This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

The market encompasses a broad range of components including catalytic converters, mufflers, pipes, and sensors, all designed to work in unison to control the emission of pollutants such as carbon monoxide, nitrogen oxides, and hydrocarbons. Technological innovations like selective catalytic reduction (SCR), diesel particulate filters (DPF), and advanced oxygen sensors are becoming standard in modern exhaust systems, especially in diesel and gasoline-powered vehicles. These advancements not only help manufacturers meet Euro 6, BS VI, and Tier 3 emission standards but also contribute significantly to improving fuel efficiency and reducing greenhouse gas emissions.

The surge in global vehicle production, particularly in emerging economies such as China, India, and Southeast Asia, has further propelled demand for automotive exhaust systems. Increasing disposable incomes and urbanization have led to higher vehicle ownership, which in turn drives the replacement and upgrading of exhaust system components to ensure compliance with evolving emission standards.

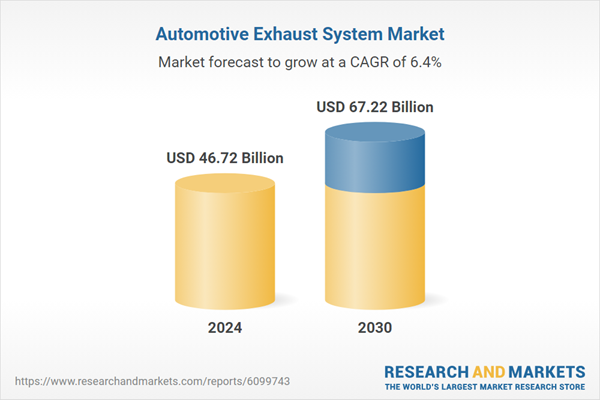

According to the research report “Global Automotive Exhaust System Market Outlook, 2030” the global Automotive Exhaust System market is projected to reach market size of USD 67.22 Billion by 2030 increasing from USD 46.72 Billion in 2024, growing with 6.38% CAGR by 2025-30.Additionally, the shift towards hybrid and electric vehicles is influencing the market dynamics, with hybrid vehicles still relying on exhaust systems to manage emissions during combustion engine operation, thus fueling innovation in exhaust system design for better integration with hybrid powertrains.

However, the rise of fully electric vehicles (EVs), which do not produce exhaust emissions, poses a challenge for the traditional exhaust system market, prompting manufacturers to diversify their product offerings and invest in R&D to adapt to the changing landscape. Furthermore, the aftermarket segment constitutes a significant portion of the automotive exhaust system market, driven by the need for repair, replacement, and customization of exhaust components. Increasing vehicle age and usage necessitate regular maintenance, which creates a steady demand for aftermarket exhaust products.

Consumers’ growing preference for performance-enhancing exhaust systems and mufflers also contributes to the aftermarket growth, especially in regions where car modification culture is prevalent. The market is highly competitive, with numerous global and regional players striving to innovate and offer cost-effective, durable, and environmentally compliant exhaust solutions. Strategic collaborations, mergers, and technological partnerships are common strategies adopted by companies to expand their market presence and keep pace with rapid technological advancements.

Market Drivers

- Stringent Emission Regulations Worldwide: Increasingly strict government regulations, such as Euro 6 in Europe, BS VI in India, and Tier 3 standards in the U.S., are compelling automakers to develop advanced exhaust systems that significantly reduce harmful emissions. This regulatory pressure drives innovation in catalytic converters, diesel particulate filters, and selective catalytic reduction systems, boosting market demand.

- Rising Vehicle Production in Emerging Economies: Rapid urbanization, rising disposable incomes, and growing middle-class populations in emerging markets like China, India, and Southeast Asia are accelerating vehicle ownership. This growth leads to higher demand for exhaust systems, both in OEM production and aftermarket replacements, fueling market expansion.

Market Challenges

- Transition to Electric Vehicles (EVs) : The growing adoption of EVs, which produce no tailpipe emissions and thus do not require traditional exhaust systems, presents a long-term challenge to the automotive exhaust system market. Manufacturers must adapt by innovating or diversifying their product portfolios to stay relevant.

- Volatility in Raw Material Prices: The automotive exhaust system relies heavily on materials like stainless steel and precious metals (platinum, palladium, rhodium) used in catalytic converters. Fluctuating prices of these metals increase manufacturing costs and impact profitability, posing a significant challenge.

Market Trends

- Integration of Advanced Emission Control Technologies: There is a rising trend toward incorporating cutting-edge technologies like selective catalytic reduction (SCR), diesel particulate filters (DPF), and advanced oxygen sensors to meet stricter emission norms while optimizing fuel efficiency and engine performance.

- Growth of Aftermarket and Customization Demand: Increasing vehicle age and consumer interest in performance-enhancing and aesthetic exhaust modifications are driving aftermarket growth. Customized mufflers, sport exhausts, and noise reduction solutions are gaining popularity among automotive enthusiasts globally.

Diesel Particulate Filters (DPFs) have emerged as a dominant component in the automotive exhaust system market because of their unparalleled efficiency in trapping and eliminating soot and particulate matter from diesel engine exhaust. With tightening emission standards across major regions such as Euro 6 in Europe, BS VI in India, and EPA Tier 3 in the U.S., automotive manufacturers are under immense pressure to reduce particulate emissions to near-zero levels. DPFs directly address this requirement by capturing over 90% of the harmful diesel particulates before they are released into the atmosphere. This makes them indispensable for compliance with environmental laws and critical for obtaining vehicle certifications.

Furthermore, as the demand for diesel-powered commercial vehicles and heavy-duty trucks remains strong in various markets due to their fuel efficiency and torque advantages, the integration of DPFs becomes not just a regulatory necessity but a market standard. Technological advancements have also improved DPF efficiency and regeneration processes, reducing maintenance concerns and enhancing their operational lifespan. As a result, OEMs and fleet operators alike are increasingly adopting DPFs, cementing their leadership position in the exhaust system landscape.

Catalytic converters are leading in the automotive exhaust system market due to their essential function in reducing harmful emissions and their mandatory inclusion in nearly all gasoline and diesel vehicles to comply with global environmental regulations.

Catalytic converters dominate the automotive exhaust system market because they are a critical technology required for transforming toxic exhaust gases - such as carbon monoxide (CO), nitrogen oxides (NOx), and unburned hydrocarbons - into less harmful substances like carbon dioxide (CO₂), nitrogen, and water vapor. Their inclusion in passenger and commercial vehicles has become mandatory across most countries, driven by increasingly stringent emission standards like Euro 6, BS VI, and U.S. EPA regulations. These components utilize precious metals such as platinum, palladium, and rhodium as catalysts to trigger chemical reactions that neutralize pollutants.

As global concern over air pollution intensifies, catalytic converters are no longer optional but standard in both gasoline and diesel vehicles. Their high efficiency in emission reduction makes them indispensable for automakers striving to meet regulatory benchmarks without compromising engine performance. Furthermore, as vehicle production rises globally - especially in emerging economies - so does the demand for catalytic converters, both in new vehicles and in the replacement market. Ongoing innovation in catalyst formulations and substrate materials is also improving their durability and cost-effectiveness, reinforcing their leadership in the exhaust system ecosystem.

Passenger vehicles are leading in the automotive exhaust system market due to their high global production volume and stringent emission regulations that mandate advanced exhaust control technologies in every unit.

Passenger vehicles dominate the automotive exhaust system market primarily because they represent the largest share of global vehicle production and ownership. With millions of cars produced and sold annually across regions like North America, Europe, and the Asia-Pacific, the sheer scale of the passenger vehicle segment drives massive demand for exhaust systems. These systems - comprising components like catalytic converters, mufflers, diesel particulate filters, and oxygen sensors - are essential not only for performance but also to meet strict emission standards.

Governments worldwide enforce rigorous environmental regulations that require automakers to equip every passenger vehicle with efficient exhaust technologies to minimize pollutants such as carbon monoxide, nitrogen oxides, and particulate matter. Additionally, consumer demand for better fuel efficiency, quieter engines, and reduced environmental impact further compels manufacturers to innovate in exhaust system design.

The growth of urbanization and middle-class populations in emerging economies has also fueled a surge in car ownership, reinforcing passenger vehicles as the leading segment. Furthermore, while electric vehicle adoption is on the rise, internal combustion engine (ICE) passenger vehicles still account for the majority of global sales, particularly in markets where EV infrastructure is still developing.

OEMs (Original Equipment Manufacturers) are leading in the automotive exhaust system market for passenger vehicles due to their role in integrating high-performance, regulatory-compliant exhaust systems directly during vehicle production to meet global emission standards.

Original Equipment Manufacturers (OEMs) hold the dominant position in the automotive exhaust system market for passenger vehicles because they are responsible for the initial design, development, and integration of exhaust systems that comply with stringent global emission norms. As environmental regulations continue to tighten - particularly in major automotive markets such as North America, Europe, and Asia-Pacific - OEMs are under pressure to equip all newly manufactured passenger vehicles with highly efficient exhaust technologies such as catalytic converters, diesel particulate filters, and selective catalytic reduction systems.

These components are engineered and installed during the production process to ensure optimal compatibility with the engine design, vehicle performance, and fuel economy requirements. Unlike aftermarket parts, OEM-installed systems are rigorously tested for durability, efficiency, and compliance, ensuring long-term performance and warranty protection.

Moreover, with rising consumer expectations for refined engine sound, better cabin comfort, and reduced emissions, automakers prioritize exhaust system quality as a key aspect of vehicle design. The surge in passenger vehicle production - driven by increased urbanization, income growth, and consumer demand in emerging economies - further amplifies OEM market dominance.

Additionally, OEMs benefit from economies of scale and advanced R&D capabilities, allowing them to innovate and implement lightweight materials, advanced coatings, and integrated sensor technologies, making their exhaust systems more effective and reliable. Consequently, OEMs lead the market by delivering exhaust solutions that meet both regulatory and consumer demands at the source of vehicle manufacturing.

