This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

These factors have contributed significantly to the steady growth of the dairy whitener market globally. One of the major drivers of the dairy whitener market is the rising urbanization and changing consumer lifestyles that favor ready-to-use products. With increasing numbers of working professionals and hectic schedules, consumers are seeking quick and convenient ways to prepare their daily beverages without compromising on taste or nutritional benefits.

Dairy whiteners provide an ideal solution by offering a product that dissolves easily, enhances the creaminess of drinks, and adds a pleasant flavor profile. Additionally, the growing awareness about health and nutrition has led manufacturers to innovate and develop fortified dairy whiteners enriched with vitamins, calcium, and other essential nutrients, further boosting consumer appeal.

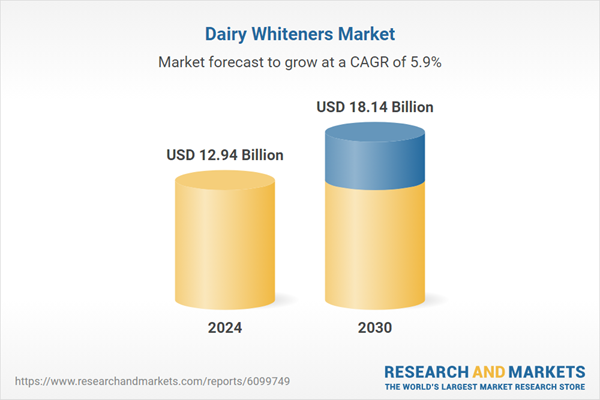

According to the research report “Global Dairy Whitener Market Outlook, 2030” the global Dairy Whitener market is projected to reach market size of USD 18.14 Billion by 2030 increasing from USD 12.94 Billion in 2024, growing with 5.91% CAGR by 2025-30.Moreover, the affordability of dairy whiteners compared to fresh milk makes them a popular choice in price-sensitive markets, driving demand in developing economies across Asia, Africa, and Latin America. In terms of trends, the dairy whitener market is witnessing a surge in product diversification and innovation.

Manufacturers are experimenting with flavored dairy whiteners, including vanilla, chocolate, and cardamom, to cater to evolving taste preferences and attract younger consumers. There is also a growing emphasis on lactose-free and low-fat variants to serve health-conscious segments and individuals with lactose intolerance. The increasing penetration of e-commerce and organized retail channels has made these products more accessible to a wider audience, boosting sales volumes and enabling better brand visibility. Sustainability is another emerging trend, with companies exploring eco-friendly packaging solutions and ethical sourcing practices to meet consumer expectations and regulatory demands.

Market Drivers

- Rising Urbanization and Changing Consumer Lifestyles: As urban populations expand globally, particularly in developing countries, busy lifestyles and fast-paced living have increased demand for convenient, ready-to-use food and beverage products. Dairy whiteners fit perfectly into this need, offering an easy-to-use alternative to fresh milk that dissolves quickly in tea or coffee and requires no refrigeration, making it ideal for urban consumers seeking convenience without sacrificing taste.

- Growing Demand in Emerging Markets Due to Affordability and Shelf Stability: In many emerging economies, fresh milk supply chains are inconsistent, and refrigeration infrastructure may be limited. Dairy whiteners, with their longer shelf life and lower price point compared to fresh milk, become an accessible and economical choice for consumers. This drives substantial growth in regions such as Asia-Pacific, Africa, and Latin America, where affordability and storage convenience are crucial factors.

Market Challenges

- Increasing Consumer Preference for Fresh and Organic Dairy Products: A rising health consciousness among consumers has led to a shift toward fresh, organic, and minimally processed dairy products. Many perceive dairy whiteners as processed and containing additives, which can deter health-conscious buyers. This evolving perception poses a challenge for the dairy whitener industry to innovate and reformulate products to meet consumer demands for natural and clean-label ingredients.

- Regulatory Compliance and Quality Control Issues: The dairy industry is highly regulated, and dairy whiteners must comply with stringent quality and safety standards. Navigating varying regulations across different countries, particularly in emerging markets, can be complex and costly for manufacturers. Smaller players may struggle to maintain consistent product quality, which affects consumer trust and market growth.

Market Trends

- Product Innovation with Fortified and Flavored Variants: To capture a broader consumer base and cater to evolving tastes, manufacturers are introducing fortified dairy whiteners enriched with vitamins, minerals, and probiotics. Additionally, flavored variants such as vanilla, chocolate, and cardamom are gaining popularity, especially among younger consumers seeking novel taste experiences beyond traditional whiteners.

- Sustainability and Eco-Friendly Packaging: Sustainability has become a key trend across the food and beverage industry, including dairy whiteners. Companies are increasingly adopting eco-friendly packaging solutions such as biodegradable or recyclable materials. There is also a growing focus on ethical sourcing and reducing the environmental footprint of production processes to appeal to environmentally conscious consumers and meet regulatory demands.

The dominance of dairy-based whiteners in the market can be attributed primarily to consumers’ growing demand for products that closely mimic the authentic flavor and texture of fresh milk in their beverages such as tea and coffee. Unlike non-dairy or synthetic whiteners, dairy-based options offer a richer, creamier taste and mouthfeel, which resonates well with traditional consumption patterns, especially in regions where dairy has long been a dietary staple. Additionally, dairy-based whiteners provide essential nutrients such as proteins, calcium, and vitamins naturally found in milk, which appeals to health-conscious consumers seeking functional benefits beyond mere taste enhancement.

The trust and familiarity associated with real dairy also foster strong brand loyalty, encouraging repeat purchases. Furthermore, with advancements in processing technology, dairy-based whiteners today offer improved solubility and shelf life without compromising on quality, addressing earlier concerns related to convenience and storage. This combination of superior sensory attributes, nutritional value, and consumer trust has positioned dairy-based whiteners at the forefront of the market, outpacing alternatives that may lack either the taste authenticity or perceived health benefits inherent in dairy ingredients.

Coffee and tea dominate the dairy whitener market because they are the most widely consumed beverages globally that rely heavily on whiteners to enhance flavor, texture, and visual appeal, making them a primary application segment driving demand.

Coffee and tea’s leading position in the dairy whitener market stems from their enormous global consumption and the traditional practice of adding whiteners to improve taste and sensory experience. These beverages have long been integral to daily routines across various cultures, with consumers expecting a creamy, smooth texture and a balanced flavor that dairy whiteners uniquely provide. The addition of whiteners not only mellows the natural bitterness of coffee and tea but also enriches the overall drinking experience, making them more enjoyable and comforting.

Moreover, with the rising trend of specialty coffee and gourmet teas, consumers increasingly seek high-quality whiteners that can complement complex flavor profiles, further boosting demand in this segment. The convenience offered by powdered or liquid dairy whiteners aligns perfectly with on-the-go consumption habits, café culture, and home brewing trends.

Additionally, dairy whiteners enhance the visual appeal of these beverages by imparting a desirable milky color, which influences consumer perception of quality and freshness. As coffee and tea continue to enjoy steady consumption growth, supported by innovations such as ready-to-drink formats and café expansions, their role as the leading application for dairy whiteners remains solid, driving continuous market growth and product development focused on these iconic beverages.

Powder form is leading in the dairy whitener market because it offers superior shelf life, ease of storage, and convenient transportability, making it the preferred choice for both manufacturers and consumers worldwide.

The dominance of powder form in the dairy whitener market can be attributed to its practical advantages that align well with consumer needs and supply chain efficiencies. Powdered dairy whiteners have a longer shelf life compared to liquid or concentrated forms, as the removal of moisture inhibits microbial growth and spoilage, ensuring product stability over extended periods. This extended shelf life is particularly valuable in regions with limited refrigeration infrastructure, making powdered whiteners accessible and reliable for diverse markets, including rural and remote areas.

Additionally, powdered whiteners are easier to store and transport since they occupy less space and weigh less than their liquid counterparts, reducing logistics costs and environmental impact. The convenience factor is significant for both end-users and retailers - consumers can easily measure and use the powder as needed, controlling portion sizes and reducing wastage. Furthermore, powdered dairy whiteners can be reconstituted to desired concentrations, offering flexibility in use across various applications, from household beverages to foodservice and industrial settings.

The form also allows manufacturers to innovate by blending powders with other ingredients like flavorings or stabilizers, enhancing product appeal and functionality. This combination of practical benefits and adaptability has cemented powder form’s leading position in the dairy whitener market, making it the go-to option for producers, distributors, and consumers alike.

Food retail is leading in the dairy whitener market because it provides widespread consumer access through diverse, convenient purchasing options that drive higher product availability and impulse buying, thereby boosting sales and market growth.

The dominance of food retail channels in the dairy whitener market stems from their extensive reach and ability to meet consumer demand efficiently. Supermarkets, hypermarkets, convenience stores, and grocery outlets serve as primary touchpoints where consumers frequently shop for daily essentials, including dairy whiteners. These retail formats offer a wide assortment of brands and product variants, enabling consumers to compare, choose, and purchase according to their preferences and budgets. The strategic placement of dairy whitener products in these stores enhances visibility and encourages impulse purchases, which significantly contributes to volume sales.

Moreover, food retail outlets benefit from established supply chains, efficient inventory management, and promotions that help maintain consistent product availability and competitive pricing. This convenience factor appeals greatly to modern consumers who prioritize time-saving and one-stop shopping experiences. Additionally, the rise of organized food retail in emerging markets has further expanded consumer access, especially in urban and semi-urban regions, accelerating market penetration.

Retailers also engage in targeted marketing campaigns and loyalty programs that foster consumer retention and brand loyalty, crucial for products like dairy whiteners that are often repurchased regularly. These dynamics make food retail the leading distribution channel, effectively bridging manufacturers and consumers, and sustaining the growth trajectory of the dairy whitener market globally.

APAC is leading in the dairy whitener market due to its large and rapidly growing population combined with increasing urbanization and rising disposable incomes, which together drive higher demand for convenient and affordable dairy products like whiteners.

The Asia-Pacific (APAC) region dominates the dairy whitener market largely because it encompasses some of the world’s most populous countries, including India, China, and Indonesia, where consumer demand for dairy products is continuously expanding. Rapid urbanization in these countries has transformed dietary habits, with more people shifting toward packaged and processed foods that offer convenience and longer shelf life - key factors favoring the adoption of dairy whiteners. Rising disposable incomes and improving standards of living have also empowered consumers to explore and regularly purchase value-added dairy products, including whiteners, as part of their daily routines such as in tea and coffee consumption.

Furthermore, changing lifestyles and a growing working population have increased the need for quick and easy-to-use food ingredients, positioning dairy whiteners as an attractive choice. In addition, the increasing penetration of modern retail formats such as supermarkets, hypermarkets, and online platforms in the APAC region has significantly enhanced product availability and accessibility. Local manufacturers are also innovating with flavors and packaging tailored to regional tastes and preferences, further boosting market growth.

- 29 November 2023, Nestlé S.A. launched N3 milk that is made from cow milk and has all the essential nutrients found in milk, such as proteins, vitamins, and minerals. It also contains prebiotic fibers and has a low lactose content and 15% fewer calories.

- 10 July 2023, Arla Foods amba partnered with Blue Ocean Closures to create a fibre-based cap for its milk cartons. It will reduce plastic consumption of the company by more than 500 tonnes annually.

- 5 July 2022, Danone S.A. launched its dairy and plants blend baby formula, in response to desire for vegetarian and flexitarian options for the baby. It is a nutritionally complete formulation that combines the best of both dairy and plants. The new baby formula is the 1st specifically created for a vegetarian diet and is the 1st blended formula for healthy babies in which more than half the required protein is derived from soy.

Considered in this report

- Historic Year: 2019

- Base year: 2024

- Estimated year: 2025

- Forecast year: 2030

Aspects covered in this report

- Dairy Whiteners Market with its value and forecast along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

- Dairy-Based Dairy Whitener

- Non-Dairy Whitener

- Coffee & Tea

- Infant formula

- Confectioneries & bakeries

- Nutritional foods

- Powder

- Liquid

The approach of the report:

This report consists of a combined approach of primary as well as secondary research. Initially, secondary research was used to get an understanding of the market and listing out the companies that are present in the market. The secondary research consists of third-party sources such as press releases, annual report of companies, analyzing the government generated reports and databases.After gathering the data from secondary sources primary research was conducted by making telephonic interviews with the leading players about how the market is functioning and then conducted trade calls with dealers and distributors of the market. Post this we have started doing primary calls to consumers by equally segmenting consumers in regional aspects, tier aspects, age group, and gender. Once we have primary data with us we have started verifying the details obtained from secondary sources.

Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations & organizations related to this industry, government bodies and other stakeholders to align their market-centric strategies. In addition to marketing & presentations, it will also increase competitive knowledge about the industry.Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Nestlé S.A.

- Fonterra Co-operative Group

- Royal FrieslandCampina N.V.

- Abbott Laboratories

- Groupe Lactalis S.A.

- Anand Milk Union Limited

- Britannia Industries Ltd.

- Hatsun Agro Products Ltd

- Fonterra Co-operative Group Limited

- Dairy Farmers of America

- Paras Dairy

- Verka

- Nakpro Nutrition

- Govind Milk & Milk Products

- Schreiber Foods

- Agropur

- Creamy Foods Limited

- Dindigul Farm Product Ltd

- Aroma Milk Products

- Param Dairy Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 204 |

| Published | May 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 12.94 Billion |

| Forecasted Market Value ( USD | $ 18.14 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |