules, and refueling spacecraft, space logistics is evolving from a mission-specific function into a full-fledged service economy.

How Are Technologies Enabling Next-Generation Space Logistics Capabilities?

Major innovations are reshaping the way space logistics is planned and executed. Reusable launch systems, pioneered by companies like SpaceX and Rocket Lab, are significantly reducing the cost per kilogram to orbit, making frequent deliveries to space more feasible. Autonomous docking systems, robotic arms, and advanced navigation systems are enabling orbital servicing missions, satellite repositioning, and even construction of modular space infrastructure in microgravity.In-space propulsion systems, such as electric and ion thrusters, are making long-duration logistics missions more efficient, especially for payload transfers between orbits or toward the Moon. On-orbit servicing platforms are being developed to refuel, repair, or deorbit aging satellites, extending their operational lifetimes and supporting sustainable space operations. Future developments such as orbital tugs, lunar cargo landers, and interplanetary logistics platforms will further expand the scope of space logistics. Additionally, software platforms using AI and blockchain are being tested to plan, optimize, and authenticate multi-stage supply chains in space.

Which Missions and Stakeholders Are Driving Demand for Space Logistics Services?

The growing constellation of commercial satellites, the rise of in-space manufacturing, and the establishment of orbital space stations are generating consistent demand for logistics services. Space agencies are planning regular missions to support lunar and deep space habitats, while private firms are preparing infrastructure to support commercial space tourism and asteroid mining. Logistics companies are being contracted not only for launch coordination but also for in-space mobility and station resupply.The U.S. leads the market, bolstered by NASA's Artemis program and the development of the Lunar Gateway. Private players such as Northrop Grumman, SpaceX, and Sierra Space are providing cargo and servicing capabilities. Europe and Japan are also actively developing their own in-space logistics capabilities, while China is constructing its own modular space station and lunar supply architecture. Emerging spacefaring nations in Asia, Latin America, and the Middle East are seeking collaborative opportunities in orbital logistics as a means of enhancing their strategic presence in space.

The Growth in the Space Logistics Market Is Driven by Several Factors…

It is driven by the rise of satellite mega-constellations, increasing demand for in-orbit servicing and refueling, and the expansion of human and robotic activity beyond low Earth orbit. The development of reusable launch vehicles, robotic docking systems, and autonomous navigation technologies is making repeated space deliveries feasible and cost-efficient. Demand is also rising from the defense sector, which requires rapid satellite replenishment and orbital asset mobility in contested environments.In addition, long-term space exploration goals - such as lunar colonization, Mars expeditions, and space-based manufacturing - are creating entirely new supply chain needs in cislunar space and beyond. The commercialization of orbital space stations and space tourism will necessitate routine cargo delivery and waste retrieval services. Government investment in public-private partnerships, combined with rising private sector interest in space infrastructure, is accelerating the maturation of space logistics as a standalone industry. As Earth-to-orbit and in-space transportation becomes more frequent and reliable, logistics will form the operational backbone of the growing space economy.

Report Scope

The report analyzes the Space Logistics market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Operation (Space Situational Awareness, Space Exploration, Active Debris Removal, On-Orbit Servicing Assembly & Manufacturing, Last Mile Logistics); Payload (Spacecraft & Satellites Systems, Cargo & Material, Other Payloads).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Space Situational Awareness segment, which is expected to reach US$2.1 Billion by 2030 with a CAGR of a 18%. The Space Exploration segment is also set to grow at 15.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $437.5 Million in 2024, and China, forecasted to grow at an impressive 16.9% CAGR to reach $687.6 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Space Logistics Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Space Logistics Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Space Logistics Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AAC Clyde Space, Advantech Wireless Technologies, Analog Devices, Inc., Cailabs, Cobham SATCOM and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Space Logistics market report include:

- Analytical Space

- Astroscale

- Atomos Space

- Blue Origin

- ClearSpace

- D-Orbit

- Exolaunch

- Exotrail

- Gateway Galactic

- Impulse Space

- Lockheed Martin

- Maxar Technologies

- Northrop Grumman

- OHB SE

- Quantum Aerospace

- Rocket Lab

- SpaceX

- Thales Alenia Space

- The Exploration Company

- Virgin Galactic

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Analytical Space

- Astroscale

- Atomos Space

- Blue Origin

- ClearSpace

- D-Orbit

- Exolaunch

- Exotrail

- Gateway Galactic

- Impulse Space

- Lockheed Martin

- Maxar Technologies

- Northrop Grumman

- OHB SE

- Quantum Aerospace

- Rocket Lab

- SpaceX

- Thales Alenia Space

- The Exploration Company

- Virgin Galactic

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 148 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

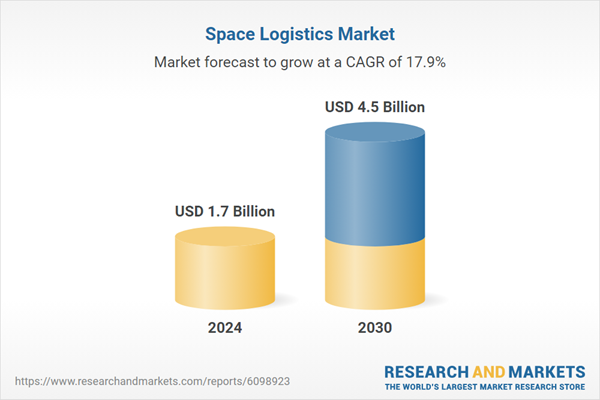

| Estimated Market Value ( USD | $ 1.7 Billion |

| Forecasted Market Value ( USD | $ 4.5 Billion |

| Compound Annual Growth Rate | 17.9% |

| Regions Covered | Global |