Global Ethernet Cards Market - Key Trends & Drivers Summarized

Why Are Ethernet Cards Still Essential in an Era of Wireless Dominance?

Despite the ubiquity of wireless communication technologies, Ethernet cards continue to play a critical role in ensuring fast, reliable, and secure data transmission across enterprise, industrial, and even residential networks. As the backbone of wired networking infrastructure, Ethernet cards - also known as Network Interface Cards (NICs) - facilitate direct physical connections between computing devices and local area networks (LANs), enabling superior speed, low latency, and minimal packet loss compared to wireless alternatives. With increasing demands for high-bandwidth applications such as 4K video streaming, cloud computing, AI model training, and real-time data analytics, the performance reliability provided by Ethernet cards is becoming indispensable. These cards are evolving rapidly, with the latest iterations offering 10GbE, 25GbE, 40GbE, and even 100GbE speeds, supporting modern data center requirements and edge computing applications. Furthermore, Ethernet cards have become smarter, integrating offloading capabilities such as TCP segmentation, virtualization support, and advanced QoS (Quality of Service) controls, which improve overall system efficiency by reducing CPU workload. Enterprises and institutions with mission-critical systems - such as financial trading platforms, medical imaging networks, and high-performance computing (HPC) clusters - rely heavily on Ethernet for consistent performance and enhanced data security. Even as Wi-Fi standards advance, Ethernet cards remain crucial in environments where stability, speed, and data integrity are non-negotiable, preserving their relevance in a rapidly transforming digital ecosystem.How Are Emerging Technologies Shaping the Evolution of Ethernet Card Capabilities?

The evolution of Ethernet cards is being directly influenced by emerging technologies and the digital infrastructure demands they generate. One major driver is the rise of data-intensive workloads from artificial intelligence (AI), machine learning (ML), and big data analytics, which require rapid, scalable, and low-latency data transfer capabilities between servers and storage units. In response, Ethernet card manufacturers are developing advanced NICs that support RDMA (Remote Direct Memory Access), enabling faster and more efficient memory-to-memory transfers across networks. The growth of virtualization and containerization in cloud-native environments has also prompted the integration of SR-IOV (Single Root Input/Output Virtualization) and DPDK (Data Plane Development Kit) into high-performance NICs, which improves network throughput and enables multi-tenant isolation. Additionally, the implementation of PCIe Gen 4 and Gen 5 interfaces in Ethernet cards is enhancing their compatibility with high-speed server architectures. The development of software-defined networking (SDN) and network function virtualization (NFV) is further transforming how Ethernet cards are used in flexible, programmable network environments. These cards are now expected to be not just passive communication devices, but intelligent components capable of dynamic network traffic management, packet inspection, and protocol offloading. As 5G infrastructure rolls out, telecom providers are also investing in Ethernet cards with ultra-low latency and high throughput to support distributed computing at the edge. These technological developments are continuously redefining the utility and performance standards of Ethernet cards, keeping them at the forefront of networking innovation.What Role Do Industry Applications and Sector-Specific Needs Play in Market Growth?

The demand for Ethernet cards is being strongly shaped by the specific requirements of diverse industry sectors, each with its own set of performance, reliability, and integration needs. In data centers and hyperscale environments, high-speed NICs are critical to maintain seamless communication between hundreds or thousands of interconnected servers, storage arrays, and network switches. The financial services sector requires Ethernet cards that deliver ultra-low latency and deterministic performance to support high-frequency trading and real-time analytics. Healthcare institutions depend on reliable NICs to ensure the uninterrupted flow of patient data, medical imaging, and remote diagnostics. Manufacturing and industrial automation sectors are adopting ruggedized Ethernet cards that can withstand harsh environments and deliver precise real-time control for systems like SCADA and PLC networks. Additionally, government and military organizations prioritize secure, tamper-proof Ethernet connectivity to support mission-critical operations and classified communications. The education and research sectors are leveraging Ethernet cards in high-performance computing (HPC) labs, where simulation models and scientific datasets necessitate rapid, high-volume data exchanges. Even the gaming and creative content industries are fueling demand for consumer-grade NICs capable of supporting lag-free online gaming, 4K video rendering, and live streaming. Furthermore, the growing deployment of smart buildings, IoT networks, and connected vehicles requires Ethernet connectivity for devices that demand stable, high-speed links. This sector-specific diversification is expanding the global Ethernet cards market well beyond traditional IT applications, turning it into a multi-domain, infrastructure-critical component of digital connectivity.What Factors Are Fueling the Sustained Growth of the Ethernet Cards Market Globally?

