This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

Fly ash is widely used as a supplementary cementitious material (SCM) in concrete production, where it enhances the strength, durability, and workability of concrete while reducing the amount of Portland cement required. This substitution is not only cost-effective but also environmentally friendly, as it lowers greenhouse gas emissions associated with cement manufacturing. Additionally, the utilization of fly ash helps mitigate the disposal challenges faced by thermal power plants, reducing the volume of waste sent to landfills and minimizing soil and water contamination risks.

As governments and industries worldwide strive to adopt greener practices, the fly ash industry has become integral to circular economy models that promote waste valorization and resource efficiency. The industry’s growth is further supported by technological advancements that improve fly ash processing and quality, enabling its use in a broader range of applications beyond construction.

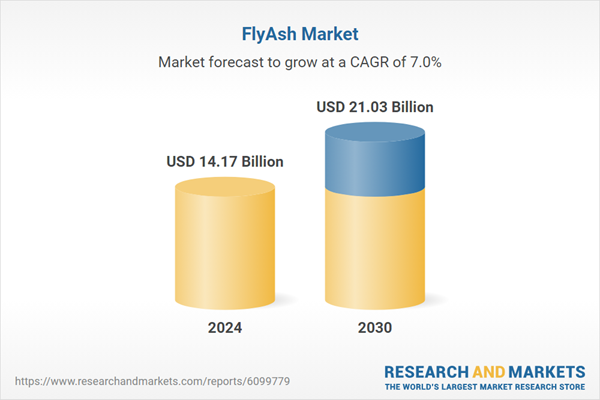

According to the research report “Global Fly ash Market Outlook, 2030” the global Fly ash market is projected to reach market size of USD 21.03 Billion by 2030 increasing from USD 14.17 in 2024, growing with 6.95% CAGR by 2025-30. Fly ash is increasingly employed in manufacturing bricks, blocks, and tiles, providing an energy-efficient alternative to traditional clay-based products. Moreover, its use extends to soil stabilization, waste management, and road embankment projects, where it improves soil properties and provides a sustainable means of construction and land reclamation. However, despite these benefits, the fly ash industry faces certain challenges that could impact its expansion.

Variability in fly ash quality due to differences in coal sources and combustion processes can affect its performance in concrete and other applications, necessitating stringent quality control and standardization measures. Additionally, the gradual shift from coal-based power generation to renewable energy sources in many regions is expected to reduce fly ash availability, prompting the industry to explore alternative raw materials and recycling technologies. Geographically, Asia-Pacific dominates the fly ash market due to its large coal-fired power generation capacity and booming construction sector, particularly in countries like China and India.

These regions are witnessing extensive infrastructure development and urbanization, which drive demand for cost-effective and sustainable construction materials such as fly ash. North America and Europe also contribute significantly to the market, focusing on advanced fly ash utilization technologies and regulatory frameworks that encourage recycling and environmental compliance. In conclusion, the fly ash industry represents a vital link between energy production and sustainable construction, offering environmental and economic advantages that align with global efforts to reduce carbon footprints and promote circularity.

Market Drivers

- Sustainable Construction Demand: The rising global focus on sustainable and green building practices drives the demand for fly ash as a supplementary cementitious material. Its ability to improve concrete strength and durability while reducing carbon emissions from cement production makes it a preferred eco-friendly alternative in the construction industry.

- Waste Management and Environmental Regulations: Increasing environmental regulations on coal ash disposal and waste management encourage power plants and industries to find productive uses for fly ash. This pushes the fly ash industry to expand utilization, reducing landfill use and environmental contamination.

Market Challenges

- Quality Variability: Fly ash quality can vary significantly depending on coal type, combustion technology, and collection methods, affecting its performance in concrete and other applications. This inconsistency complicates standardization and widespread acceptance, requiring rigorous quality control.

- Declining Coal Power Generation: The global shift toward renewable energy sources reduces the volume of fly ash generated from coal-fired power plants, posing a supply challenge for industries dependent on fly ash, and pushing the market to seek alternative materials or recycling methods.

Market Trends

- Technological Innovations in Fly Ash Processing: Advances in processing technologies are enabling improved fly ash quality, enabling its use in high-performance concrete and specialized applications such as geopolymers and construction bricks, expanding market opportunities.

- Expansion into New Applications: Beyond traditional concrete use, fly ash is increasingly utilized in soil stabilization, road construction, waste remediation, and as a raw material in geopolymer cement, reflecting a broader trend toward resource efficiency and circular economy principles in industrial sectors.

Fly ash’s predominant use as a supplementary cementitious material in the cement and concrete industry stems from its ability to improve key properties such as strength, durability, and workability of concrete mixes. When incorporated into concrete, fly ash reacts with calcium hydroxide released during cement hydration to form additional calcium silicate hydrate (C-S-H), which enhances the overall matrix of the concrete. This results in higher long-term strength, reduced permeability, and improved resistance to chemical attacks and environmental degradation. Additionally, fly ash reduces the heat of hydration, minimizing thermal cracking in large concrete structures.

From an environmental perspective, replacing a portion of Portland cement with fly ash lowers carbon dioxide emissions significantly since cement manufacturing is energy-intensive and a major source of greenhouse gases. Economically, fly ash is a cost-effective additive that reduces the demand for cement clinker and helps lower raw material and energy costs in concrete production.

Its availability as a byproduct of coal combustion also supports waste recycling initiatives, aligning with sustainable construction practices. Together, these benefits have made cement and concrete the dominant application for fly ash, driving the growth of the fly ash market globally as the construction industry increasingly prioritizes sustainability, cost-efficiency, and performance in building materials.

The construction sector is leading the fly ash market because fly ash offers a sustainable, cost-effective, and performance-enhancing solution that meets the growing demand for eco-friendly building materials in large-scale infrastructure and urban development projects.

Fly ash’s integral role in the construction industry arises from its unique ability to improve the quality and durability of concrete, which is the backbone of virtually all modern construction activities. By partially replacing Portland cement with fly ash, construction projects benefit from stronger, longer-lasting concrete that resists cracking, chemical attacks, and environmental degradation such as sulfate and chloride exposure. This not only extends the lifespan of structures but also reduces maintenance costs, making fly ash an attractive additive for builders and developers.

Moreover, fly ash contributes significantly to sustainable construction goals by reducing the carbon footprint associated with cement production, which is a major contributor to global CO2 emissions. The increasing emphasis on green building certifications and regulatory incentives worldwide further encourages the use of fly ash in construction materials. Additionally, the cost-effectiveness of fly ash, derived as an industrial byproduct, helps lower overall material expenses, which is especially crucial in large infrastructure projects where budget optimization is key.

Its versatility also allows use in a variety of construction applications beyond concrete, such as bricks, blocks, soil stabilization, and road embankments, broadening its market scope. Given the rapid pace of urbanization, infrastructure expansion, and the global push for sustainable development, the construction industry’s leading position in the fly ash market is expected to strengthen, driving continued innovation and adoption of fly ash-based solutions.

Dry fly ash is leading the fly ash market because it offers superior handling, storage stability, and consistent quality, making it highly suitable for large-scale industrial applications such as cement and concrete manufacturing.

Dry fly ash, collected through electrostatic precipitators or baghouse filters in thermal power plants, is preferred over wet or slurry forms due to its low moisture content and ease of transport, which significantly reduces logistical challenges and costs. The dry form ensures longer shelf life without the risk of clumping or microbial growth, which are common issues with wet fly ash. This stability allows manufacturers and construction companies to store and use the material efficiently over extended periods. Moreover, dry fly ash typically exhibits more consistent physical and chemical properties, which are critical for its performance as a supplementary cementitious material in concrete production.

Consistency in quality ensures predictable strength development, durability, and workability of concrete mixes, which is essential for meeting stringent building standards and project specifications. The dry form’s adaptability also facilitates precise dosing and uniform blending with other raw materials in cement plants, enhancing production efficiency and product quality.

Additionally, environmental regulations and the need to minimize water usage in industrial processes have further propelled the demand for dry fly ash, which aligns better with sustainability goals. Collectively, these advantages have cemented dry fly ash’s dominance in the market, especially in regions with extensive coal-based power generation and booming construction activities, making it the preferred choice for end-users seeking reliability, performance, and environmental compliance.

Pulverized Coal Combustion (PCC) is leading the fly ash market because it produces high-quality fly ash with consistent particle size and chemical composition, making it ideal for use in cement, concrete, and other industrial applications.

PCC technology, which involves grinding coal into a fine powder before combustion, enables more efficient and complete burning of coal in thermal power plants. This process generates fly ash particles that are uniformly fine and possess desirable pozzolanic properties, essential for enhancing the strength and durability of cement and concrete products. The uniformity in particle size distribution and chemical composition of fly ash produced by PCC ensures predictable performance when used as a supplementary cementitious material, contributing to improved workability, reduced permeability, and increased resistance to chemical attacks in concrete structures.

Furthermore, the high carbon burnout efficiency in PCC reduces unburned carbon content in fly ash, which is a critical parameter influencing its suitability for construction applications. Fly ash derived from PCC is also easier to handle and process, with lower moisture content compared to fly ash from other combustion methods, facilitating transportation, storage, and incorporation into industrial processes.

Given the widespread use of pulverized coal-fired power plants globally, especially in regions with significant construction and infrastructure development, the PCC method remains the dominant source of fly ash supply. This has reinforced its leading position in the fly ash market as industries seek reliable, high-quality fly ash to meet environmental standards and improve the sustainability and performance of construction materials.

Class F fly ash is leading the fly ash market because of its superior pozzolanic properties, which enhance the strength, durability, and environmental performance of concrete, making it highly preferred in a wide range of construction applications.

Class F fly ash is primarily produced from burning anthracite or bituminous coal and contains low calcium content, typically less than 10%. This composition grants it excellent pozzolanic characteristics, meaning it reacts with calcium hydroxide released during cement hydration to form additional cementitious compounds that significantly improve concrete’s mechanical properties. The use of Class F fly ash in concrete leads to higher long-term strength, reduced permeability, and enhanced resistance to sulfate and alkali-silica reactions, which are common causes of concrete degradation. Moreover, it contributes to reducing the heat of hydration, minimizing the risk of thermal cracking in massive concrete pours.

From an environmental standpoint, Class F fly ash is highly valued because it enables substantial substitution of Portland cement, thereby lowering carbon dioxide emissions associated with cement production. Its fine particle size and spherical shape improve the workability and finishability of concrete mixes, making it easier to handle and apply in diverse construction projects ranging from infrastructure to commercial buildings. Due to these technical and ecological advantages, Class F fly ash is widely accepted and preferred by engineers, contractors, and environmental regulators, driving its dominant position in the fly ash market globally, especially in regions with abundant bituminous coal-based power generation.

Asia-Pacific is leading the fly ash market primarily due to its extensive coal-based power generation capacity combined with rapid urbanization and infrastructure development, which drive high demand for fly ash as a sustainable construction material.

The Asia-Pacific region, home to some of the world’s largest coal-fired power plants, produces vast quantities of fly ash as a byproduct, creating a readily available supply for various industrial uses. Countries such as China and India dominate this market due to their reliance on coal for electricity generation and ongoing efforts to expand and modernize infrastructure to support growing populations and urban centers. The booming construction sector in Asia-Pacific significantly fuels demand for fly ash, especially in cement and concrete production, where it is used extensively to improve material performance while reducing environmental impact.

Additionally, governments in the region are increasingly promoting sustainable building practices and imposing stricter environmental regulations, which encourage the recycling and utilization of industrial byproducts like fly ash. This regulatory push, coupled with the cost advantages of using fly ash as a supplementary material, makes it highly attractive for manufacturers and builders aiming to meet both economic and ecological objectives.

Furthermore, rapid industrialization and investments in transportation, housing, and commercial infrastructure amplify the consumption of fly ash-based products. Together, these factors establish Asia-Pacific as the dominant player in the global fly ash market, with continued growth expected as the region balances energy production, environmental concerns, and infrastructural development.

- In November 2024, Titan America announced its acquisition of D.M. Conner Sand & Gravel Company, expanding its presence in the Mid-Atlantic region. The acquisition strengthens Titan’s supply of aggregates, clay, and beneficiated fly ash for cement production. This strategic move supports Titan’s growth and innovation in sustainable construction materials.

- In November 2024, NTPC showcased its eco-friendly "Sukh" Eco-house at the India International Trade Fair, built using 80% fly ash-based materials. These affordable houses, costing just Rs 1.5 lakh for a 30 sqm structure, offer sustainability by eliminating the need for cement, steel, and sand. The initiative aligns with the Pradhan Mantri Awas Yojana-Gramin and promotes carbon reduction and waste management.

- In August 2024, A Green National Highway Corridor Project has been agreed between the Government of India and the World Bank covering 781 km of highways running through Himachal Pradesh, Rajasthan, Uttar Pradesh, and Andhra Pradesh. Eco-friendly methods including using fly ash along with different green technologies and bio-engineering methods have been undertaken, which aims at reducing carbon emission.

- In May 2024, Heidelberg Materials acquired ACE Group, the largest supplier of pulverised fly ash in Malaysia, to strengthen its circular economy and carbon reduction goals in Southeast Asia. The acquisition supports the use of fly ash in composite cement, reducing CO2 intensity. This move is part of Heidelberg Materials' strategy to achieve net-zero cement and concrete globally.

- In April 2024, Ambuja Cements acquired a 1.5 MTPA cement grinding unit in Tuticorin, Tamil Nadu, for Rs 413.75 crore. The plant, spread over 61 acres, benefits from a long-term fly ash supply agreement and strengthens Ambuja's coastal presence in southern markets.

- In April 2024, Ambuja Cements acquired a 1.5 MTPA cement grinding unit in Tuticorin, Tamil Nadu, for Rs 413.75 crore. The plant, spread over 61 acres, benefits from a long-term fly ash supply agreement and strengthens Ambuja's coastal presence in southern markets.

Considered in this report

- Historic Year: 2019

- Base year: 2024

- Estimated year: 2025

- Forecast year: 2030

Aspects covered in this report

- FlyAsh Market with its value and forecast along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

- Class F Fly Ash

- Class C Fly Ash

- Blended Fly Ash

- Cement and Concrete

- Bricks and Blocks

- Road Construction

- Mine Backfilling

- Agriculture

- Soil Stabilization

- Waste Treatment & Solidification

- Others(Ceramics, geopolymer products, paints, fillers, etc.)

- Construction

- Mining

- Agriculture

- Utilities / Power Plants

- Public Infrastructure & Transport

- Environmental Services

- Chemical Manufacturing

- Others(Glass and Ceramics Industry, Paints and Coatings, Plastics and Rubber Compounds, Refractory Materials)

The approach of the report:

This report consists of a combined approach of primary as well as secondary research. Initially, secondary research was used to get an understanding of the market and listing out the companies that are present in the market. The secondary research consists of third-party sources such as press releases, annual report of companies, analyzing the government generated reports and databases.After gathering the data from secondary sources primary research was conducted by making telephonic interviews with the leading players about how the market is functioning and then conducted trade calls with dealers and distributors of the market. Post this we have started doing primary calls to consumers by equally segmenting consumers in regional aspects, tier aspects, age group, and gender. Once we have primary data with us we have started verifying the details obtained from secondary sources.

Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations & organizations related to this industry, government bodies and other stakeholders to align their market-centric strategies. In addition to marketing & presentations, it will also increase competitive knowledge about the industry.Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Holcim Limited

- CEMEX S.A.B. de C.V.

- Heidelberg Materials

- Seven Group Holdings

- Charah Solutions, Inc.

- Waste Management, Inc.

- Ashtech (India) Pvt. Ltd.

- Titan America LLC

- Anglo American plc

- EP Power Europe, a. s.

- Eco Material Technologies

- PPC Ltd.

- CRH plc

- NTPC Limited

- Phenix Enterprise

- Pyramid Chemicals (P) Ltd

- Royal Mineral

- UltraTech Cement Limited

- Dangote Industries Limited

- Kumaraswamy Industries

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 199 |

| Published | May 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 14.17 Billion |

| Forecasted Market Value ( USD | $ 21.03 Billion |

| Compound Annual Growth Rate | 6.9% |

| Regions Covered | Global |