The industrial gloves market encompasses personal protective equipment designed to shield workers' hands from hazards such as cuts, punctures, chemical exposure, heat, and contaminants. These gloves, constructed from materials including latex, nitrile, rubber, neoprene, leather, and cloth, are essential across sectors like manufacturing, construction, automotive, healthcare, food processing, oil & gas, and chemicals. They mitigate workplace injuries, prevent cross-contamination, and ensure compliance with safety standards, supporting operational efficiency and employee well-being.

This research examines current trends in demand, supply, and sales, alongside recent developments shaping the industrial gloves market. It provides a comprehensive analysis of key drivers, restraints, and opportunities. The study details industry trends, policies, and regulations across geographical regions, offering stakeholders a thorough understanding of the regulatory framework and critical factors influencing the market environment.

Competitive intelligence identifies major industry players and their revenue contributions, derived from extensive secondary research. Sources include industry association studies, analyst reports, investor presentations, press releases, and journals. Market size for the overall industrial gloves sector and its key segments was determined using both bottom-up and top-down methodologies. Values were validated with primary inputs from stakeholders in the global industrial gloves value chain. Comprehensive market engineering integrated data from diverse sources and proprietary datasets, employing data triangulation for accurate market breakdown and forecasting.

Key players profiled include 3M Corporation, Ansell Limited, Top Glove Corporation Berhad, Honeywell International Inc., and Radians, among others.

Key Highlights

Industries are intensifying the use of industrial gloves to enhance worker safety and hygiene. Manufacturers are innovating reusable gloves for chemical and pharmaceutical applications, emphasizing durability and reusability. Stricter worker safety regulations in Europe are propelling demand, with OSHA's 2023 plan underscoring PPE necessity. Asia-Pacific's rapid industrial expansion in manufacturing and construction fuels steady growth.Growth Drivers

Escalating concerns over occupational safety, with the ILO reporting 2 million annual deaths from work-related incidents, drive adoption. Stringent regulations from bodies like OSHA and EU directives mandate protective gear, boosting compliance-driven demand. Investments in sectors such as automotive, construction, and healthcare expand applications, while technological advancements in materials like nitrile and Kevlar enhance protection and comfort. Rising industrialization in emerging markets, coupled with sustainability focus, propels eco-friendly innovations.Restraints

Fluctuating raw material prices, influenced by global supply chains, elevate production costs and challenge affordability. The prevalence of unorganized sectors in developing regions leads to substandard products, undermining market penetration. High costs of advanced, specialized gloves deter SMEs, while latex allergies shift demand toward alternatives like nitrile.Segmentation Analysis

By Type: Reusable gloves are projected to grow significantly, driven by adoption in chemical and pharmaceutical industries for their durability and cost-efficiency. Disposable variants hold steady share in hygiene-sensitive applications like healthcare and food processing. Specialized types, including chemical-resistant, cut-resistant, and thermal-resistant, cater to niche hazards.By Application: Manufacturing leads due to automation and mechanization needs, with mechanical gloves at USD 3.1 billion in 2024. Construction and automotive follow, fueled by urbanization and infrastructure projects.

By Material: Nitrile dominates with 29.8% share in 2024 for its puncture and chemical resistance. Sustainable options like bio-based latexes are emerging.

Regional Analysis

Europe commands a significant share, propelled by rigorous safety regulations and emphasis on worker protection. Asia-Pacific exhibits the highest growth at over 8% CAGR, driven by industrialization in China and India. North America sustains leadership through advanced infrastructure and compliance focus.Key Developments

In July 2024, the Indian Rubber Gloves Manufacturers Association advocated banning chlorinated glove imports to curb bio-waste, aligning with QCO standards. February 2024 saw Ansell launch the MICROFLEX Mega Texture 93-256 nitrile glove, featuring ultra-textured grips for industrial durability. October 2024 marked SHOWA's introduction of MFT PRO gloves, integrating advanced materials for enhanced protection. In May 2025, Wadi Surgicals debuted accelerator-free nitrile gloves under Enliva, prioritizing skin safety. March 2025 brought Ejendals AB's TEGERA Arc Flash 2010 for high-risk electrical environments.This report equips industry experts with critical insights into market trends, regulatory landscapes, and competitive dynamics. It highlights opportunities in sustainable innovations and regulatory compliance amid challenges like cost volatility. The rigorous methodology, blending primary and secondary data, ensures reliable findings, enabling stakeholders to navigate complexities and prioritize investments in this essential PPE sector.

Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, and Competitive Intelligence.Report Coverage:

- Historical data from 2022 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others)

Segmentation

- By Material

- Latex

- Nitrile

- Vinyl

- Neoprene

- Polyethylene

- Others

- By End-User

- Manufacturing

- Food Processing

- Healthcare

- Chemical Handling

- Construction

- Others

- By Distribution Channel

- Online

- Offline

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Others

- North America

Table of Contents

Companies Mentioned

- Towa Corporation

- Top Glove Corporation Bhd

- Superior Glove

- SHOWA Group

- Honeywell International Inc.

- Ansell Limited

- Shamrock Manufacturing Company Inc.

- Rubberex

- Hartalega Holdings Berhad

- 3M

- Semperit AG Holding

- Kosan Robber Industries Bhd

- Kimberly-Clark Corporation

Table Information

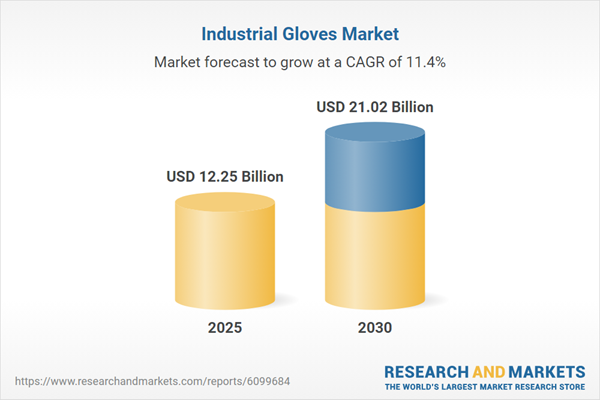

| Report Attribute | Details |

|---|---|

| No. of Pages | 145 |

| Published | November 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 12.25 Billion |

| Forecasted Market Value ( USD | $ 21.02 Billion |

| Compound Annual Growth Rate | 11.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |