This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

Both routers and switches are indispensable for building efficient local area networks (LANs), wide area networks (WANs), and enterprise data centers, which are now critical in a digitally connected economy. Whether it’s a multinational corporation managing global data traffic or a small business setting up internal communication systems, routers and switches form the backbone of modern digital infrastructure.

Over the past few years, the market has witnessed significant technological advancements. Traditional hardware-based solutions are being complemented - and in some cases replaced - by software-defined networking (SDN), network function virtualization (NFV), and cloud-managed platforms. These advancements are not only improving network agility and scalability but also enabling better management, security, and performance optimization.

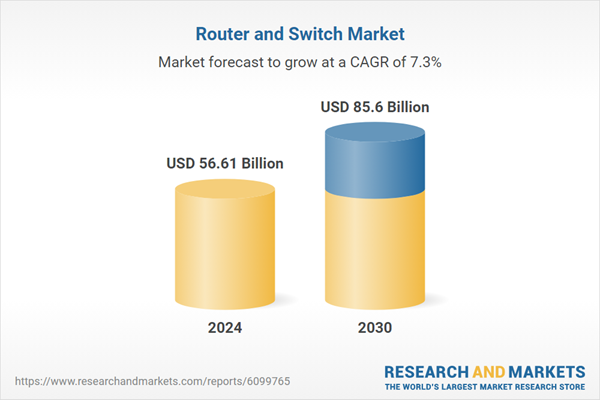

According to the research report “Global Router & Switch Market Outlook, 2030” the global Router & Switch market is projected to reach market size of USD 85.60 Billion by 2030 increasing from USD 56.61 Billion in 2024, growing with 7.29% CAGR by 2025-30. The rise of edge computing and the Internet of Things (IoT) has further amplified the demand for advanced networking gear that can handle decentralized data traffic and deliver low-latency responses.

This has spurred innovation among leading manufacturers such as Cisco Systems, Juniper Networks, Hewlett Packard Enterprise, Huawei Technologies, and Arista Networks, all of which are investing heavily in R&D to develop next-generation routers and switches that meet the needs of an evolving market landscape. Regionally, North America holds a dominant position in the global router and switch market, primarily due to its early adoption of advanced technologies, a mature IT infrastructure, and the strong presence of key industry players. The United States, in particular, leads in the deployment of enterprise networking solutions, driven by the expansive growth of cloud computing, data centers, and 5G rollout.

Europe is also a significant market, with robust investments in smart city initiatives, cybersecurity, and next-generation enterprise networks. Meanwhile, the Asia-Pacific region is emerging as a high-growth market due to rapid urbanization, increasing internet penetration, and large-scale digital initiatives in countries like China, India, and Japan. The need for better connectivity in rural areas and the development of digital economies are further bolstering demand across this region.

Market Drivers

- Adoption of 5G and Edge Computing Technologies: The global rollout of 5G networks is dramatically increasing the demand for advanced routers and switches capable of supporting ultra-low latency and high bandwidth. Edge computing, which processes data closer to its source, requires highly efficient and reliable networking equipment to handle distributed data flows. This synergy is driving innovation and boosting sales of high-performance routers and switches designed for edge environments and next-gen mobile networks.

- Surge in Cloud Computing and Data Center Expansion: The exponential growth in cloud services and data center infrastructure worldwide is a key driver for the router and switch market. Enterprises increasingly rely on cloud platforms for their IT needs, requiring robust, scalable, and secure network infrastructure. High-capacity switches and routers ensure smooth data transmission between on-premise networks and cloud data centers, fueling market growth.

Market Challenges

- Cybersecurity Threats and Vulnerabilities: Networking equipment like routers and switches are prime targets for cyberattacks due to their critical role in data flow. Ensuring these devices are secure against increasingly sophisticated threats is a persistent challenge. Manufacturers must continuously innovate to embed advanced security features and firmware updates, but this adds complexity and cost.

- Supply Chain Disruptions and Component Shortages: Global supply chain disruptions, especially in semiconductor manufacturing, have created shortages and delayed production timelines for routers and switches. This affects availability, raises costs, and complicates inventory management, particularly during periods of high demand, making it difficult for vendors to maintain steady supply.

Market Trends

- Shift Toward Software-Defined Networking (SDN) and Network Virtualization: The industry is rapidly embracing SDN and network function virtualization (NFV), which decouple network control from hardware, allowing more flexible, programmable, and automated networks. This trend is transforming traditional router and switch architectures, enabling better network management, faster deployment, and cost efficiencies.

- Integration of AI and Machine Learning for Intelligent Network Management: AI-powered network management tools are being integrated with routers and switches to enable predictive maintenance, dynamic traffic routing, and enhanced security. This intelligent automation improves network reliability and performance while reducing manual intervention, signaling a significant evolution in how network infrastructure is managed.

Switches have become the backbone of modern network infrastructure due to their critical role in connecting multiple devices within LANs and managing the flow of data packets efficiently. Unlike routers, which primarily connect different networks and manage traffic between them, switches operate at the data link layer and focus on directing data within a network with minimal latency and high throughput. In enterprise environments, data centers, and campus networks, switches facilitate seamless communication between servers, computers, storage devices, and other networked hardware, supporting ever-increasing demands for bandwidth and speed.

The surge in cloud computing, virtualization, and the proliferation of IoT devices have further intensified the need for scalable, fast, and reliable switching solutions. Additionally, advances in switch technology, such as support for multi-gigabit speeds, Power over Ethernet (PoE), and enhanced security features, have made switches indispensable for creating robust and efficient network architectures. As businesses continue to invest heavily in upgrading their internal networks to support digital transformation, remote work, and data-intensive applications, the demand for advanced switching equipment consistently outpaces that of routers, positioning switches as the leading segment within the router and switch market.

Broadband/residential routers are leading in the router and switch market because of the exponential growth in internet penetration and the rising demand for high-speed, reliable home internet connectivity driven by remote work, streaming, and smart home adoption.

The dominance of broadband and residential routers in the router and switch market is largely fueled by the global surge in internet usage across households. As remote work, online education, video streaming, gaming, and smart home devices become integral parts of daily life, consumers demand robust and high-performance routers capable of handling multiple connected devices simultaneously with minimal latency. Broadband routers serve as the gateway between home networks and internet service providers, making them essential for delivering seamless internet experiences.

The ongoing rollout of fiber-optic broadband and advancements in Wi-Fi technology, such as Wi-Fi 6 and 6E, have further intensified the need for modern residential routers that can support higher speeds, better coverage, and improved security features. Additionally, the COVID-19 pandemic accelerated the shift towards home-based digital activities, pushing many households to upgrade their internet infrastructure.

Internet service providers are also aggressively bundling advanced routers with their offerings to capture market share and enhance customer satisfaction. This widespread consumer-driven demand, combined with technological innovation and network infrastructure expansion, ensures broadband and residential routers remain the leading segment in the router and switch market globally.

Fully managed switches are leading in the router and switch market due to their advanced control, customization, and security features that meet the complex networking demands of large enterprises and data centers.

Fully managed switches dominate the router and switch market because they provide unparalleled flexibility and control over network traffic, making them essential for organizations with complex and high-performance networking needs. These switches offer comprehensive management capabilities, including configuration, monitoring, and troubleshooting, which enable IT administrators to optimize network efficiency, ensure reliability, and maintain robust security.

In environments such as large enterprises, data centers, and service provider networks, fully managed switches allow granular control over VLANs, Quality of Service (QoS), access control lists, and traffic segmentation, which are critical for maintaining seamless communication and protecting sensitive data. Additionally, these switches support advanced features like redundancy protocols, link aggregation, and SNMP (Simple Network Management Protocol), facilitating network resilience and scalability. As digital transformation accelerates, the demand for scalable, secure, and high-performance network infrastructure intensifies, pushing organizations to invest in fully managed switches to future-proof their networks.

Furthermore, the rise of cloud computing, virtualization, and hybrid IT environments increases the need for switches that can integrate with software-defined networking (SDN) and network automation tools, areas where fully managed switches excel. This combination of advanced capabilities, security, and adaptability ensures that fully managed switches remain a leading choice in the router and switch market, especially among enterprises prioritizing performance and control in their networking infrastructure.

The enterprise/commercial segment is leading in the router and switch market because large organizations demand high-performance, scalable, and secure networking infrastructure to support complex operations, vast data traffic, and digital transformation initiatives.

The enterprise and commercial sector dominates the router and switch market primarily due to its extensive need for robust networking solutions capable of managing high volumes of data and ensuring seamless connectivity across multiple locations and devices. Enterprises operate complex IT environments that require scalable network architectures to support diverse applications such as cloud computing, virtualization, big data analytics, and unified communications. These organizations prioritize advanced features including enhanced security protocols, traffic management, redundancy, and Quality of Service (QoS) to maintain operational efficiency and data integrity.

Furthermore, the increasing adoption of digital transformation strategies, remote work models, and IoT deployments within enterprises drives continuous upgrades and expansions of their networking infrastructure. Commercial sectors such as banking, healthcare, education, and manufacturing are heavily reliant on reliable routers and switches to ensure uninterrupted services and compliance with stringent regulatory standards. Additionally, enterprises typically invest in fully managed and high-capacity switches and routers that allow greater control, monitoring, and customization to meet evolving business needs.

The demand for cutting-edge networking equipment that can integrate with emerging technologies like software-defined networking (SDN) and network function virtualization (NFV) also bolsters the enterprise segment’s market leadership. In essence, the critical role that networking plays in maintaining enterprise productivity, security, and innovation underpins the dominance of the enterprise/commercial segment in the global router and switch market.

North America is leading in the router and switch market due to its early adoption of advanced networking technologies, strong presence of key industry players, and substantial investments in IT infrastructure driven by high demand for cloud computing, 5G deployment, and digital transformation.

North America’s leadership in the global router and switch market stems from a combination of technological maturity, innovation capacity, and robust market demand across various sectors. The region is home to major networking equipment manufacturers such as Cisco Systems, Juniper Networks, and Arista Networks, which drive continuous innovation and set industry standards worldwide. Early adoption of cutting-edge technologies like software-defined networking (SDN), network function virtualization (NFV), and cloud computing has created a fertile environment for growth.

Additionally, the rapid deployment of 5G infrastructure and the widespread use of high-speed broadband have intensified the need for advanced routers and switches that can handle increased data traffic and offer improved network reliability. North America’s enterprises, government agencies, and service providers are also investing heavily in network modernization to support digital transformation initiatives, remote work, and IoT integration, all of which require scalable and secure network infrastructure. Furthermore, the region benefits from a strong regulatory framework and significant research and development spending, which foster innovation and accelerate the commercialization of new networking solutions.

- In September 2024, Cisco announced a strategic partnership with Flex, a global electronics production company, for the development as well as expansion of a manufacturing plant in India. This facility will initially emphasize on the production of Cisco's NCS 540 Series of routers.

- In March 2024, Department of Telecom, India, in collaboration with CDOT and Nivetti Systems, India-based network operating system provider, launched nation's indigenously produced, fastest Multiprotocol Label Switching router, with an excellent capacity of 2.4 tdps.

Considered in this report

- Historic Year: 2019

- Base year: 2024

- Estimated year: 2025

- Forecast year: 2030

Aspects covered in this report

- Router and Switch Market with its value and forecast along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

- Router

- Switch

- SOHO(Small Office and Home Office/Residential

- Enterprise/Commercial

- Data Centers

- Telecom/ISP

- Industrial /Utility/Transport

- On-Premise

- Cloud Managed

- Edge Computing

- Software-defined

The approach of the report:

This report consists of a combined approach of primary as well as secondary research. Initially, secondary research was used to get an understanding of the market and listing out the companies that are present in the market. The secondary research consists of third-party sources such as press releases, annual report of companies, analyzing the government generated reports and databases.After gathering the data from secondary sources primary research was conducted by making telephonic interviews with the leading players about how the market is functioning and then conducted trade calls with dealers and distributors of the market. Post this we have started doing primary calls to consumers by equally segmenting consumers in regional aspects, tier aspects, age group, and gender. Once we have primary data with us we have started verifying the details obtained from secondary sources.

Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations & organizations related to this industry, government bodies and other stakeholders to align their market-centric strategies. In addition to marketing & presentations, it will also increase competitive knowledge about the industry.Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Cisco Systems, Inc.

- Dell Technologies Inc.

- Hewlett Packard Enterprise Company

- Huawei Technologies Co., Ltd.

- Broadcom Inc.

- ZTE Corporation

- Extreme Networks, Inc.,

- Ribbon Communications, Inc.,

- Palo Alto Networks, Inc.

- Nokia Corporation

- D-Link Systems, Inc.

- Fortinet, Inc.

- TP-Link

- Telefonaktiebolaget LM Ericsson

- F5, Inc.

- MikroTik

- ADTRAN Holdings, Inc.

- 6WIND

- Arista Networks, Inc.

- Actelis Networks, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 226 |

| Published | May 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 56.61 Billion |

| Forecasted Market Value ( USD | $ 85.6 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Global |