Such innovations are encouraging patients who struggle with CPAP therapy to explore alternative treatment options, fueling further market growth. Many individuals find CPAP devices uncomfortable, difficult to use consistently, or disruptive to their sleep. As a result, they often seek more convenient, effective, and personalized treatments that better suit their lifestyle. Advances in sleep apnea implants, including improvements in device design and surgical techniques, are helping to bridge this gap by offering long-term solutions that require minimal patient involvement after the initial procedure. The ability to provide effective, non-invasive treatments that address the underlying causes of sleep apnea has become a game-changer for those who have previously found CPAP therapy challenging.

The hypoglossal neurostimulation (HGNS) devices segment generated USD 770.7 million in 2024. This technology is proving to be particularly effective for patients with moderate to severe OSA who are unable to tolerate CPAP machines due to discomfort, noise, or other factors. Numerous clinical studies have shown substantial improvements in oxygen saturation and AHI (apnea-hypopnea index) scores, driving the adoption of HGNS devices. Additionally, the support from regulatory agencies for these devices has broadened the treatment options for a wider group of OSA patients, which has contributed to the growth of the market.

The segment focused on obstructive sleep apnea is anticipated to witness significant growth, with a CAGR of 17.6%, reaching USD 4 billion by 2034. OSA affects 30 million Americans, many of whom remain undiagnosed, and public awareness of the condition's risks, such as cardiovascular disease, diabetes, and cognitive decline, is increasing. This has led to a higher demand for effective treatments, especially among those who cannot tolerate CPAP machines. Hypoglossal nerve stimulation devices, as an alternative to CPAP, are gaining considerable traction, offering a promising solution for OSA patients.

The hospitals segment accounted for the largest share in 2024, generating 60.7%. Sleep apnea implants, including phrenic nerve stimulators and hypoglossal nerve stimulators, require skilled surgical intervention and post-operative care, making hospitals the ideal setting for their implantation. Hospitals provide optimal care, offering necessary follow-up treatments, monitoring, and adjustments that improve patient outcomes. Advanced sleep medicine clinics within hospitals also play a crucial role in diagnosing and managing sleep disorders and providing comprehensive care, including polysomnography and device optimization.

Key players in the U.S. Sleep Apnea Implants Market include Inspire and Asahi KASEI. To strengthen their position in the U.S. sleep apnea implants market, companies are focusing on technological innovation and the development of minimally invasive implant solutions. Many manufacturers are actively improving the design and functionality of hypoglossal neurostimulation devices to enhance their efficacy and patient comfort. Additionally, companies are collaborating with healthcare providers to expand patient access to these treatments, while also investing in comprehensive post-implantation care to improve long-term outcomes.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this U.S. Sleep Apnea Implants market report include:- Asahi KASEI

- Inspire

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 100 |

| Published | May 2025 |

| Forecast Period | 2024 - 2034 |

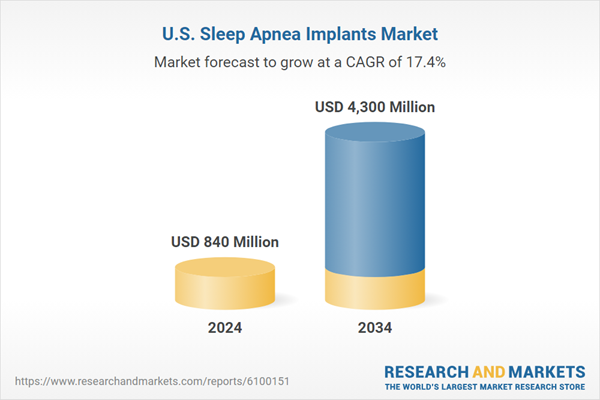

| Estimated Market Value ( USD | $ 840 Million |

| Forecasted Market Value ( USD | $ 4300 Million |

| Compound Annual Growth Rate | 17.4% |

| Regions Covered | United States |

| No. of Companies Mentioned | 3 |