The growth in the Ethernet cards market is driven by several factors linked to technological innovation, data consumption patterns, infrastructure modernization, and end-user demands. The global acceleration of digital transformation initiatives across industries has created sustained demand for robust and scalable network infrastructure, in which Ethernet cards serve as foundational components. The surge in cloud computing, edge computing, and hybrid IT environments is increasing the need for high-speed, low-latency network interfaces capable of handling large data flows with minimal overhead. Data center expansion - particularly in emerging economies - is providing significant opportunities for NIC vendors, as every server deployment requires Ethernet interfaces tailored to specific bandwidth and functionality needs. The proliferation of smart devices, connected machinery, and intelligent transport systems is also boosting demand for embedded Ethernet solutions that offer real-time responsiveness and deterministic communication. From the consumer side, rising expectations for high-performance home networking, especially for online gaming, streaming, and remote work, are encouraging adoption of multi-gigabit Ethernet cards in personal and SOHO (Small Office/Home Office) setups. Furthermore, enterprise investment in cybersecurity is prompting the deployment of NICs with built-in encryption, traffic shaping, and advanced authentication features. As global regulatory frameworks push for improved data protection and operational transparency, reliable wired connectivity - enabled by Ethernet cards - is becoming a compliance requirement in many sectors. Lastly, the development of energy-efficient Ethernet standards and eco-friendly NIC designs is supporting the sustainability goals of organizations, adding another layer of appeal to this vital market. These cumulative drivers are cementing the position of Ethernet cards as indispensable enablers of the high-speed, connected future.Report Scope

The report analyzes the Ethernet Cards market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Data Transfer Rate (Less Than 1 Gbps, 1-10 Gbps, More than 10 Gbps); End-Use (IT & Telecom, BFSI, Retail, Manufacturing, Healthcare, Transportation & Logistics, Energy & Utilities, Education, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Less Than 1 Gbps Ethernet Cards segment, which is expected to reach US$5.7 Billion by 2030 with a CAGR of a 7.9%. The 1-10 Gbps Ethernet Cards segment is also set to grow at 5.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.8 Billion in 2024, and China, forecasted to grow at an impressive 11.4% CAGR to reach $2.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Ethernet Cards Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Ethernet Cards Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Ethernet Cards Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aurubis AG, Cohen Recycling, CWG (Communications Wireless Group), DOWA Holdings Co., Ltd., ecoATM Gazelle and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 33 companies featured in this Ethernet Cards market report include:

- Allied Telesis

- AMD (includes former Solarflare)

- Arista Networks

- Belden Inc.

- Broadcom Inc.

- Buffalo Technology

- Cavium (formerly QLogic)

- Chelsio Communications

- Cisco Systems, Inc.

- D-Link Corporation

- Huawei Technologies Co., Ltd.

- Intel Corporation

- Marvell Technology Group Ltd.

- Napatech A/S

- NVIDIA Corporation (includes Mellanox)

- Oracle Corporation

- QNAP Systems, Inc.

- Realtek Semiconductor Corp.

- TRENDnet, Inc.

- Zyxel Communications Corp.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Allied Telesis

- AMD (includes former Solarflare)

- Arista Networks

- Belden Inc.

- Broadcom Inc.

- Buffalo Technology

- Cavium (formerly QLogic)

- Chelsio Communications

- Cisco Systems, Inc.

- D-Link Corporation

- Huawei Technologies Co., Ltd.

- Intel Corporation

- Marvell Technology Group Ltd.

- Napatech A/S

- NVIDIA Corporation (includes Mellanox)

- Oracle Corporation

- QNAP Systems, Inc.

- Realtek Semiconductor Corp.

- TRENDnet, Inc.

- Zyxel Communications Corp.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 288 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

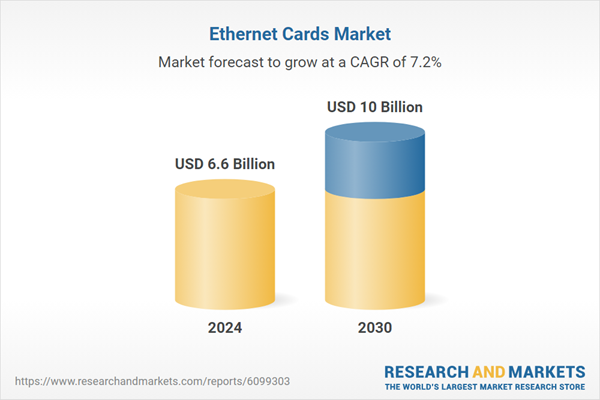

| Estimated Market Value ( USD | $ 6.6 Billion |

| Forecasted Market Value ( USD | $ 10 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Global |