Asia-Pacific is leading the automotive exhaust system market for passenger vehicles due to its massive vehicle production capacity, growing consumer base, and rapidly evolving emission regulations across key developing economies.

The Asia-Pacific region dominates the automotive exhaust system market for passenger vehicles primarily because it hosts some of the world’s largest automotive manufacturing hubs, including China, India, Japan, and South Korea. These countries contribute significantly to global vehicle production, with China alone accounting for a substantial portion of the world’s passenger car output.

The region's rapidly expanding middle class, increasing disposable incomes, and urbanization have fueled a surge in car ownership, which in turn drives demand for exhaust systems in both original equipment and aftermarket segments. Furthermore, governments in Asia-Pacific are tightening environmental regulations to combat rising air pollution levels.

Policies like China’s National VI standards and India’s BS VI norms are compelling automakers to adopt advanced exhaust technologies such as catalytic converters, diesel particulate filters, and selective catalytic reduction systems to curb harmful emissions. The presence of low-cost manufacturing capabilities, abundant raw materials, and a strong supplier base also supports the production and innovation of high-performance exhaust components in the region. Additionally, with Asia-Pacific being a major exporter of vehicles and automotive parts, the demand for globally compliant exhaust systems is even higher. OEMs are heavily investing in R&D and production facilities across the region to cater to domestic and international markets alike.

- In February 2024, the Indian Ministry of Road Transport and Highways (MoRTH) announced the implementation of Bharat Stage VI (BS-VI) emission standards, similar to Euro 6. This led to the increased demand for advanced exhaust systems from local and international manufacturers.

- In October 2023, Purem AAPICO, a joint venture between Eberspaecher and AAPICOHitech, officially inaugurated its new facility in Rayong, Thailand. Positioned 100km southeast of Bangkok, this production site was set to manufacture exhaust systems for pickup trucks.

- In July 2023, Proton AG and AAPICO Hitech Public Company Limited formed a strategic partnership through a joint venture, Purem Aapico. This collaboration aims to supply exhaust emission control systems to Proton and other vehicle manufacturers in Thailand and the ASEAN market. The newly constructed plant in Amata City Rayong, Thailand, will manufacture exhaust systems and components for commercial vehicles and passenger cars.

- In May 2023, Cummins Inc. announced the acquisition of FORVIA Faurecia's commercial automotive exhaust business in Europe and the U.S. The manufacturing plants in Columbus, Indiana, and Roermond are included in this acquisition. This proposed deal aims to help both companies achieve their long-term strategic objectives. By doing so, they intend to safeguard the operations and jobs of skilled employees in these two plants and associated technology centers, all while generating value for customers and suppliers throughout the entire supply chain.

Considered in this report

- Historic Year: 2019

- Base year: 2024

- Estimated year: 2025

- Forecast year: 2030

Aspects covered in this report

- Automotive Exhaust System Market with its value and forecast along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

- Diesel Particulate Filter (DPF)

- Selective Catalytic Reduction (SCR)

- Gasoline Particulate Filter (GPF)

- Three-way Catalytic Converter(TWC)

- Lean NOx Trap (LNT)

- Others(EGR, Ammonia Slip Catalyst, EHC)

- Manifolds

- Downpipes

- Catalytic Converter

- Mufflers

- Tailpipes

- Sensors

- Hangers

- Others (Resonator, Gaskets, Pipes)

- OEM

- Aftermarket

The approach of the report:

This report consists of a combined approach of primary as well as secondary research. Initially, secondary research was used to get an understanding of the market and listing out the companies that are present in the market. The secondary research consists of third-party sources such as press releases, annual report of companies, analyzing the government generated reports and databases.After gathering the data from secondary sources primary research was conducted by making telephonic interviews with the leading players about how the market is functioning and then conducted trade calls with dealers and distributors of the market. Post this we have started doing primary calls to consumers by equally segmenting consumers in regional aspects, tier aspects, age group, and gender. Once we have primary data with us we have started verifying the details obtained from secondary sources.

Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations & organizations related to this industry, government bodies and other stakeholders to align their market-centric strategies. In addition to marketing & presentations, it will also increase competitive knowledge about the industry.Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Marelli Holdings Co., Ltd.

- Forvia SE

- Corning Incorporated

- Tenneco Inc.

- BASF SE

- Katcon S.A. de C.V.

- Sango Co. Ltd

- Yutaka Giken Co., Ltd

- Hirotec Corporation

- Sejong Industrial Co., Ltd.

- Friedrich Boysen GmbH & Co

- Benteler International AG

- Grand Rock Co Inc

- Continental AG

- Freudenberg & Co. KG

- MagnaFlow

- Dinex A/S

- Sharda Motor Industries Ltd.

- Eisenmann Exhaust Systems GmbH

- Flowmaster Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 203 |

| Published | May 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 46.72 Billion |

| Forecasted Market Value ( USD | $ 67.22 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |